Nano One Technologies

Can Nano One Technologies’ “One Pot” Approach Be a Jackpot for Investors?

Much of the investing world is abuzz about electric vehicles and green energy. While much of the focus thus far has been on more glamorous names like Tesla, Nikola, etc., the companies that provide the critical components needed by manufacturers remain somewhat under the radar, and in some cases, undervalued.

We have dedicated significant time sifting through the electric vehicle ecosystem and supply chain. In doing so, we found what we believe to be a company with the potential to be truly transformative; Nano One Technologies (ticker: NNOMF). Formidable Asset Management (“Formidable”) recently established a position; and the following are the key pieces of our investment thesis behind this action:

- Scalable, capital-light business

- Established partners

- Innovative technology

Overview

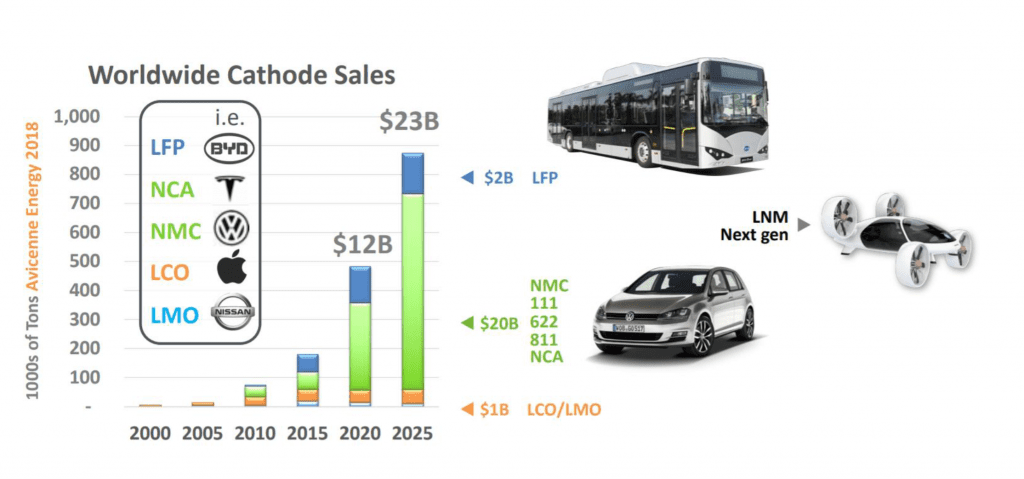

Nano One Technologies looks to occupy a niche in the battery value chain. The company believes its technology will allow cathode manufacturers to simplify their processes and improve margins; and our analysis appears to confirm this contention. In exchange, Nano One will earn an ongoing royalty from licensing its technology (company estimates are between 2% and 5%), giving it a potentially meaningful portion of what it expects to be a $23 billion market for cathodes within the next five years, (almost double the current $12 billion in worldwide sales).

Established Partners

While not currently working with the names that steal the electric vehicle headlines, Nano One has partnerships with large manufacturers looking to enter the EV space in a big way–most prominently Volkswagen (VW). On the heels of the public relations fiasco from its emissions scandal, VW is making a major push into this domain with plans to produce 22 million EVs over the next ten years. VW is collaborating with Nano One in an effort to boost the longevity and range of VW’s patented battery technology. Such close collaboration could lead to an acquisition by VW, though such a transaction is not integral to our thesis.

Nano One also has a joint venture with Pulead in China in the cathode space, and with Saint-Gobain in France for cathode processing. Overall growth for the EV space is anticipated to expand, continuing to take market shares from internal combustion engines. This provides continued opportunities for future partnerships.

Additional opportunities for collaboration exist with dedicated battery manufacturers, which tend to focus on the operational, not the technological, aspects of battery development. Increasing tensions between China and the United States make development of additional battery factories in North America more likely, and Nano One could benefit from such “near-sourcing.”

Innovative technologies

The above attributes do not matter unless the technology is sound and backed by defensible intellectual property.

