Market Commentary November, 2022 – Are You Ready for Some Football?

November Update: Are You Ready for Some Football?

Yes, this is the Hank Williams, Junior catchphrase from the erstwhile intro to Monday Night football (American Style) but we are going to be looking at markets through the lens of association football, specifically the World Cup, which kicks off in a few weeks. Yes, this event is typically played in the summer, but since it is being played in Qatar this year for reasons that certainly have nothing to do with unethical behavior on the part of soccer’s governing body, FIFA, let’s get ready for some football, I mean soccer.

Open Wide for Some Soccer

The Simpsons parodied the American take on soccer decades ago, complete with a catchy jingle. The match leads to one of Homer’s iconic “boring” retorts, fueling a riot and the imposition of mob rule.

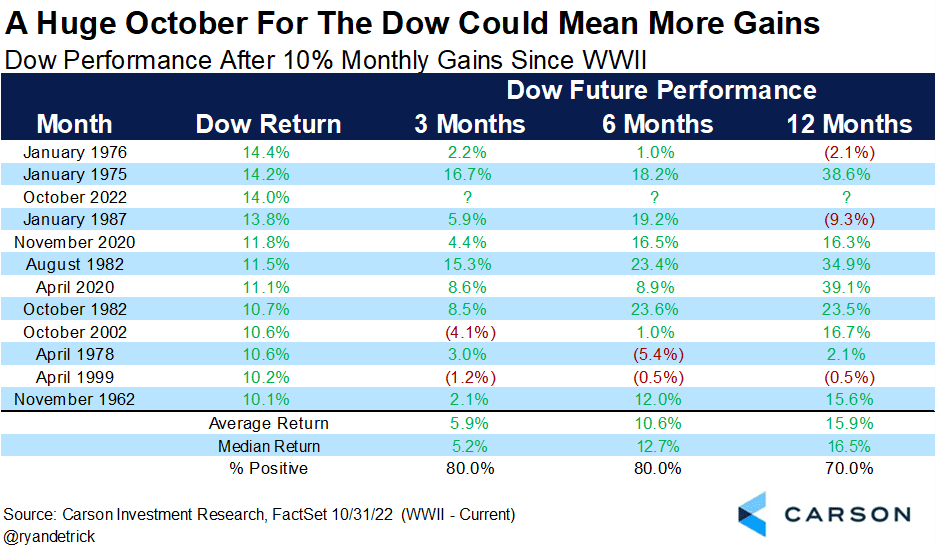

The only thing riotous in October was the performance of equities, where the mob overlooked continuing economic weakness and the prospect of further rate increases, fueling one of the best Octobers on record, specifically for the Dow. With Elon Musk’s takeover of Twitter and the likely return of the former President Trump to the platform, references to the Dow, which Trump used as a proxy for the STOCK MARKET, seem appropriate.

Bulls point to such statistics, as well as positive seasonality, especially during midterm election years, as cause to be sanguine.

Pivot

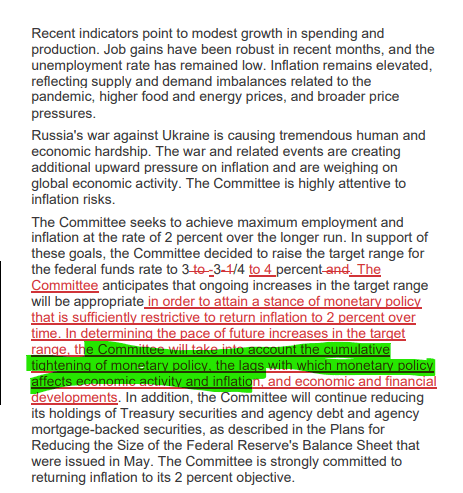

The bullish action was in large part driven by the notion of a pivot (pi-vuht) by the Fed. Coincidentally, there is a position in soccer’s cousin, futsal, called pivot (pee-vo), which although spelled the same is pronounced differently. This position on the futsal court is an attacker, and those expecting a pi-vuht at the Fed’s November meeting were instead treated to Chairman Powell as a pee-vo, i.e., attacker. While the market reacted favorably to the changes we have highlighted in green as being indicative of a dovish pivot, Powell delivered a crunching two-footed tackle worthy of a red card to the dovish narrative during the Q&A portion of the conference.

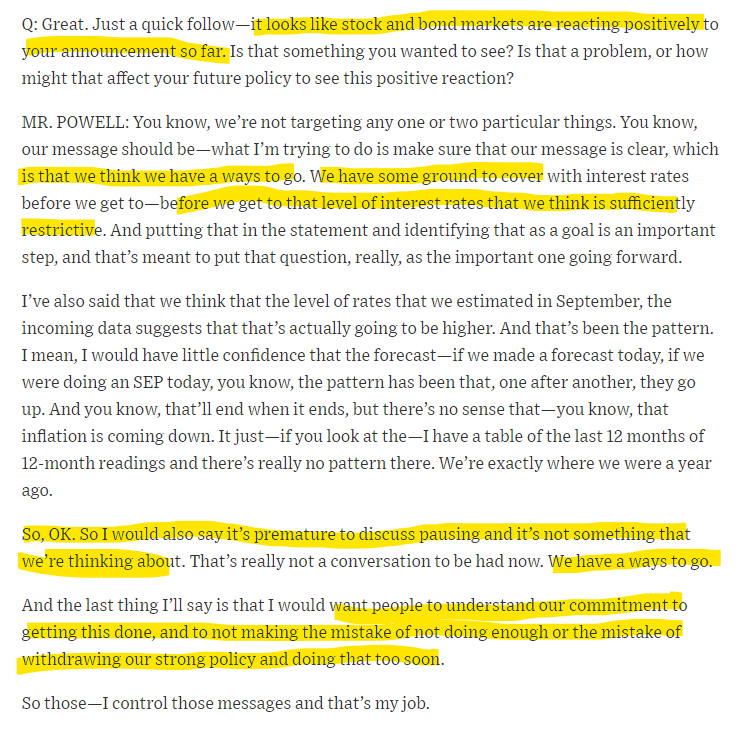

In particular, when questioned about the market’s initial favorable reaction to the change in language, he responded thus, with the language in yellow what we believe disabused investors about the likelihood of a pivot:

