Acacia Research: Undervalued Biotech Tentacles

Executive Summary

In this research note, Formidable takes a deep dive into Acacia Research Corporation (NASDAQ: ACTG), which represents an investment opportunity in secondary private equity as well as patent litigation (its historical bailiwick). See below for the company’s mission statement, pulled from its website.

“Acacia Research seeks to acquire undervalued businesses with a primary focus on mature technology, life sciences, industrial and certain financial services segments, and pursues opportunities for value creation that leverage Acacia’s significant capital resources as well as its expertise in corporate governance and operational restructuring.”

Formidable’s base case estimates the unrealized value of ACTG’S private equity investments exceeds the company’s book value accounting for these investments by approximately $425 million. The body of the whitepaper provides insight into the methodology applied to arrive at the Formidable base case estimated value for each investment. Formidable concludes ACTG currently trades at approximately a 35% discount to the fair value of its assets and anticipates unrealized value could be unlocked by any of the following:

- Upcoming Oxford Nanopore IPO

- New acquisitions

- Additional sell side analyst coverage

- Portfolio development of life sciences assets

- Additional patent litigation wins

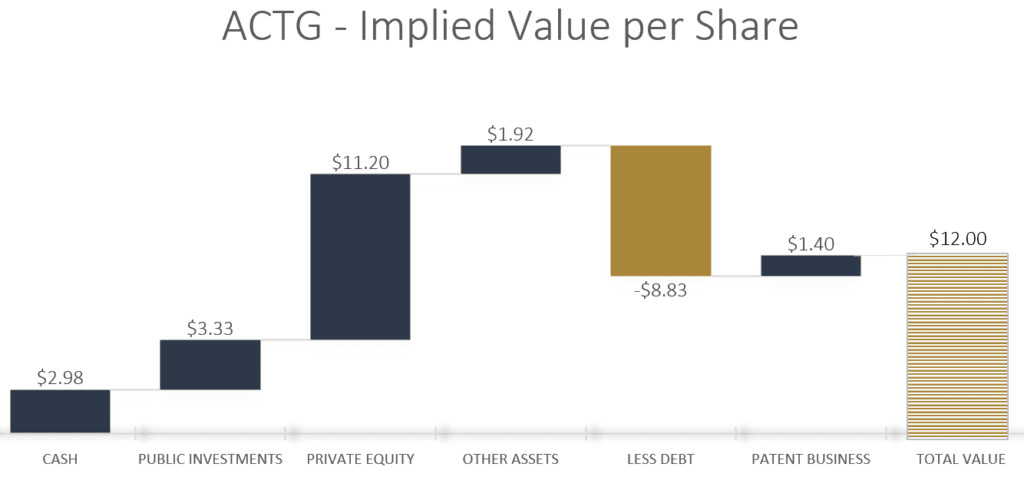

Our base case price target of $12 considers the undervaluation of its investment portfolio as well as improved momentum for its patent litigation business.

Formidable Asset Management (“Formidable”) conducts extensive research intended to identify potentially meaningful mismatches in valuation of both publicly traded and privately held entities. Our research process includes scraping social media platforms, and closely reviewing relevant material from filings, media, and third-party publications. Overall, Formidable’s research process aims to pinpoint investment opportunities that may have been overlooked by the market.

For the last few months, we have studied the portfolio companies and businesses at Acacia Research Corp (NASDAQ: ACTG) and believe that the opportunities are misunderstood or potentially overlooked by investors. On the surface, Acacia looks like an Andy Capp fistfight—legs and arms everywhere.

We believe Acacia is similar to an octopus. Octopi are highly intelligent creatures with physical regenerative powers, highly specialized problem-solving skills, and multiple means of sourcing solutions. They are clever, misunderstood, and beautiful. Unbeknownst to these authors—until now—an octopus does not have eight legs. In fact, it has two legs and six arms. For our purposes, we see both Oxford Nanopore and Immunocore Holdings PLC ADR (NASDAQ: IMCR) as the legs of the octopus while the other portfolio companies and legacy patent business serve as the arms. Our valuation addresses every tentacle of the “Acacia Octopus”.

Interestingly, each octopus tentacle is specialized. Driven by the intellect of the cephalopod, each tentacle performs a unique set of tasks. It possesses the ability to reshape itself for problems and is known to be one of the most highly complex and intelligent invertebrates on the planet. This is very similar to the structure of Acacia Research’s style; deliberate execution of acquisitions, and opportunity.

