May Update: The First Republic

Key Takeaways

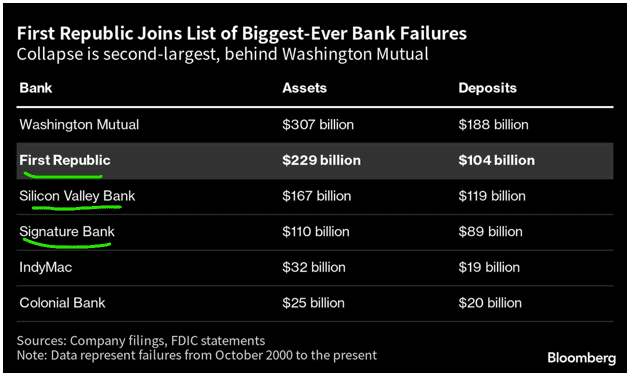

- The second largest bank failure in U.S. history was not enough to take stock indexes lower in April.

- A smaller and smaller cohort of megacap stocks continues to account for almost all of the market’s returns.

- Current expectations for the paths of earnings and interest rates are almost certainly mutually exclusive yet serve as the foundation on which index investors are relying.

“The Roman character had a strong streak of snobbery: effectively, citizens preferred to vote for families with strong brand recognition.” Tom Holland, Rubicon: The Last Years of the Roman Republic

“Men are nearly always willing to believe what they wish.” Julius Caesar

“He who sows the ground with care and diligence acquires a greater stock of religious merit than he could gain by the repetition of ten thousand prayers.” Edward Gibbon

2023 has seen three of the four largest bank failures in U.S. history (underlined in green). According to the winning suitor in the First Republic shotgun wedding, J.P. Morgan’s Jamie Dimon, the problem is solved. Per CNBC: “There may be another smaller one, but this pretty much resolves them all.”

With First Republic the most recent (and largest) victim this year, we look back to the (according to some sources) original First Republic, i.e., Rome, for inspiration.

April Recap – The Roman character had a strong streak of snobbery.

American investors, like the Romans, have a strong snobbery streak as it relates to the largest holdings in the index. We went through this in excruciating detail last month, though it has continued unabated; this article from the FT talks about the phenomenon.

A few pieces of trivia from the article:

- The two largest stocks (Apple and Microsoft) comprise the highest percentage ever of the index (13.4% between the two).

- The ten largest stocks are down from record levels of early 2022 but still reflect a level of index concentration in the highest 5%.

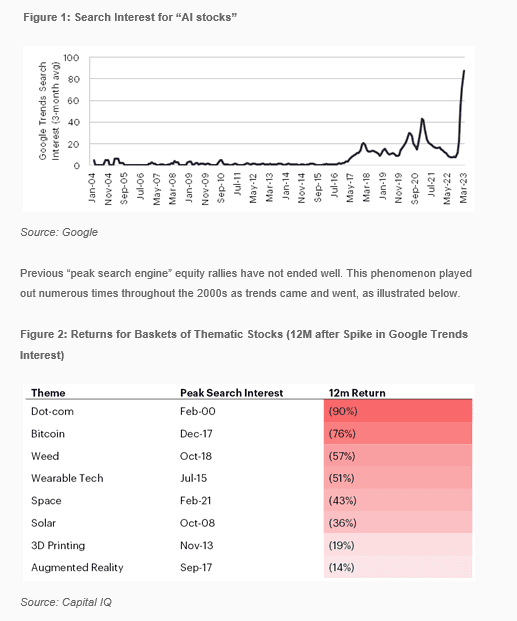

- Artificial Intelligence (AI) themed stocks have gained $1.4 trillion in market cap this year. No wonder Google mentioned the term 54 times during its earnings call according to my perusal of Bloomberg…

Verdad Capital looked at prior instances where what one might pejoratively (and accurately) call thematic retail stocks have seen spikes in Google Search trends, and what the subsequent results have been. Perhaps it will be different for AI stocks, but history has shown these types of stocks to have often been fads not underpinned by sound business models or profitability. While some of the stocks in the current AI basket are solid companies, valuations are very much elevated.