Regarding the intellectual property, Nano One has been granted 16 patents worldwide from seven (7) different patent families; 30 more are pending and spread across 21 families. The majority of its patents are relatively young.

A cursory review of the science and technology behind Nano One’s products and output demonstrates the company’s process produces more durable crystals, which in turn produces cathodes with improved range and charge. Their output is also simpler, cheaper, and produces far less hazardous waste. While the former is what gets the attention of most, the latter is a truly meaningful value add Nano One delivers.

To make material today, Nano One’s team begins by dissolving raw materials in a slightly acidic, aqueous solution and initiating a self-seeded crystallization, which occurs as water evaporates from a reactor. Once the water is gone, a dry powder remains, which must be fired (calcined) in a furnace under a controlled atmosphere; this may be oxygen, nitrogen, or argon.

The company’s “magic sauce” is its unique ability to produce a coated nanocrystal. Competitors make a solid chunk of cathode, then protect its outer surface with a passivation layer. When the cathode shrinks and swells as it is loaded and unloaded with lithium during each cycle, the protective outer coating can crack, disrupting the passivation, limiting the efficiency of the battery, and, ultimately, limiting the number of cycles a battery can endure.

Alternatively, Nano One builds the cathode material from the ground up, as tiny nanocrystals, and encapsulates each one with the protective layer (5-10 nm thick) because the coating material is already present in the crystal structure prior to firing. As a result, the precursor can be fired for shorter times while it literally coats itself during firing, cutting production costs and simplifying the process. This is the company’s ‘one pot’ approach, and we think it could be a significant differentiator in the space Now, instead of increasing the battery size in the car to increase range, a more durable cathode enables more aggressive charging and deeper discharging during every cycle without inducing battery damage. It is a substantial improvement; 4x in durability and longevity, as recently described by Nano One.

Nano One deals with lithium carbonate, instead of lithium hydroxide, which simply decomposes and burns off in the furnace, eliminating both the hazards and costs associated with the above risks.

In addition to creating more durable crystals, Nano One’s approach also is also advantaged in terms of chemical permitting and waste regulations. Competitive technologies to produce NMC (nickel, manganese, and cobalt) cathodes require highly caustic solutions to prevent reaction with water. Obtaining permits for such a process is difficult in countries with more stringent environmental regulations because of the risk to operators and environmental exposure. Given the aforementioned likelihood of future battery plants being in North America, especially the U.S. or Canada, this is critically important.

Similarly, traditional technologies create large amounts of sulfate waste, which must either be addressed as hazardous waste or returned to and reclaimed by the raw material manufacturer. In the NMC process used by cathode producers, they start with nickel sulfate, manganese sulfate and cobalt sulfate from the raw material suppliers. These chemicals react to form the Ni0.4Co0.2Mn0.4(OH)2 precursor prior to firing, leaving sodium sulfate in solution… a lot of it. Once the solids are filtered out and washed, the waste cannot just go down the drain. Even if it is reclaimed by the ore producers, processing comes at a cost that must be passed on to the consumer. Nano One’s chemistry eliminates the sulfates in favor of metal acetates that again can be degraded in firing rather than creating hazardous byproducts.