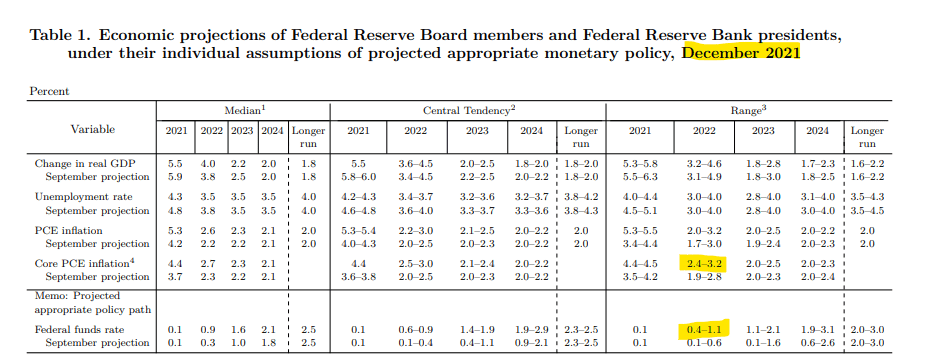

As a reminder, as of December 2021, here is where the Fed predicted inflation and rates would be, the infamous era of “transitory” inflation. Are we sure the Fed will be correct about its opposite, i.e., “entrenched” inflation? Reminds me of a coffee mug I once saw that stated, “often wrong but never in doubt.”

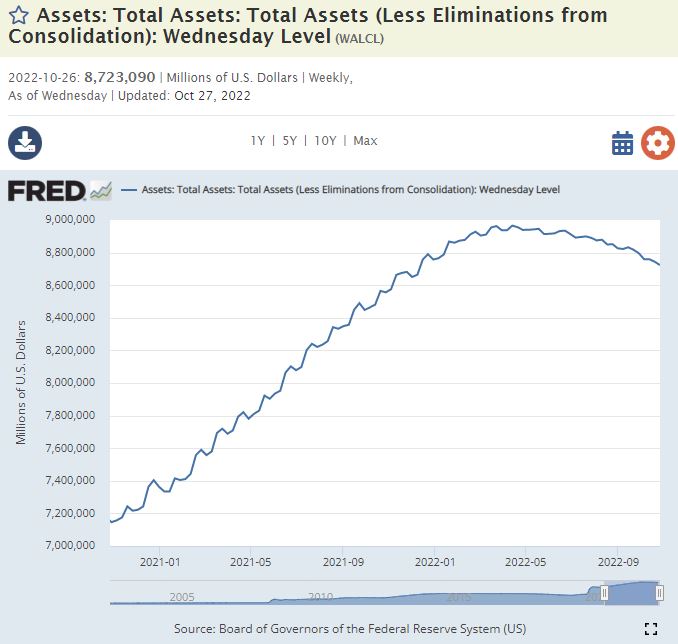

We provide more analysis on the Fed’s stance on the current podcast, which can be found here. While the focus has been on interest rates, important to not forgot the Fed is also reducing the size of its balance sheet, i.e., quantitative tightening. Such a two-footed approach to dampening inflation is beginning to draw the ire of lawmakers, with Senators Brown and Warren, as well as Representative Maxine Waters, Chair of the Committee on Financial Services, writing open letters critical of Fed policy.

U.S.A., U.S.A.