Our spotlight is primarily on the value of Oxford Nanopore (a portfolio company of Acacia Research) and Immunocore. There have been several write-ups about the company focused here, with good work by several Seeking Alpha contributors and Finance Twitter stalwarts (@TheIPHawk and @msumak are particularly good). We have performed significant due diligence and believe the opportunity is generally misunderstood. This is the classic mistake frequently made by myopic investors and the sell side analyst community, though the latter are almost nonexistent here.

Private equity is booming. When promised high returns and low volatility, investors—especially institutions— clamor for exposure. However, private equity is expensive, complex, and often inaccessible for retail investors. Paradoxically, sometimes the best private equity opportunities are in public equities. We believe we have identified a mispricing for ACTG and have established a position in the stock; following are the key pieces of our investment thesis:

- Pivot to Private Equity with an Outstanding Partner

- Significantly Undervalued Assets

- Imminent Monetization

ACTG offers an opportunity to invest in secondary private equity where value has yet to be realized. In this report, we will highlight our findings regarding the current price dislocations within the stock.

Demise of the Patent Troll

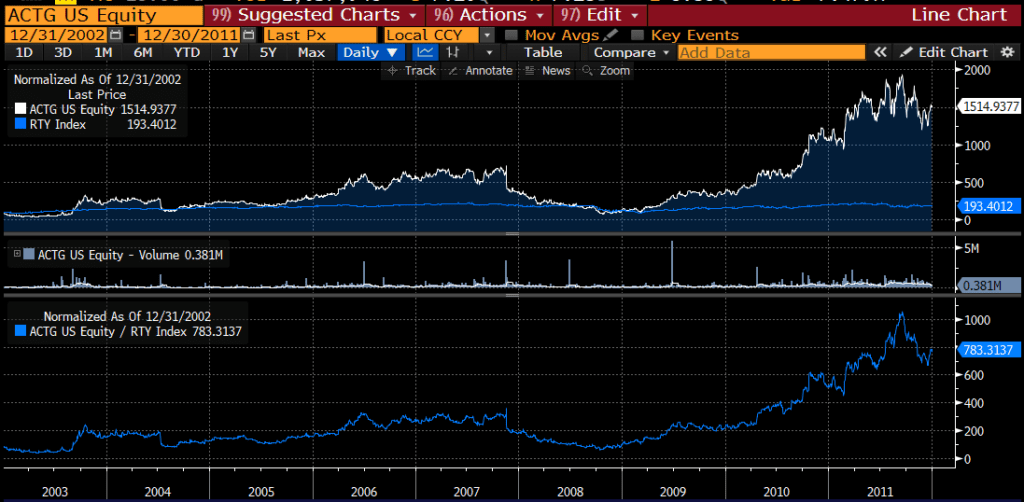

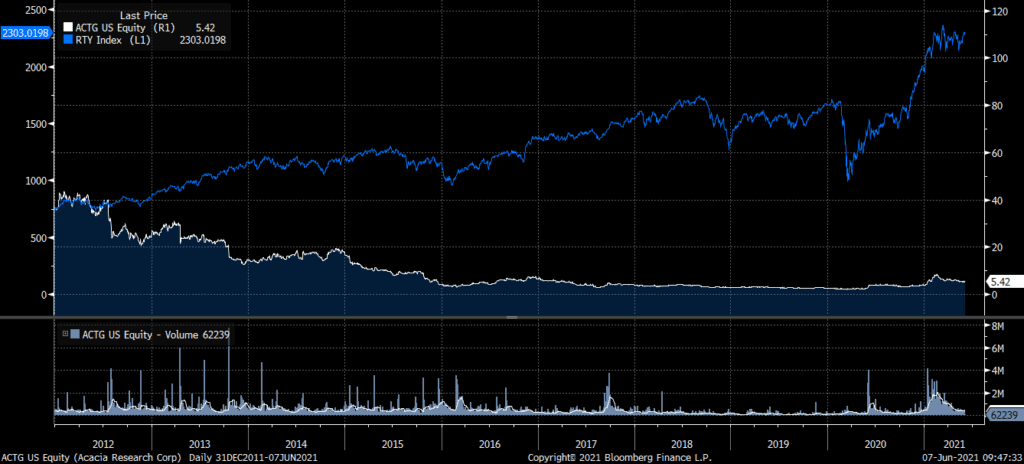

Acacia Research, pejoratively speaking, was a patent troll for much of its history. Though not glamorous, the company generated outsized returns from its IPO in 2002 until the world of patent litigation changed starting in 2012. Graph One shows its performance during the patent litigation boom; Graph Two during the bust.