For April, we saw continued strength for megacap stocks and weakness for smaller stocks and commodities, normally a sign of impending economic weakness:

| Index | 1-Month | 3-Month | YTD | 1-Year |

| S&P 500 INDEX | 1.56 | 2.71 | 9.16 | 2.64 |

| Invesco S&P 500 Equal Weight E | 0.36 | -3.87 | 3.26 | 0.31 |

| NASDAQ Composite Index | 0.07 | 5.78 | 17.13 | 0.05 |

| Russell 2000 Index | -1.80 | -8.08 | 0.88 | -3.68 |

| MSCI EAFE Index | 2.92 | 3.43 | 11.83 | 9.10 |

| MSCI Emerging Markets Index | -1.12 | -4.68 | 2.85 | -6.15 |

| Bloomberg US Treasury Total Re | 0.54 | 1.03 | 3.56 | -0.93 |

| Bloomberg US Agg Total Return | 0.61 | 0.49 | 3.59 | -0.43 |

| Invesco DB Commodity Index | -0.76 | -5.27 | -4.42 | -13.90 |

Source: Bloomberg (as of most recent month end)

May Outlook – Men are nearly always willing to believe what they wish.

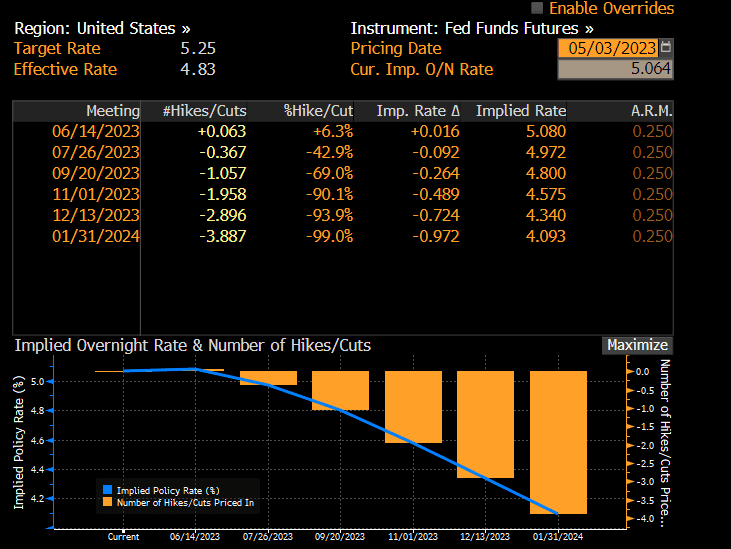

What does the market wish to be true? First is that the Fed is done with rate increases, pauses in June and July, then starts aggressively cutting rates.

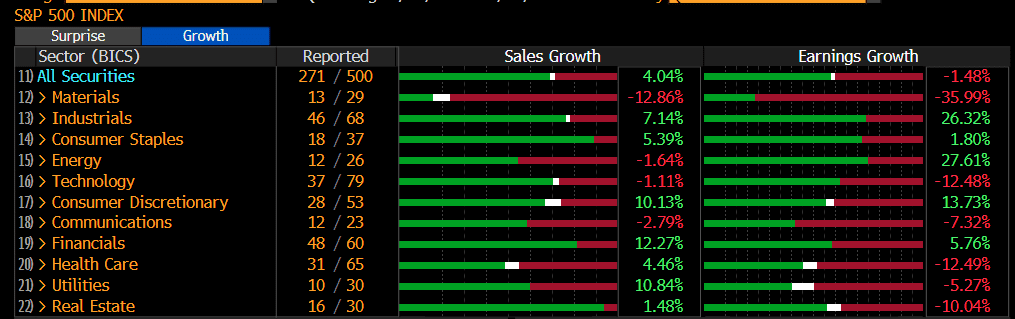

Next is that earnings nadir in Q1 with a small decline, which is currently what we are seeing about halfway through earnings season, then ratchet higher during the remainder of 2023. Some of the enthusiasm over earnings has been a result of positive earnings surprises, i.e., results have been slightly better than feared, though one could also argue the bar was substantially lowered and thus easier to clear).