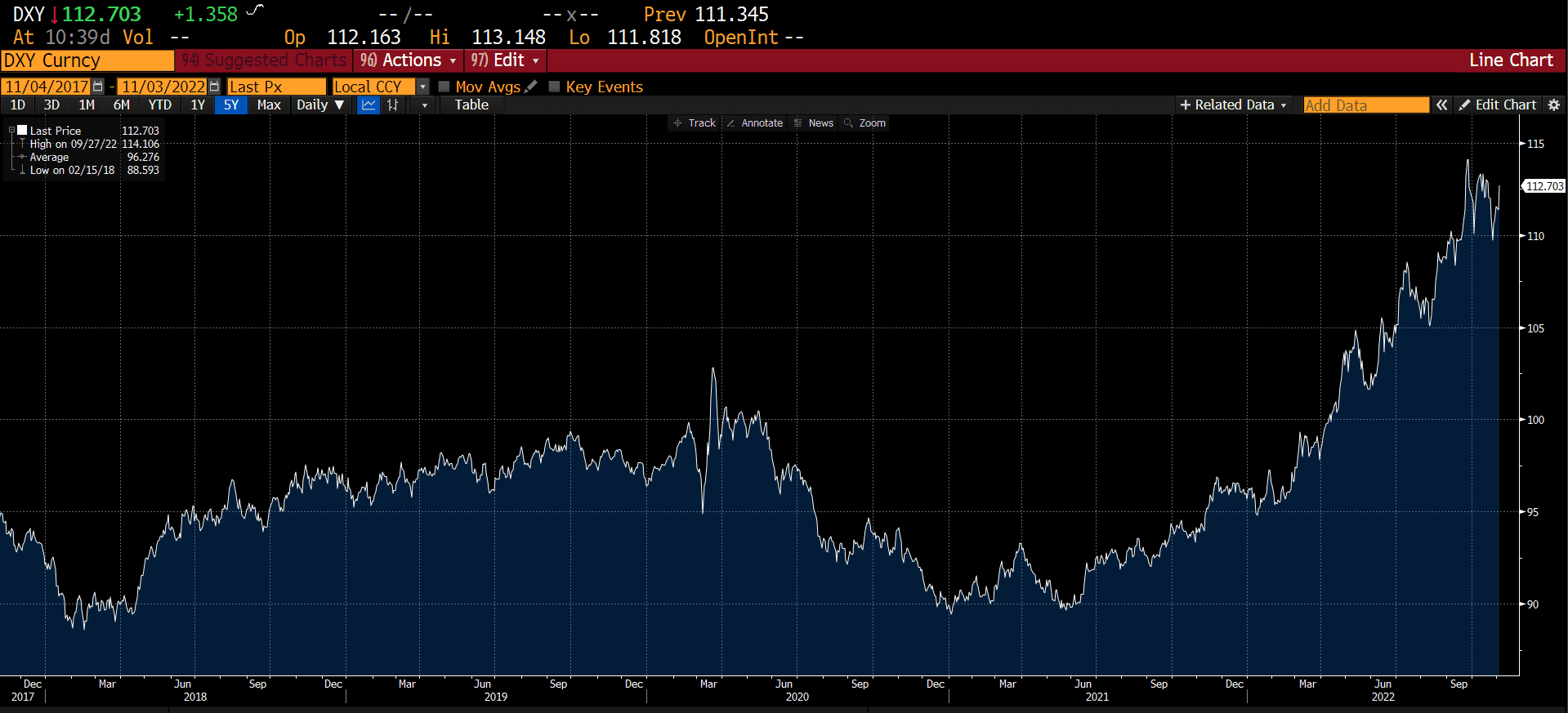

After missing the World Cup in 2018, the U.S.A. qualified for Qatar in 2022. Unfortunately, prospects for a deep run by the U.S. are not seen as high according to oddsmakers (U.S. is +15,000 to win). However, if there was a World Cup of currencies, the U.S would currently be odds-on favorite. To use Will’s preferred term, the rise in the dollar has been “parabolic,” putting it at its highest level in over 20 years.

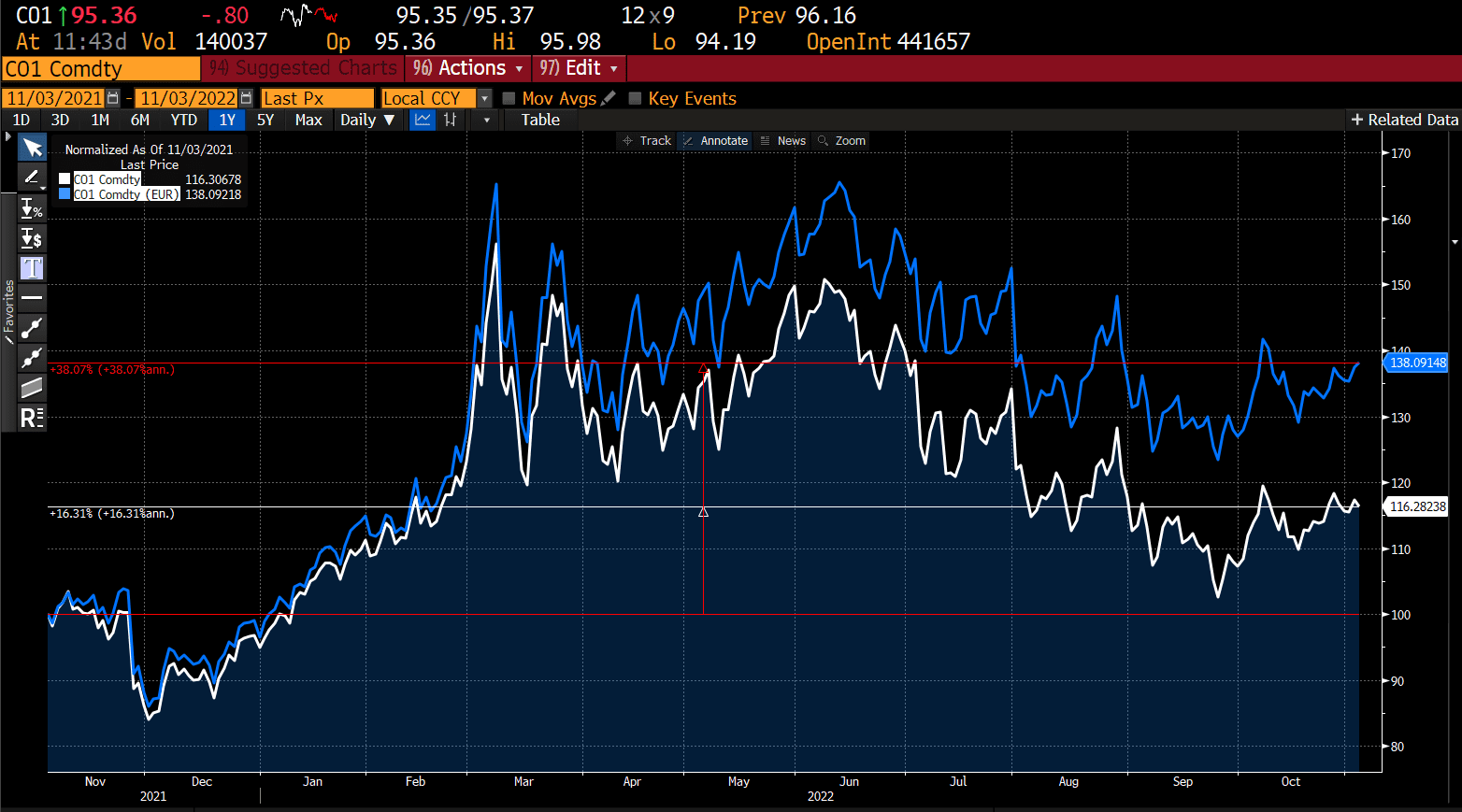

For those of us here in the states, a strong dollar is generally beneficial. Specifically, though it probably does not feel like it at the gas pump or the grocery store, a strong dollar has kept inflation from being even worse. For example, in dollar terms, oil (Brent crude) has increased 16% over the last year (white line) in dollar terms but is 38% more expensive in terms of the Euro (blue line); this graph would look similar in terms of the yen, pound, or almost any currency.

One place where the strong dollar is deleterious is with regard to the earnings of large, multinational corporations. According to the Wall Street Journal, companies with more than 50% of their revenues outside the U.S. are likely to see EPS decline by 0.7% in Q3 versus an approximate 3% growth for domestically focused companies. The Financial Times see a reduction in EPS of between 1% and 3%, with stalwarts like Apple estimating a 10% headwind due to the dollar.