Graph One: Patent Boom

Graph Two: Patent Bust

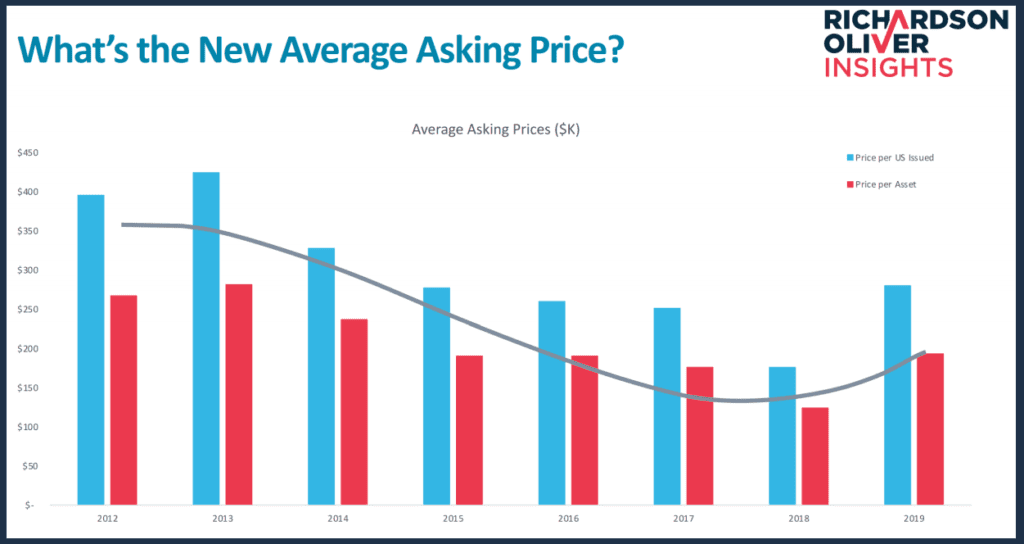

The value of its patent portfolio declined as regulatory and legal changes made enforcement more difficult, sinking prices per the company’s presentation (Graph Three).

Graph Three

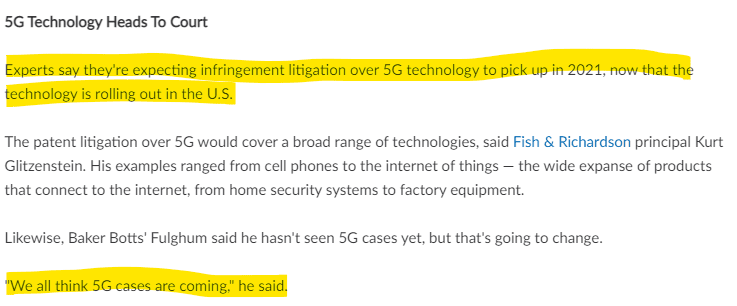

It appears prices have found a floor, giving ACTG’s core business base a firmer foundation. Moreover, patent litigation is back on the upswing, which should benefit ACTG’s legacy business.[1]

Specifically, ACTG’s acquisition of Newracom puts it in a sweet spot for future litigation according to industry experts.[2]

This month, David Hoff of the IP Hawk Newsletter reported that ACTG filed against Amazon. He has a great summary of current litigation ACTG is pursuing on his substack.[3]

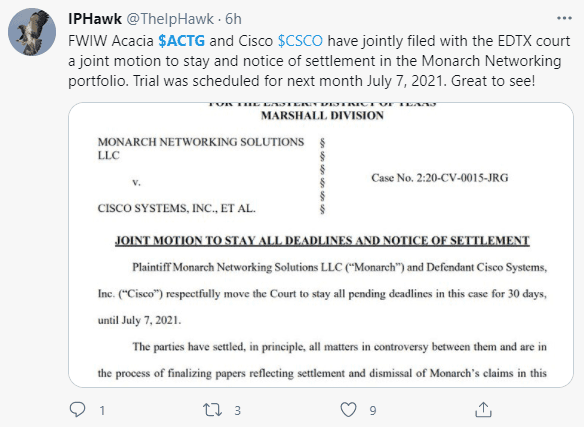

On June 8, 2021, the company announced the settlement of a case involving Cisco Systems (NASDAQ: CSCO):

Given the challenging backdrop for patent litigation, ACTG began exploring innovative ways to leverage its intellectual property expertise; it found a partner in this endeavor in Starboard Value (more on this later) and was the winner of a fire sale for assets from a liquidating U.K. fund (“Woodford Fund”).