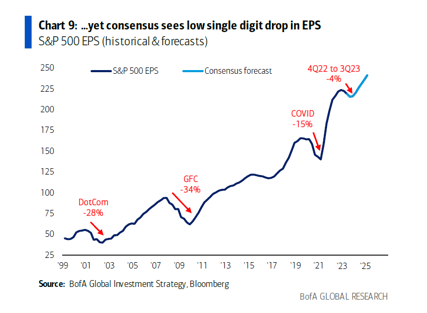

Consensus estimates call for a mere 4% decline in EPS in 2023, followed by a sharp jump in 2024:

This is where we see the market’s belief as more of a wish. It is incredibly difficult to envision a scenario where the Fed is compelled to rapidly cut interest rates unless we have some sort of economic contraction, the likes of which might be caused by banking troubles. As Powell stated, “these tighter credit conditions are likely to weigh on economic activity, hiring and inflation.” If that occurs, it is unlikely that earnings would decline a mere 4%. To put it succinctly, you could have a Fed pivot, or you could have a very modest earnings decline, but it is unlikely you could have both. However, that is what stocks are (in our mind) incorrectly pricing.

The seven key factors we track showed no change month over month, but we will spend a little time on each.

| More Negative | Neutral | More Positive | |||

| Inflation | ≈ | ||||

| GDP Growth | ≈ | ||||

| Fed Policy | ≈ | ||||

| Interest Rates | ≈ | ||||

| Credit Spreads | ≈ | ||||

| Stock Multiples | ≈ | ||||

| Earnings Growth | ≈ | ||||

| Deteriorating | ← | ||||

| Status Quo | ≈ | ||||

| Improving | → | ||||

- Inflation – Negative but stable. While March CPI data was a little better than expected, Core PCE, which the Fed considers more useful, showed inflected higher, cementing the case for a May hike.