Why is the dollar so strong? One reason is the aforementioned Fed hawkishness. Two is that, ceteris paribus, the U.S. economy is in far better shape than the rest of the world. Europe is suffering through worse inflation and higher exposure to the economic consequences of Russia’s invasion of Ukraine, while China wrestles with an unwinding property bubble and a continuation of its Zero Covid policy. Another is the reflexivity of a strong dollar, what in layman’s terms one might consider a vicious cycle. As of 2020, there was approximately $13 trillion in dollar denominated debt outside the U.S.; around one-third was owed by developing countries. As the dollar rises, this debt becomes more expensive, increasing the demand for dollars, which makes the debt more expensive, increasing the demand for dollars. You get the idea.

Group of Death

The World Cup divides the 32 teams randomly (subject to some geographic constraints) into eight (8) groups of four (4) teams. Inevitably, one group is stacked with strong teams, and it is known as the group of death.

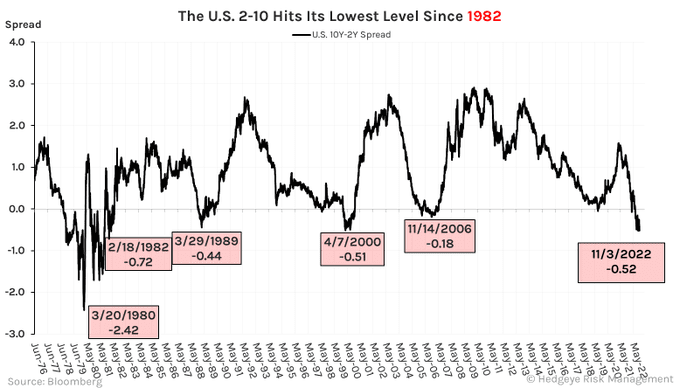

From an investment perspective, we have our own group of death in terms of the metrics we track. First and foremost is the shape of the yield curve. This is one of the key metrics we track in terms of the macroeconomic part of our investment process. The size of the current version is historic and foreboding.

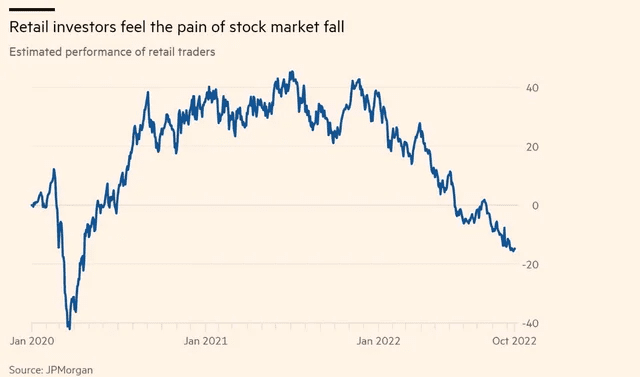

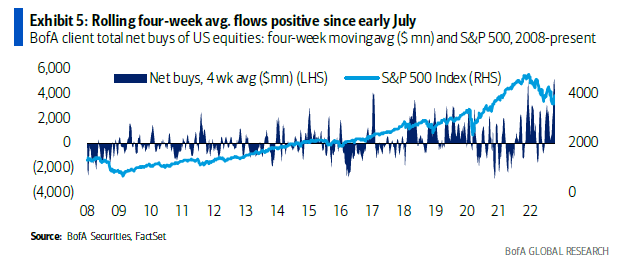

Second is a lack of capitulatory behavior. Investors, especially retail, have been conditioned to “buy the dip.” Normally markets find a nadir when retail investors throw in the towel, though in spite of this kind of performance, we continue to see inflows.

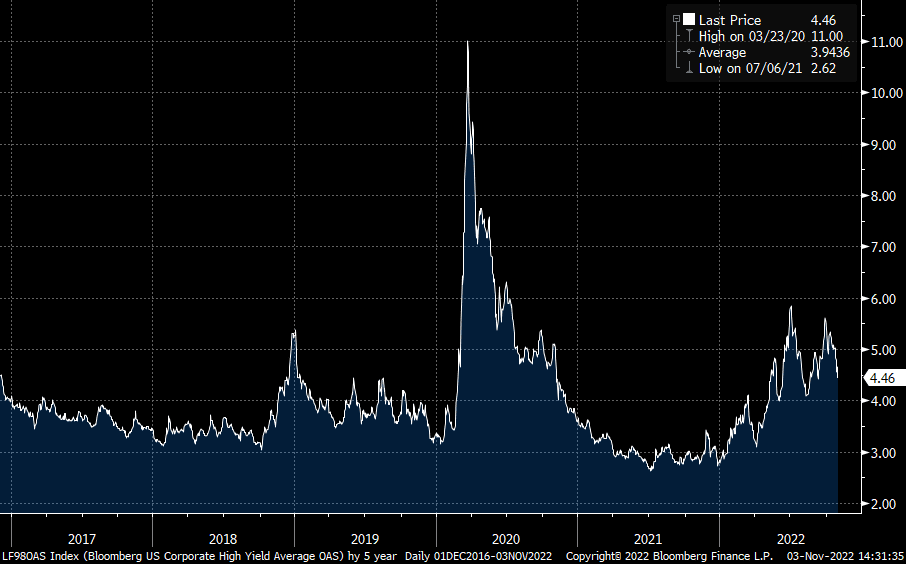

Third is a lack of stress in high yield bond spreads, which are only slightly above their long-term average. Again, normally a sustainable low in equities is accompanied by capitulation in high yield bonds, which is indicated by spreads in excess of 600 basis points; we are at 446 basis points now.

The fourth constituent of the group we have already discussed: the Fed. The market is not currently anticipating any relief in rates at the short end of the yield curve.

Group B

The U.S. is in Group B. Let’s look at what each country can help us learn about the outlook for the economy and markets.