Pivot to Private Equity with an Outstanding Partner

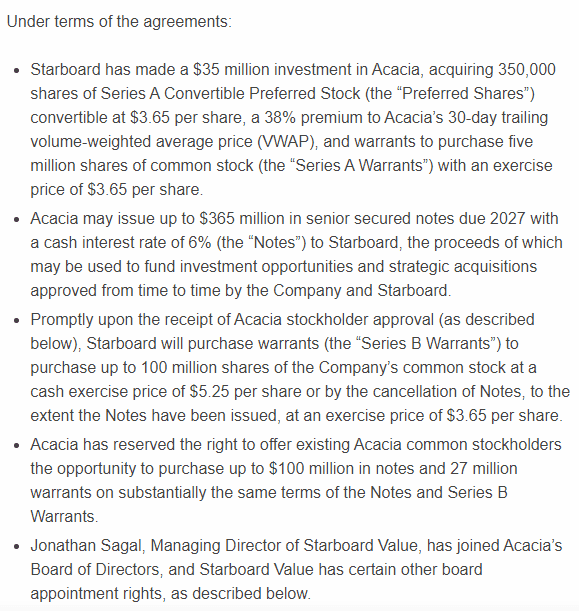

As the patent business struggled, ACTG looked for alternative ways to leverage its infrastructure and expertise. It looked for a partner and could not have found one much better than Starboard Value (see Appendix for more info). ACTG announced a strategic partnership in late 2019.[4] Starboard’s recent acquisition for its special purpose acquisition company (“SPAC”) would seem to indicate it believes there are ample opportunities to deploy capital. [5]

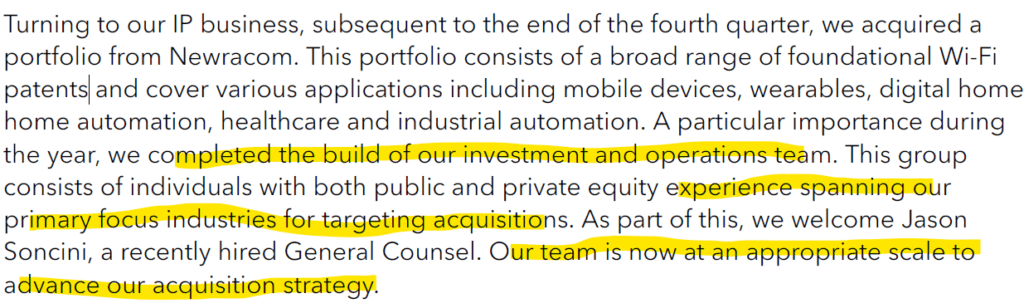

ACTG, given its favorable tax situation, i.e., the presence of net operating losses of $200M, may be Starboard’s preferred vehicle for future transactions, especially given its flexibility to pursue other public companies, something SPACs are generally unable to do. ACTG has up to $400 million in dry powder through the Starboard relationship and has recently assembled its team to allow pursuit and execution of M&A.

Significantly Undervalued Assets

Between the cash on its books and the valuation, based on Formidable’s estimates, of its underlying investments, ACTG is at an approximately 35% discount to the current share price.[6] It is important to note this reflects a moment in time, and that continued execution by any one of ACTG’s private investments could further grow valuation.

The company’s current market cap is $307M as of June 17, 2021 ($6.24 per share).

ACTG acquired a stake in 18 different biotech companies as part of its acquisition distressed assets from the Woodford Fund. According to Citywire, “The deal for the assets [was] struck at a price well below the level at which the stocks were being valued by the fund”.