Conclusion

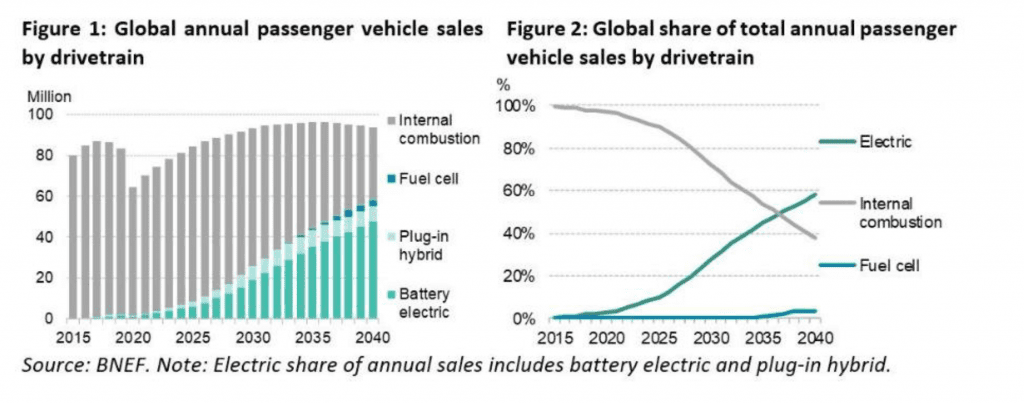

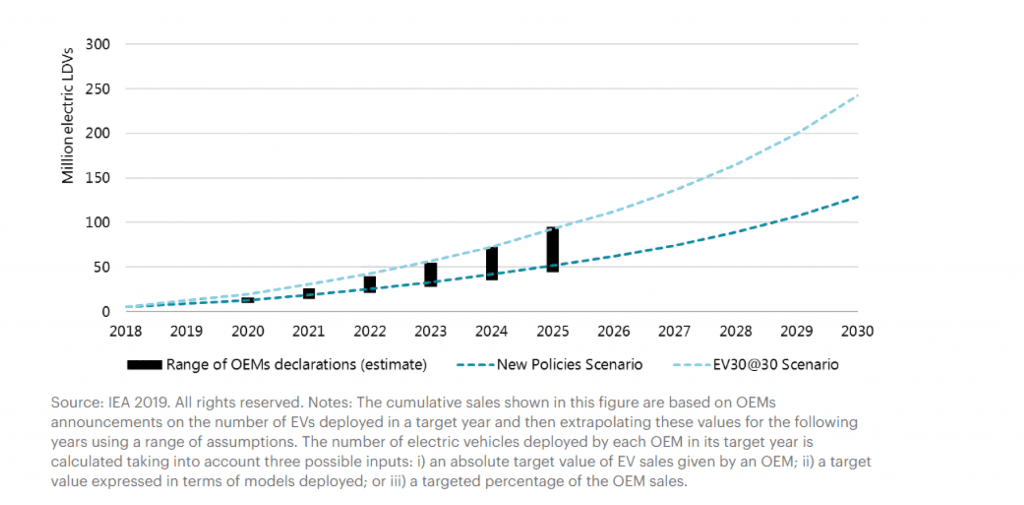

Ultimately, Formidable believes the market has a tremendous appetite for electric vehicles, as do investors. Instead of owning manufacturers trading at exorbitant valuations, our preference is to focus elsewhere in the value chain. We believe Nano One’s unique position and technology make it a compelling way for investors to benefit from the seismic shift to electric estimates from the International Energy Agency (IEA) and automakers (OEMs) project.