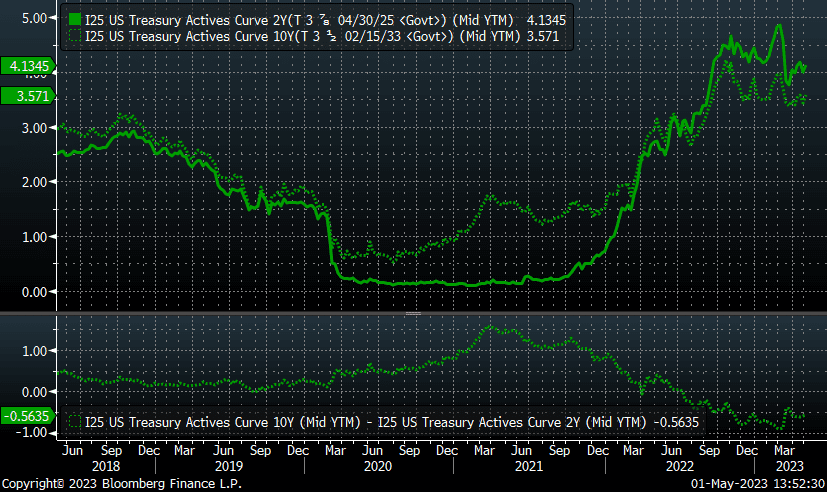

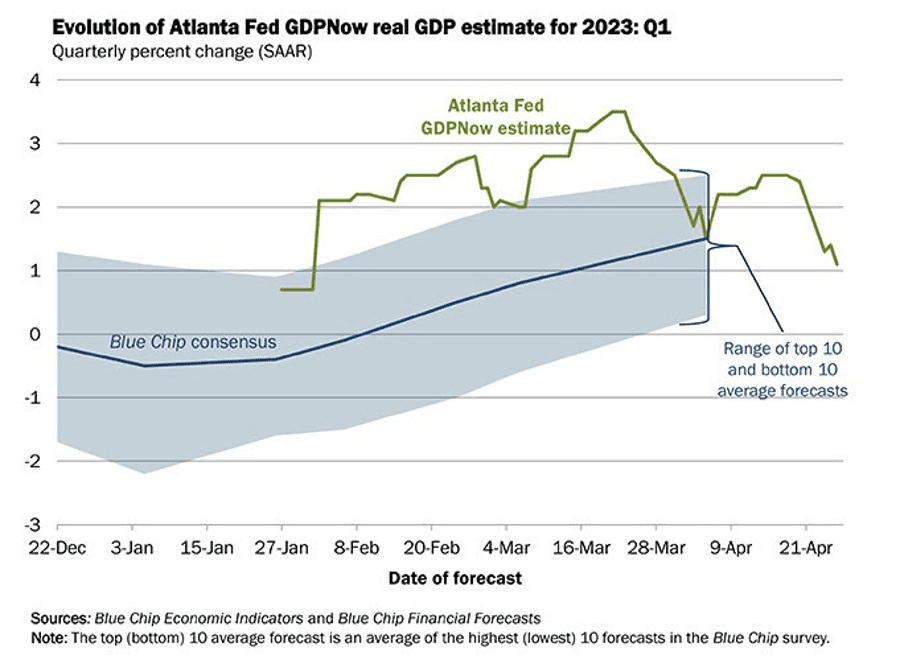

- GDP Growth – Negative but stable. The inverted yield curve remains a problem; the 2-10 inversion is 56 basis points, which is relatively deep. Moreover, 93% of the yield curve is currently inverted. The only thing worse will be if this curve un-inverts due to a collapse in the two-year treasury. The Atlanta Fed’s GDP estimates continue to decline as well.

- Fed Policy – Negative but stable. The Fed has seen its balance sheet resume its decline after the SVB spike, so we could have put this in the deteriorating camp, but a pause in rate increases may be in the offing. However, with the bond market pricing in more cuts over the next 18 months than at any other time in history, we could still be set up for disappointment.

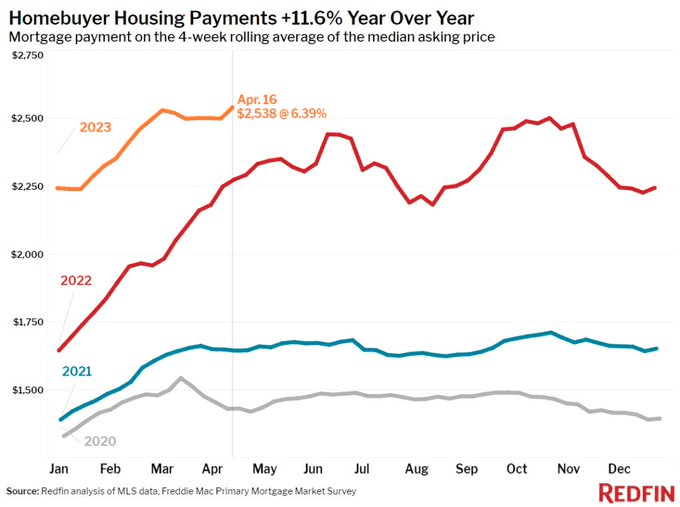

- Interest rates – Negative but stable. The 10-year Treasury increased slightly in April, and effective rates on both credit cards and mortgages remain elevated in absolute terms and versus treasuries. The combination of higher rates and home prices is a significant tax on consumers.