England/Wales

In a strange coincidence, the U.S. faces two countries from the same country. Sadly, I recently won a bet that a head of iceberg lettuce would last longer than now former Prime Minister Liz Truss. Though relatively unimportant from a GDP perspective, the British pound has been trading like an emerging market currency, and the calamitous results of Truss’ short-lived premiership exposed structural weaknesses in the U.K. pension system. Certain U.K. bonds were without bids, e.g., buyers, forcing the Bank of England to intercede in the interest of market stability. The Bank of England, which also sets monetary policy for Wales, et al., is predicting a prolonged recession, so they could really use some good news on the football front.

Iran

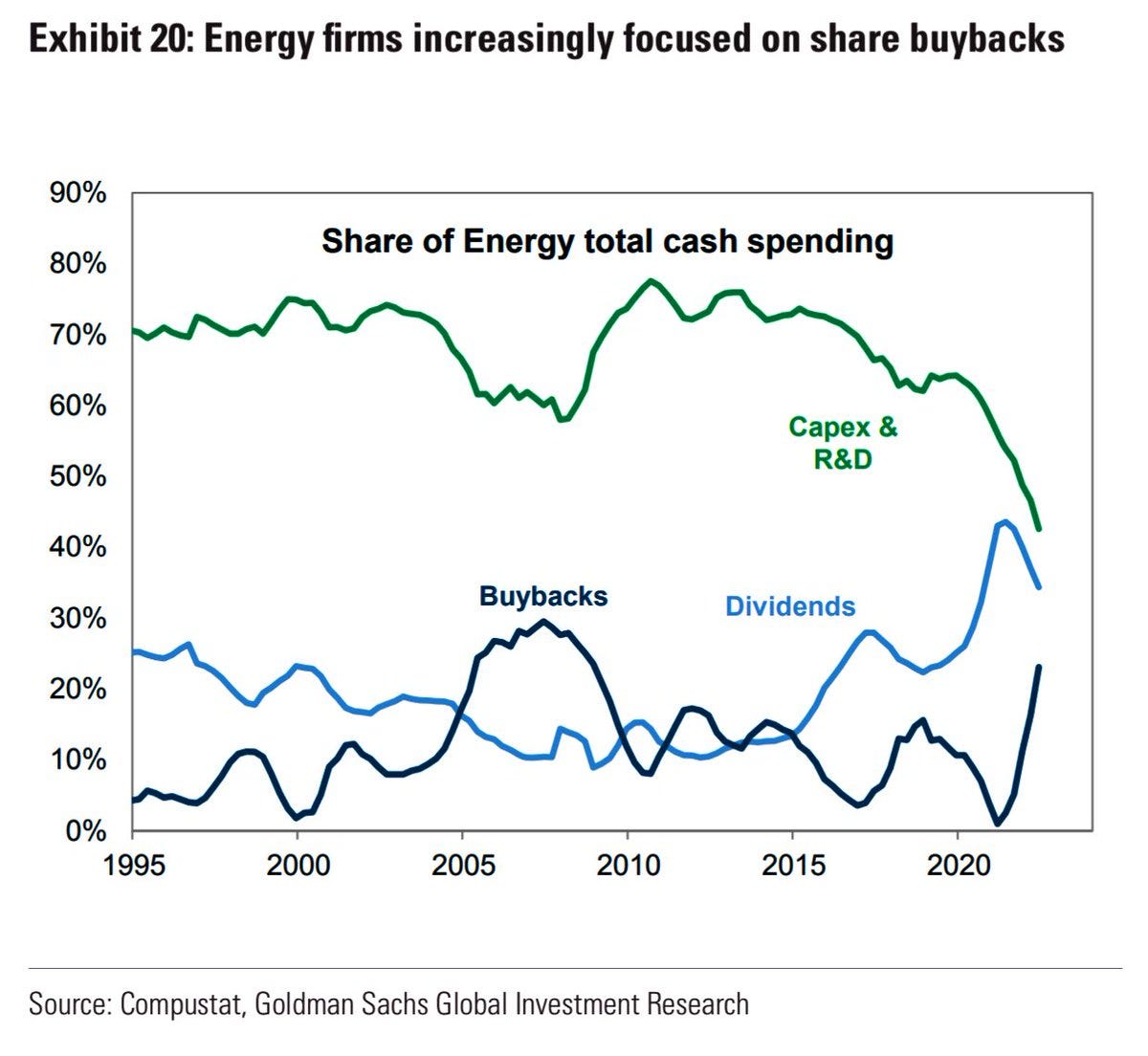

We discussed oil in terms of the dollar and Euro earlier. While higher over the last 12 months, it has come off the boil of late. Iran, as an international pariah, albeit an OPEC member, has been (officially) a bystander, though its OPEC colleagues have committed to production cuts. Domestically, the fossil fuel industry continues to draw the ire of politicians in the leadup to midterm elections, in large part due to their outsized profits and continuing affinity for returning capital to shareholders as opposed to reinvesting.

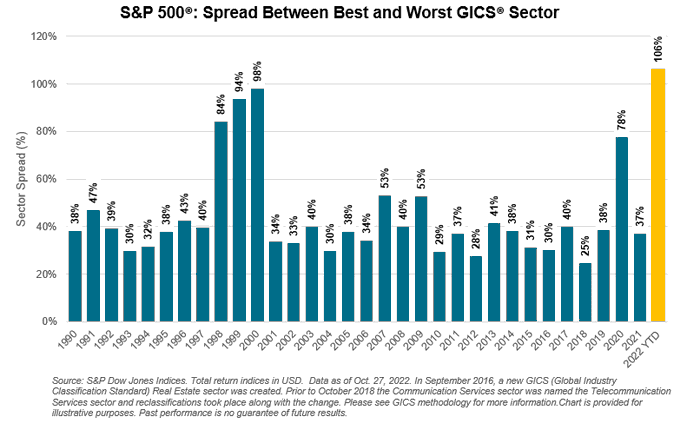

Investors in U.S. energy stocks have been rewarded in both absolute (+60%) and relative terms, with the sector’s outperformance versus the worst sector the widest on record:

United States

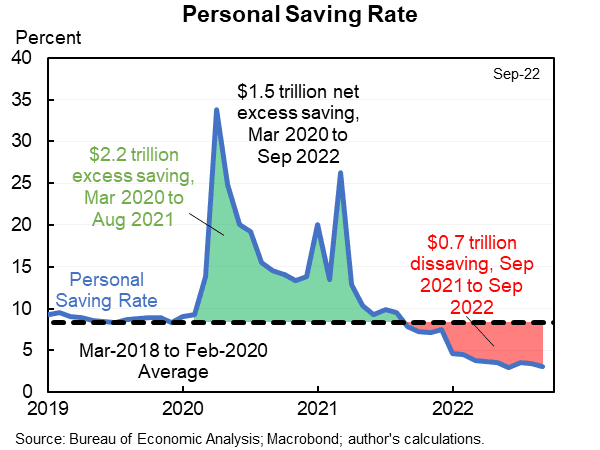

I know we have discussed all the dreadful things happening, but the U.S., on a relative basis, has an economy performing reasonably well. Is inflation high? Yes. Is the Fed tightening, perhaps too aggressively? Yes. Having said that, the employment picture remains strong, at least superficially, and consumers are continuing to spend, albeit at the expense of the surplus saving from Covid in large part (not to mention exploding credit card usage). However, especially at the upper end of the wage spectrum, savings remains abundant, i.e., there is still over $1 trillion left in excess Covid-era savings. Moreover, household debt service is less than 10%, well below the 13% peak it reached in the lead-up to the financial crisis.

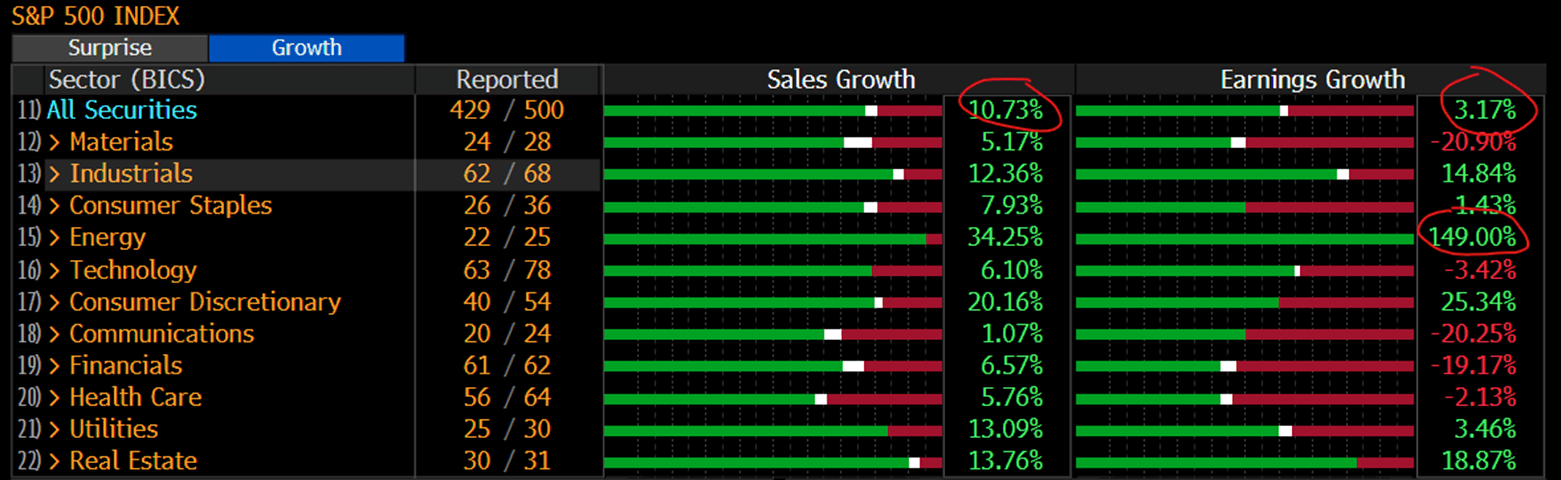

Moreover, earnings for companies in the S&P have been resilient, though strength in energy (149% EPS growth) has had an outsized effect. Earnings growth (+3.17%) has lagged sales growth (+10.73%) indicating profit margins are deteriorating:

League Table

In football, a league table shows the rank of the teams. The league table for indices in 2022 makes for troubling viewing for investors. At the top, i.e., the best performer, is the equal-weighted S&P 500, wherein each company has an equal weight as opposed to the market cap weighted structure of the traditional S&P 500, where megacap tech stocks like Apple and Microsoft have an outsized weight. These companies are also large weights in the NASDAQ index, which is at the bottom of the table YTD.

| Index | 1-Month | 3-Month | YTD | 1-Year |

| Invesco S&P 500 Equal Weight E | 9.65 | -3.87 | -13.04 | -10.03 |

| Bloomberg US Treasury Total Re | -1.39 | -7.16 | -14.30 | -14.09 |

| Bloomberg US Agg Total Return | -1.30 | -8.23 | -15.72 | -15.68 |

| Russell 2000 Index | 11.01 | -1.67 | -16.86 | -18.56 |

| S&P 500 INDEX | 8.10 | -5.87 | -17.72 | -14.63 |

| MSCI EAFE Index | 5.38 | -8.91 | -22.74 | -22.53 |

| MSCI Emerging Markets Index | -3.09 | -14.02 | -29.22 | -30.76 |

| NASDAQ Composite Index | 3.94 | -11.13 | -29.31 | -28.53 |

Source: Bloomberg (as of most recent month end)

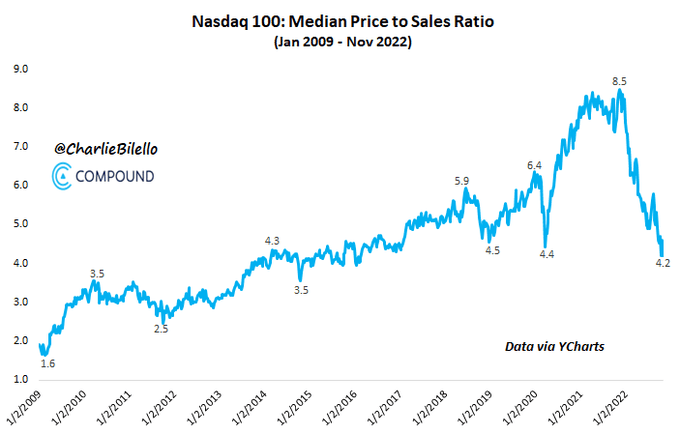

Although the NASDAQ is at valuation levels that are consistent with recent lows, it is not cheap versus its longer-term history.