Valuation

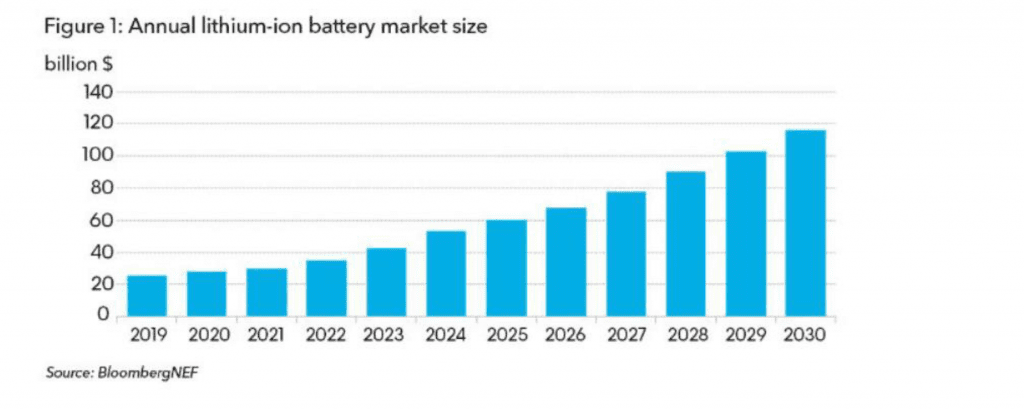

A sensible valuation framework to use for Nano One is similar to what we would typically use for a biotech company. Companies that are also generally reliant on such licensing revenues from pre-revenue products with patent protection. Instead of the FDA as the final arbiter, Nano One’s partners will determine whether its products are effective and scalable. The starting point would be the total addressable market (TAM) for batteries; this is Bloomberg’s estimate:

Our research shows that cathodes typically represent 31% of the cost of a battery. Accordingly, let us say the size of the cathode market is around $7 billion in 2020 just for lithium-ion batteries. This is more conservative than the company’s own estimates.

Our valuation estimates for the company use a risk-adjusted net present value. We assume the company is able to succeed in scaling the technology and achieves modest market share in a rapidly growing space (extrapolating the above estimates for TAM growth). Our discount rate is relatively large, and we assume no further innovation, i.e., the patents expire, and no additional economic benefit is derived after expiry. We also assume the royalty is lower than the top end of the company’s estimates (2%-5% is the range the company uses). With 78 million shares outstanding, we derive a price between $3 USD and $8 USD, between 60% and 300% above the stock’s closing price on July 17, 2020. The estimate range varies depending on market penetration and royalty rate.

Nano One’s Challenges

This is a tough business; the science is very difficult. As is stated in a Quartz article from 2019, “How we get to the next big battery breakthrough”, “(B)atteries are already big business, and the market for them keeps growing. All that money attracts a lot of entrepreneurs with even more ideas. But battery startups are difficult bets—they fizzle even more often than software companies, which are known for their high failure rate. That’s because innovation in material sciences is hard.” Nano One is hardly a startup. It already has significant intellectual property, making failure less likely, while providing a valuation floor.

After receiving additional funding from the Canadian government, the company has approximately four years of capital at its current burn rate to make good on the promise of the technology.

For a point of reference, Nano One partner VW currently has about 10% market share for the world’s supply of light vehicles, so a proportionate share of EVs is not implausible.

What could unlock the value?

Like chemical reactions, stocks often need a catalyst for investors to realize their potential; Nano One is no exception. Formidable believes any of the following events could help the market begin to realize the Nano One’s full potential. Each event has a reasonable probability of coming to fruition in the foreseeable future:

- New marquee joint venture partner – The existing relationships are well known, and VW certainly has the requisite gravitas to provide the company with credibility. Adding another major partner to the fold could certainly burnish Nano One’s credentials (and improve the likelihood of monetizing its assets).

- Favorable legislation – The possibility of a “Green New Deal” is being widely discussed as part of the Biden campaign. Some details emerged within the past week, which hinted at massive dollars heading into the green energy sector. Government programs at aimed reducing emissions and incentivizing the shift to EVs would also be a positive for Nano One, not to mention initiatives to move toward greener solutions in Europe and Asia, specifically China, where Nano One has strategic relationships in place

- Widening investor base – This could happen for three reasons. First, the company’s increasing market cap puts it on the radar of larger investors. However, its ordinary shares are traded in Canada, with U.S. investors generally only able to access the company through an OTC-traded American Depositary Receipt (ADR). Many mutual funds and ETFs, not to mention individual investors, who have shown quite an appetite for EV companies, are unable to purchase such OTC-traded securities.

This leads us to the second potential reason for a wider base. If the company either decides to become dually registered through a listing on the NADAQ or NYSE, or becomes a Level 2 ADR (it is currently a Level 1 ADR), it will open the company to a whole new set of potential investors. Given the growing interest (and assets) dedicated to so-called ESG (environmental, social, and governance) investing, we think Nano One’s ability to move onto a regular exchange has the potential to boost shares.