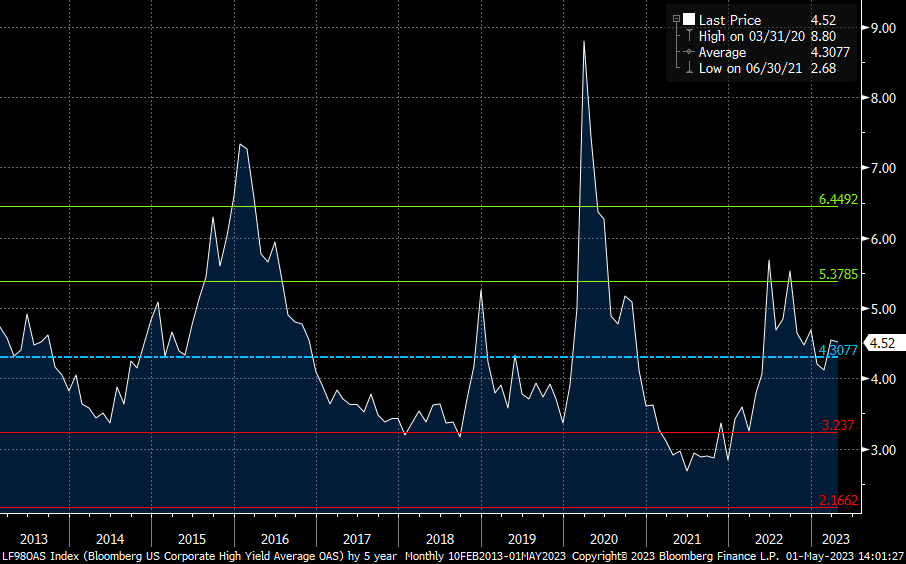

- Credit spreads – Negative but stable. Spreads do not reflect the likelihood of an economic slowdown. High-yield spreads are in-line with their long-term average and have not widened despite banking tumult.

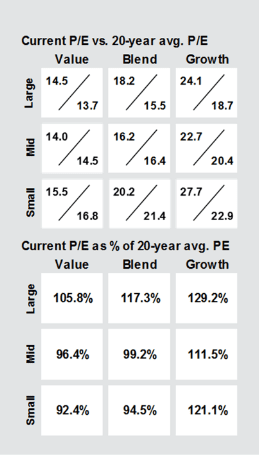

- Stock multiples – Negative but stable. Stocks are slightly expensive on an index basis versus recent history, i.e., the last 25 years, on every metric. Growth stocks, especially large cap, are the most expensive, according to J.P. Morgan.