Predictions

People love sports because of the unpredictability. Soccer is even more unpredictable due to the dearth of scoring chances, one of the criticisms many Americans have on the sport, along with ties.

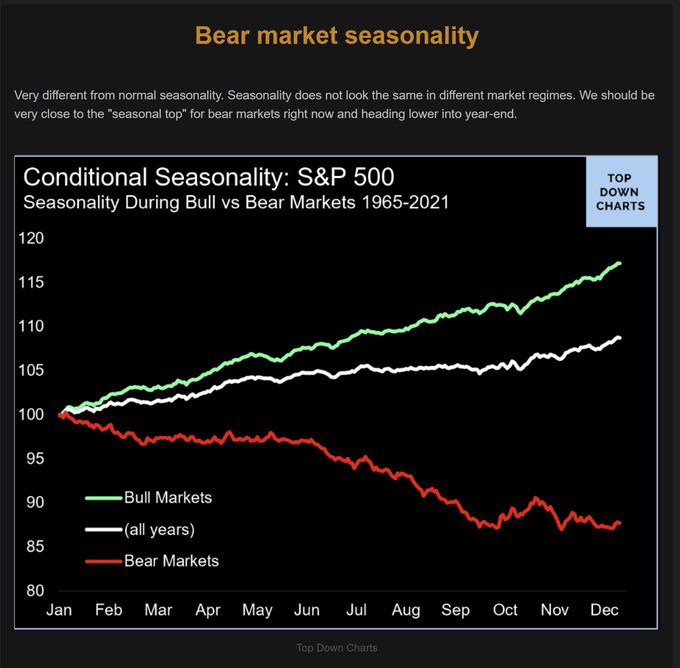

Markets are also unpredictable. As mentioned, our base case is that volatility continues as the market digests more rate increases, quantitative tightening, a midterm election, and unfavorable seasonality during a bear market, i.e., tax selling.

Despite soccer’s unpredictability, the favorite has won the World Cup nine (9) of the 21 times the event has been played. Right now, the favorite, so to speak, is for the Fed’s tightening to tip the economy into a recession. Look no further than the shocking headlines from the housing complex. Mortgage applications are 41% lower than a year ago, mortgage rates are at 20-year highs of over 7%, and Wells Fargo had mortgage originations 90% below year ago levels. As mentioned in prior letters, the sequence of economic slowdowns is predictable: housing -> orders -> profits -> employment.

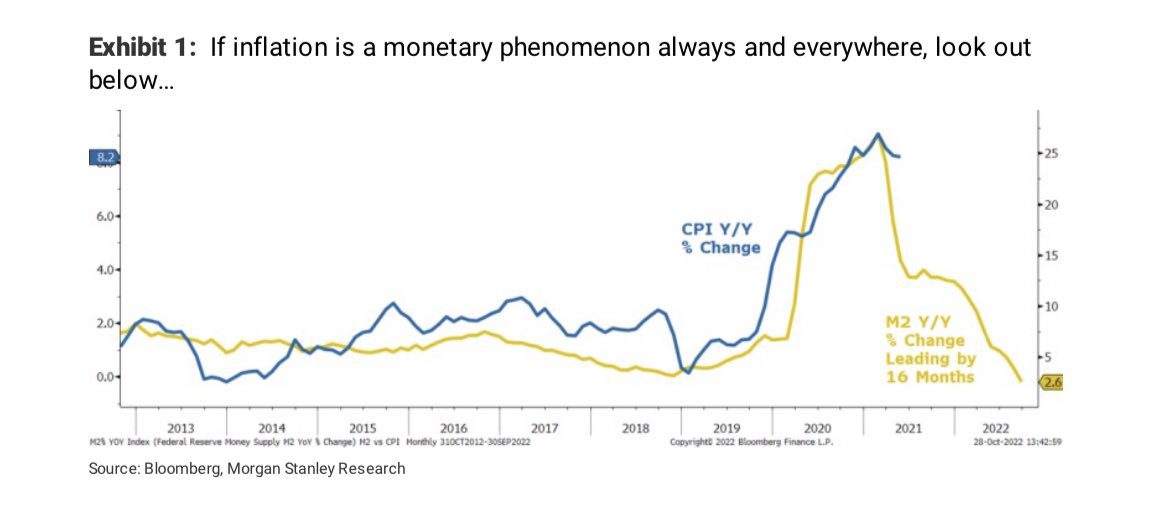

Perhaps the historical relationship between M2 and inflation holds, leading to a rapid retrenchment of CPI, allowing for an earlier pivot by the Fed. This, combined with reasonably good economic and earnings growth would be the cliched “soft landing”, the odds of which Powell stated had “narrowed” but was still possible.

We would look at a soft landing in similar terms to the U.S winning the World Cup. Is it possible? Sure. Is it likely? No. In other words, although we will be rooting for it the odds are stacked against us.