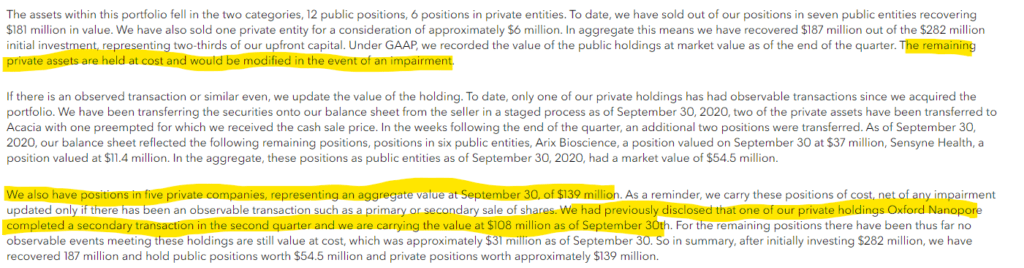

ACTG paid $282M for the Woodford Fund’s assets and almost immediately liquidated $187M, quickly booking a sizable gain as of 9/30/2020:

Assets as of September 30 for private assets reflected the deeply discounted cost paid by ACTG, i.e., they were not marked to market.

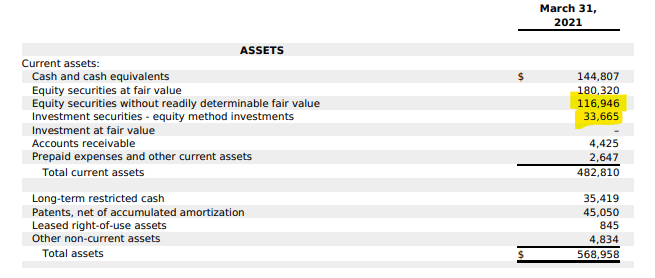

As of December 31, 2020, we started to see some increases in valuation, given observed transactions; the subsequent IPO of Immunocore (NASDAQ: IMCR) in Q1 also helped properly value certain assets. However, we believe fair value remains materially understated.

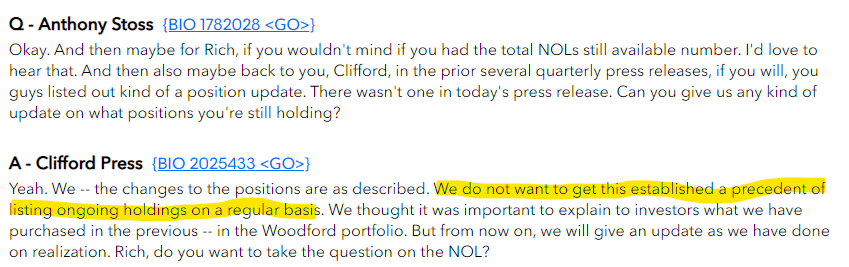

With its Q1 earnings release, the company stopped providing granular data on individual positions.

We believe the total private holdings value as of March 31, 2021 of $151M ($117M plus $34M) provided by the company vastly understates what we believe fair market value to be. See Appendix for details on valuation.

| Private Equity Investments | ACTG Book Value | Formidable Base Case Estimated Value | Difference | Uplift to per Share Value |

| Oxford Nanopore | 111,100,000 | 329,460,000 | 218,360,000 | 4.49 |

| Other (includes following): | 39,511,000 | 246,604,173 | ||

| Viamet | >n/a | 175,474,173 | ||

| AMO | n/a | 31,130,000 | ||

| NovaBiotics | n/a | 40,000,000 | ||

| Total | 150,611,000 | 576,064,173 | 425,453,173 | 8.75 |

Private Equity Investments

As mentioned, private assets are not marked to market except in the event of an observed transaction. We attempted to derive estimates of fair value for the following (more information on each company may be found in the Appendix):