The third reason is the possibility of initiation of coverage on the stock. Currently, there are no sell-side analysts with coverage. Speaking from experience on the buy-side, many look to street research before (or in lieu of) doing their own research on a company. Any coverage would likely increase the profile of the company which, heretofore, has been overlooked. This neglect by the investment community creates an opportunity for early investors willing to do the work before sell-side analysts start to discover Nano One’s unique value proposition and the valuation gap begins to close.

* Dr. Kevin Krogman holds a PhD in Chemical Engineering from MIT, with a focus on nanomaterials and thin films, and aminor focus in Corporate Finance from MIT’s Sloan School of Management. After MIT, he was the technical founder of Svaya Nanotechnologies, Inc. which developed optical thin films for selective energy transmission or rejection in the automotive and architectural space. After acquisition of the company by Eastman Chemical, he now runs a consulting practice focused on materials and thin film design and performance at the nanoscale, through productization of thin film technologies.

DISCLOSURES

General Firm

Formidable Asset Management, LLC (Formidable) is an investment adviser registered under the Investment Advisers Act of 1940. Registration as an investment adviser does not imply any level of skill or training. The information presented in the material is general in nature and is not designed to address your investment objectives, financial situation or particular needs. Prior to making any investment decision, you should assess, or seek advice from a professional regarding whether any particular transaction is relevant or appropriate to your individual circumstances. Although taken from reliable sources, Formidable cannot guarantee the accuracy of the information received from third parties.

The opinions expressed herein are those of Formidable and may not actually come to pass. This information is current as of the date of this material and is subject to change at any time, based on market and other conditions. Any index performance cited or used throughout is intended to illustrate historical market trends and performance. Indexes are managed and do not incur investment management fees. An investor is unable to invest in an index. The performance shown may not reflect a Formidable portfolio.

Past performance is no guarantee of future results.

Reader should assume that future performance of any specific investment or investment strategy (including the investments and/or investment strategies discussed in these materials) made reference to directly or indirectly in these materials will be profitable or equal the corresponding indicated performance level(s). Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will either be suitable or profitable. Historical performance results for investment indices and/or categories generally do not reflect the deduction of transaction and/or custodial charges, the deduction of an investment management fee, nor the impact of taxes, the incurrence of which would have the effect of decreasing historical performance results.

Specific Securities

The mention of specific securities and sectors illustrates the application of our investment approach only and is not to be considered a recommendation by Formidable. The specific securities identified and described above do not represent all of the securities purchased and sold for the portfolio, and it should not be assumed that investment in these securities were or will be profitable. There is no assurance that the securities purchased remain in the portfolio or that securities sold have not been repurchased. Charts, diagrams and graphs, by themselves, cannot be used to make investment decisions. You may contact Formidable Asset Management, LLC for a full list of recommendations made during the preceding period one year

Not an Offer

These materials do not constitute an offer to sell, a solicitation of an offer to buy, or a recommendation of any security or any other product or service by Formidable or any other third party regardless of whether such security, product or service is referenced here. Furthermore, nothing in these materials is intended to provide tax, legal, or investment advice and nothing in these materials should be construed as a recommendation to buy, sell, or hold any investment or security or to engage in any investment strategy or transaction. Formidable does not represent that the securities, products, or services discussed here are suitable for any particular investor. You are solely responsible for determining whether any investment, investment strategy, security or related transaction is appropriate for you based on your personal investment objectives, financial circumstances and risk tolerance. You should consult your business advisor, attorney, or tax and accounting advisor regarding your specific business, legal or tax situation.

The opinions expressed here are those of Will Brown, Kevin Krogman, and Adam Eagleston are not intended as investment advice. They are also subject to change with changing market conditions. Clients of Formidable may have positions in securities discussed in this article. This writing is for informational purposes only—Formidable and the authors expressly disclaim all liability in respect to actions taken based on any or all of the information from this writing

READY TO TALK?