Own Goal

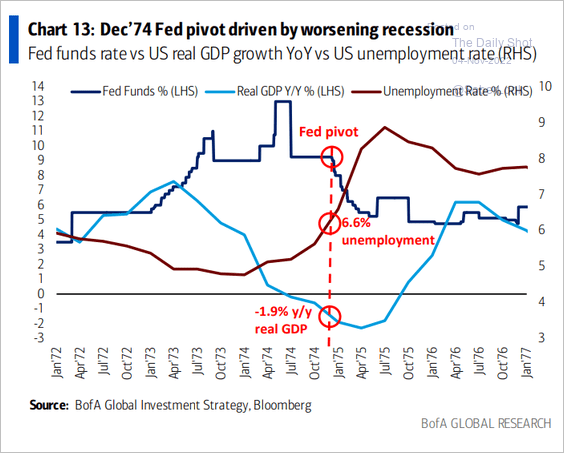

The most ignominious event in soccer is the own goal, where a player, normally when trying to defend, inadvertently puts the ball in his or her own net. Often, the own goal is caused by looking in the wrong direction. In trying to defend against inflation, could the Fed put the ball in its own goal by looking in the wrong direction? If history is any guide, it is a distinct possibility.

For a hopefully inaccurate analog, we look at the mid-1970s, when by the time the Fed pivoted, GDP growth was at nearly -2% and headed lower, and unemployment was at 6.6% and headed higher.

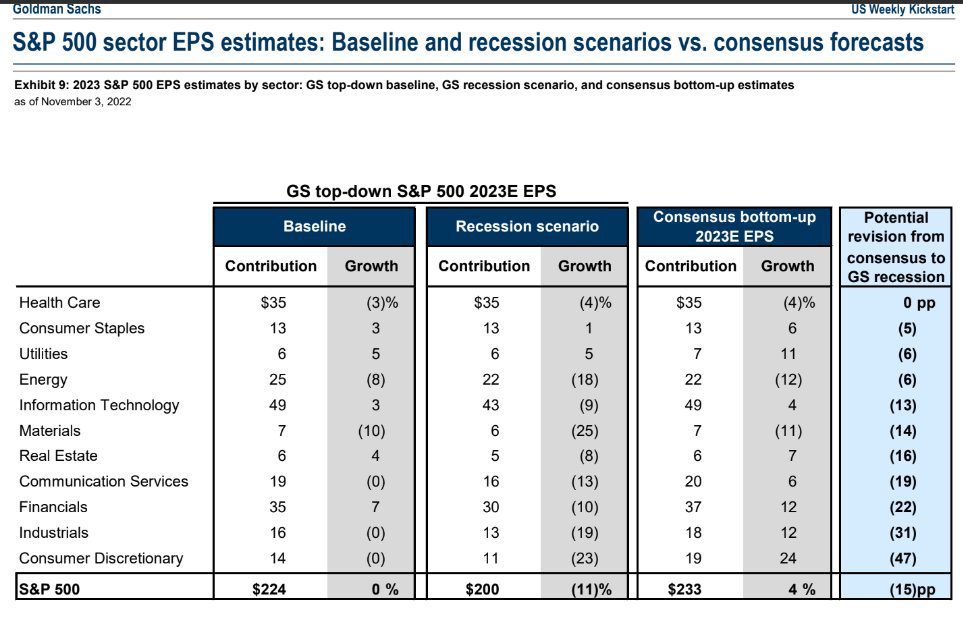

If an analogous situation unfolds over the next 12-18 months, this would put the U.S. economy firmly in recession territory. As of now, that is not the base case for Wall Street, where estimates for S&P 500 earnings are for 4% EPS growth in 2023. Historically, recessions are accompanied by earnings declines of anywhere between 10% and 15%.

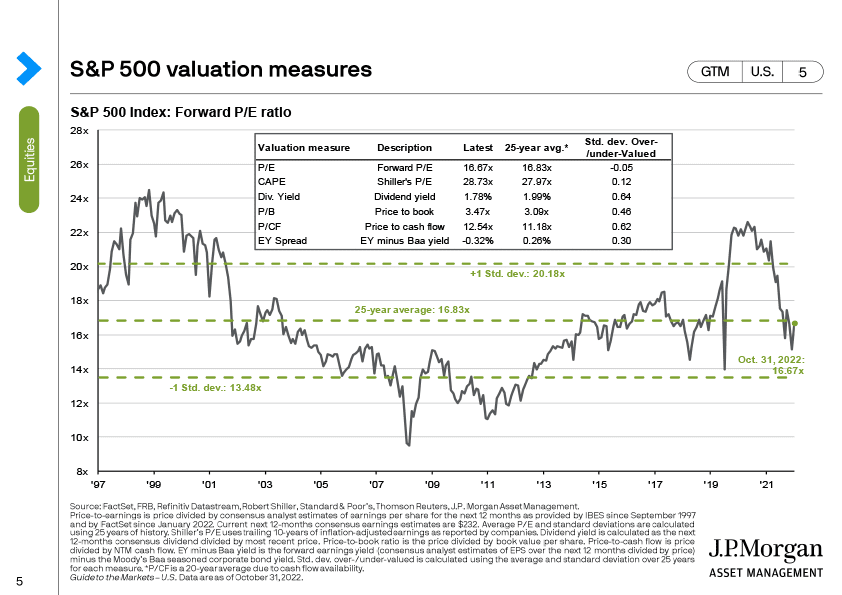

The market’s year-to-date decline has been a function of multiple compression, with the S&P’s multiple declining from 21x to 17x, in-line with the 25-year average for the S&P. Accordingly, an “average” recession would lead to an 11% drawdown for the S&P 500 based on lower S&P earnings, i.e., exclusive of any further multiple contraction.

In addition to my role at Formidable, I also coach soccer (pictured here with my favorite player, i.e., our daughter).

There are more similarities between the gigs than one might think. When you put a line-up together, you assemble players that complement one another (goalie, defenders, midfielders, strikers). Against more formidable opponents, you set up your team more defensively, i.e., more defenders and fewer strikers.

The Fed is just such an opponent. Accordingly, in soccer parlance, we plan to “park the bus.” Does that mean eleven goalies, i.e., all cash? Certainly not. Does it mean fewer attackers and more defenders? Absolutely.

Our plan is to focus on developing a portfolio of complementary companies we think may prove more resilient, e.g., higher quality, stronger balance sheets, lower valuations. In other words, being more defensively minded as opposed to chasing the leaders from the last cycle that, although in some cases are down significantly, remain expensive in a world where capital, once again, has a cost.

READY TO TALK?