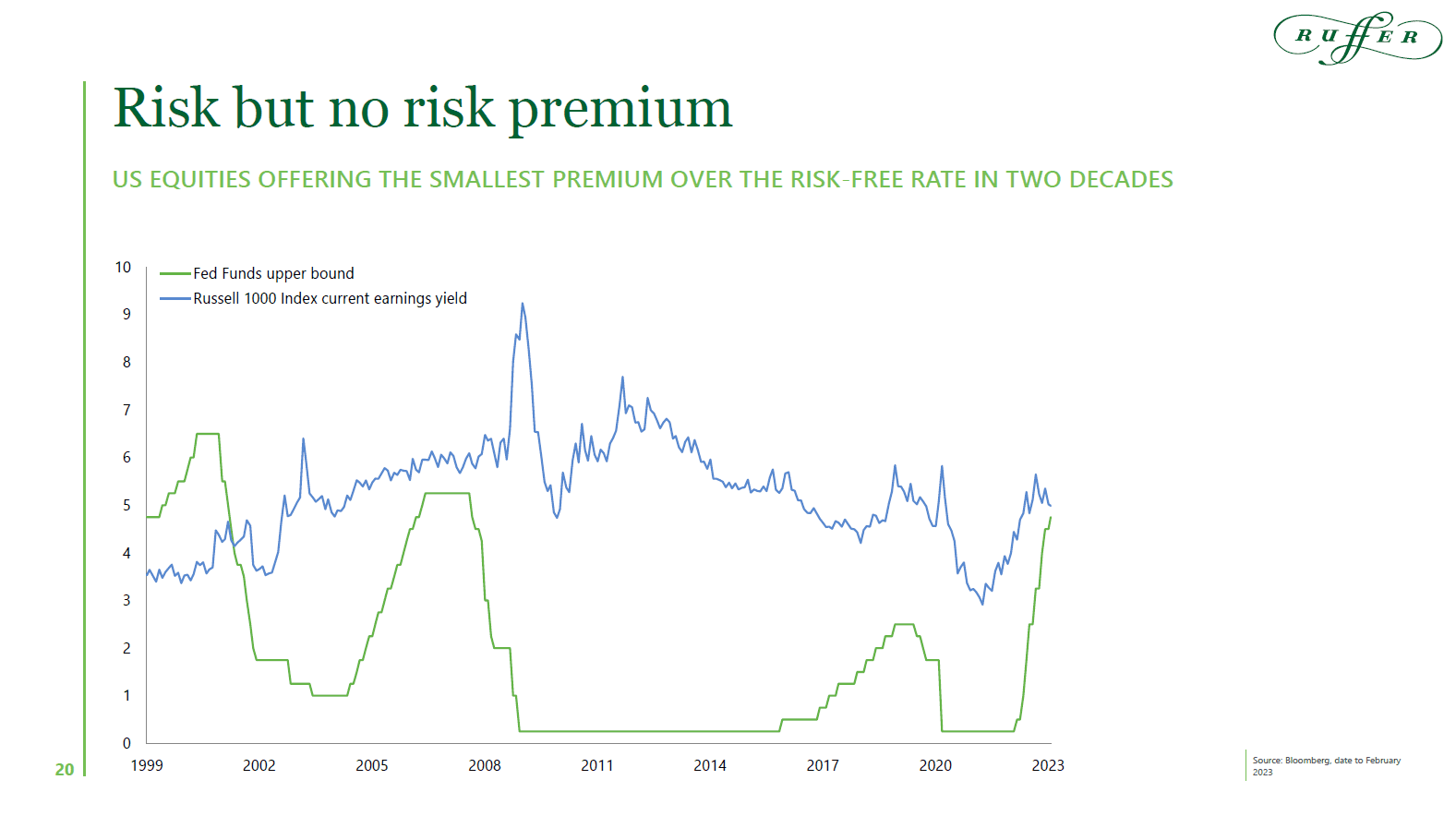

Moreover, versus the so-called ‘risk-free rate’, i.e., the Fed Funds rate, they have not been this unattractive since the tech bubble, according to Ruffer Investments:

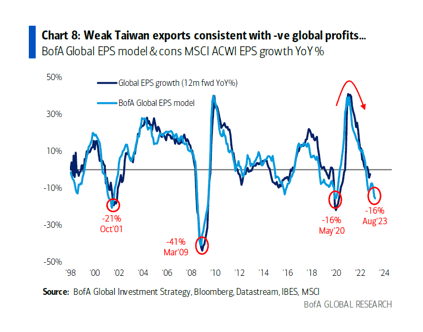

- Earnings growth – Negative but stable. We addressed the disconnect previously. Bank of America’s proprietary model is calling for a 16% decline in EPS globally. Could U.S. earnings decline a mere 4% if things are this bad globally? Seems unlikely.

Conclusion – He who sows the ground with care and diligence acquires a greater stock of religious merit than he could gain by the repetition of ten thousand prayers.

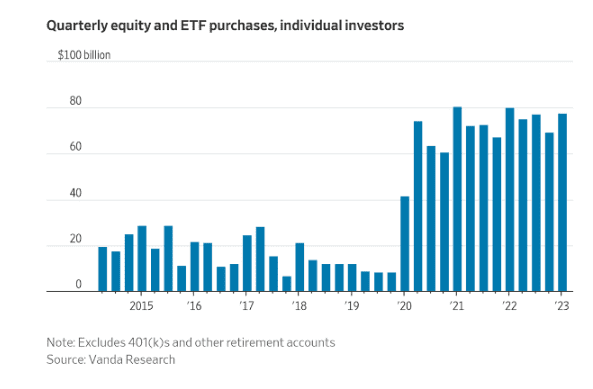

The market is currently held aloft by something akin to the repetition of ten thousand prayers. Retail investors have continued to pile into equities at an elevated rate, praying for strong earnings and a Fed pivot to support high multiples, not to mention incredibly low volatility, as measured by the VIX.

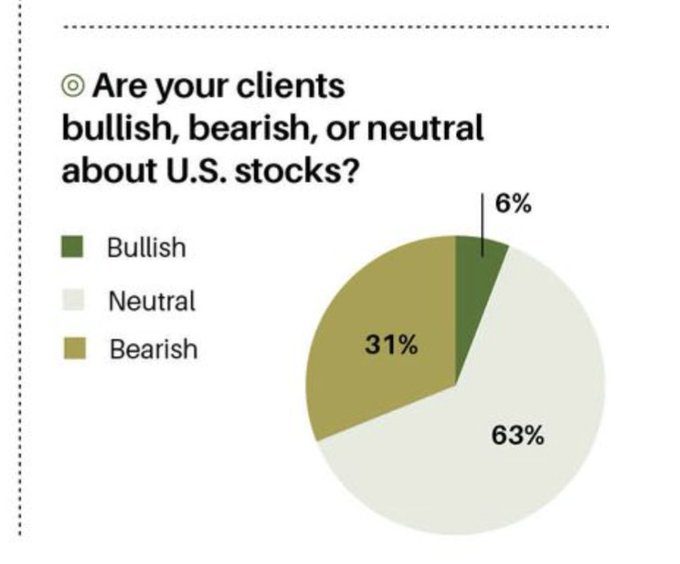

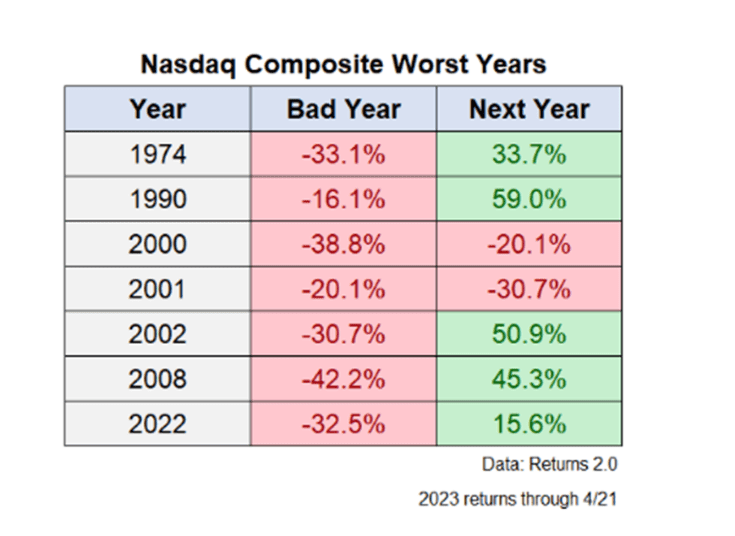

Could we be wrong? Most certainly. We have seen even frothier environments in the past, and even though flows have been positive, sentiment remains depressed. Were we to see a pivot from neutral/bearish sentiment to bullishness in light of prior tech bear market rebounds, it could be “Look out above!”.

Per the quote from Edward Gibbons’ The Decline and Fall of the Roman Empire, we take away two things. One, power became more concentrated in Rome over time, as it transitioned from republic to empire. We are seeing a similar phenomenon in markets, where a handful of companies are solely responsible for the returns of the index. Whether in a political system or markets, this concentration is unhealthy.

Second, our job is not the repetition of prayers that that the market gods favor us, but rather to sow the ground with care and diligence. We have a well-defined investment process, which is critical at times like this. Right now, as we saw in the prior section, that process indicates caution. We continue to focus on higher quality, lower valuation, and stocks outside of the speculative froth.

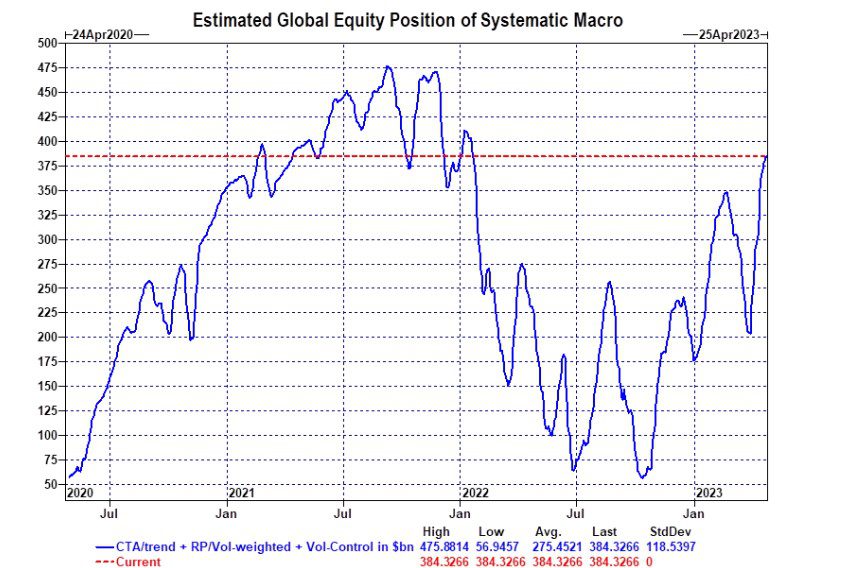

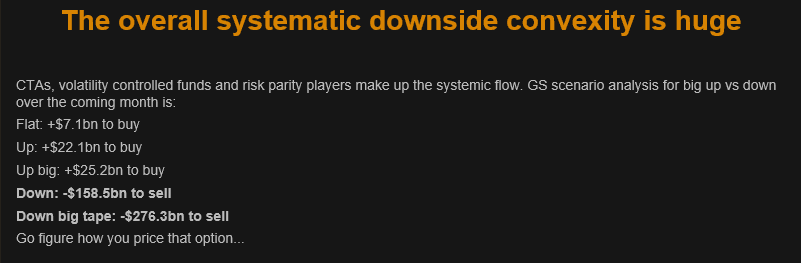

In addition to our process indicating caution, we would note a sizable (and unfavorable) asymmetry present in the market at present. Systematic macro funds, which tend to be trend following, have been large purchasers of stocks on recent strength, buying almost $143 billion in the past month, according to Goldman Sachs.

If markets continue higher, these funds will continue to buy, albeit at a more modest clip ($20-$25 billion). If, however, we see any weakness, the asymmetry looks problematic (sells could be over $150 billion).

Even if earnings are good enough, several factors could provide a downward bias to markets and tip us into these reflexive sells:

- Further financial instability among banks or in credit markets.

- Renewed hawkish rhetoric from the Fed.

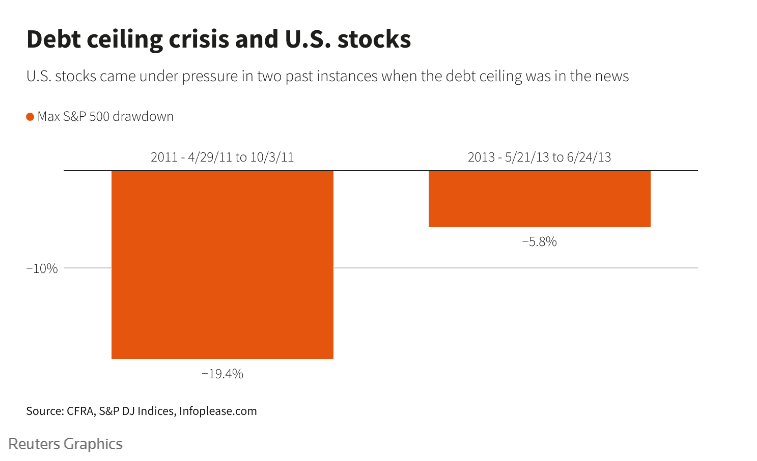

- Further political intransigence over the debt ceiling, which is now estimated to be hit in June as opposed to later in the year. The last two debt ceiling showdowns have seen sharp declines and, as this Bloomberg article speculates, “Markets would react so badly in that intervening period, the thinking goes, that elected officials would have no other choice but to quickly hammer out a deal.”:

As a Cincinnati-based firm, we would be remiss to omit our city’s namesake. Cincinnatus was a leader during the early days of the republic, legendarily leaving his fields to assume the role of dictator (which had a much different connotation at that time), then returning to the plow after his job saving the republic was accomplished.

If we harken back to the start of this month’s update, Jamie Dimon’s statement also included the phrase, “This part of the crisis is over.” Perhaps he is correct in assuming that this triumvirate are the only banks that will be killed by a Fed-induced liquidity crunch. We are dubious of this claim, and only time will tell. However, implied in his statement is that another part of the crisis is to come, and on that we agree. The time for vigilance remains, and before we can return to the work of harvesting gains for portfolios, we must continue to defend against threats.

READY TO TALK?