- Oxford Nanopore

- Viamet

- AMO Pharma

- NovaBiotics

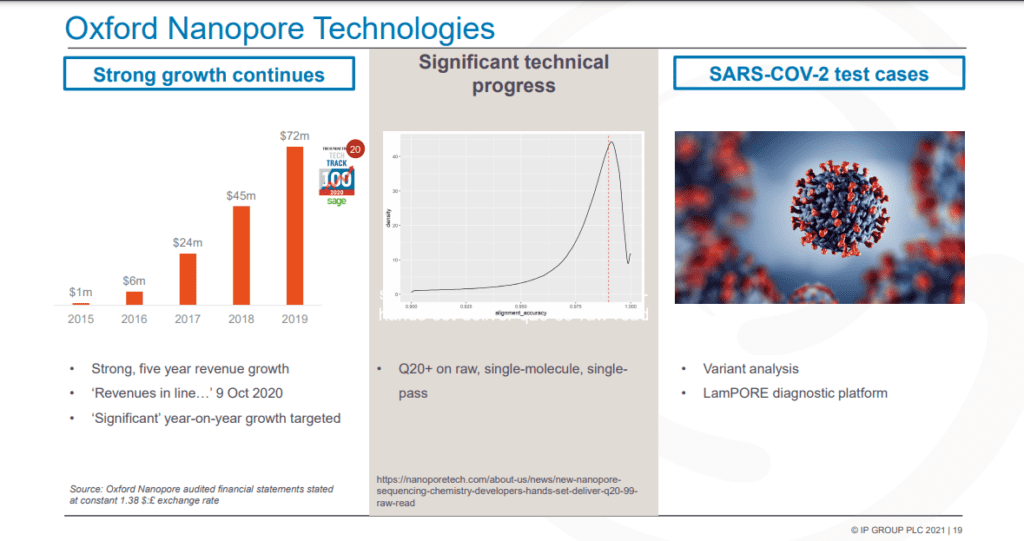

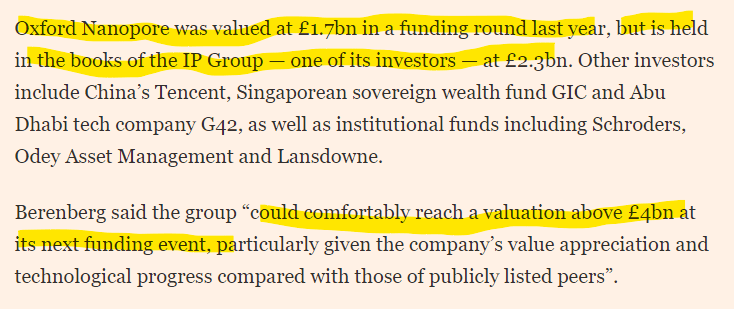

Oxford Nanopore

Not everyone has a unicorn in their portfolio; ACTG does and owns a hefty 6% of the company.

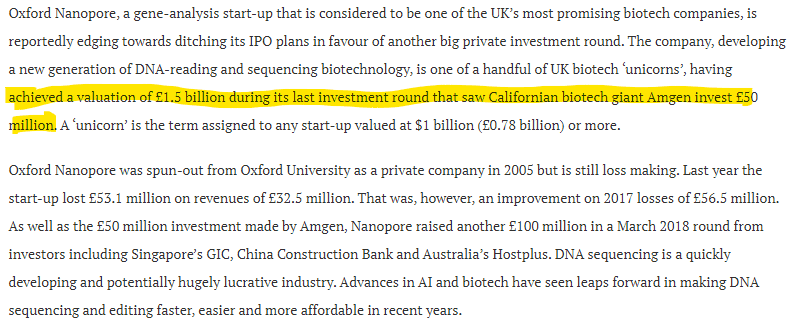

ACTG’s $111M book value used for the company is presumably based on Oxford’s October 2020 capital raise.[7]

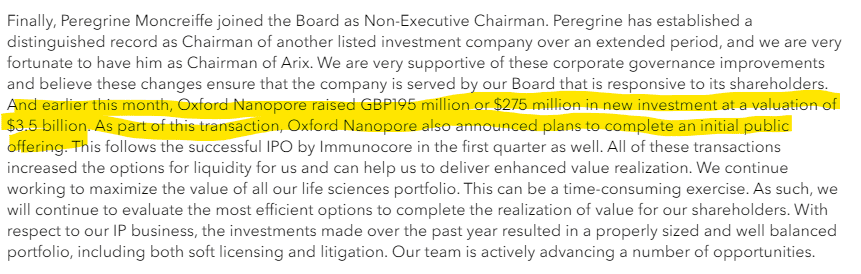

As noted on its Q1 earnings call, ACTG noted a recent raise for Oxford, which will compel ACTG to remark this investment higher by approximately $100M based on our calculations; good for over a $2 per share increase in book value:

Oxford also announced its intent to file for an IPO[8] as well, which will compel the market to ascribe a fair value to this investment in the near future. Using a range of estimates for Oxford’s IPO valuation, we see significant upside:

| Source | Estimated Value (USD) | Implied ACTG Ownership Value (USD$) | Implied ACTG Stake (per share) |

| ACTG Financial Statements | 1,851,666,667 | 111,100,000 | 2.29 |

| Oxford 5/2021 Capital Raise | 3,500,000,000 | 210,000,000 | 4.32 |

| PACB (Peer; as of 6/7/21) | 5,500,000,000 | 329,460,000 | 6.78 |

| FT Article (High) | 9,920,400,000 | 595,224,000 | 12.25 |

| Telegraph Article | 32,595,600,000 | 1,955,736,000 | 40.24 |

To summarize, ACTG’s ownership in Oxford Nanopore, based on various sources of conjecture, could be worth anywhere between $111M (ACTG’s current book value) or $1.9 billion (that seems a touch high, in fairness); we use valuation for Pacific Biosciences (NASDAQ: PACB) as a proxy in our base case. PACB’s market cap is approximately $5.5B, though was materially higher earlier this year.

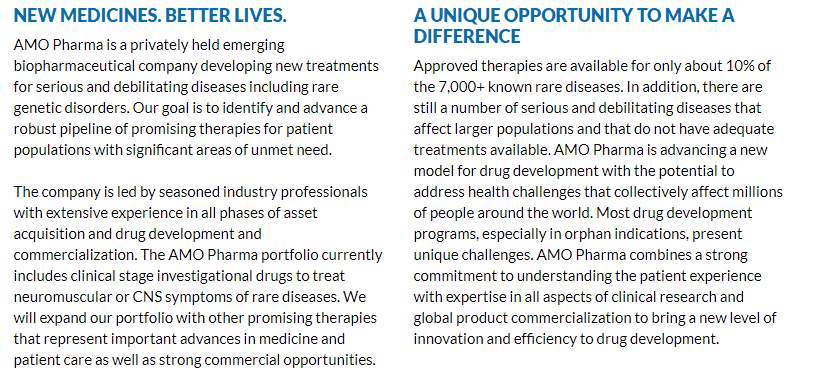

Viamet

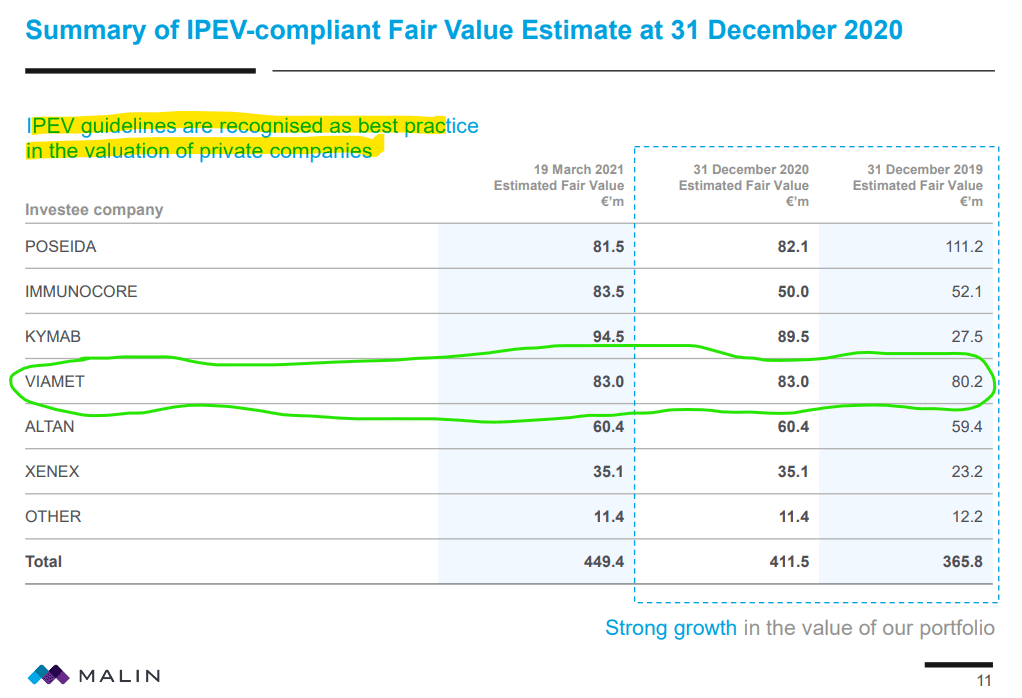

Though privately held, information on Viamet’s fair value may be derived using reports from Malin Corporation, PLC, which reports its fair value estimate.[9]

Using Marin’s figure would put ACTG’s interest at approximately $175M, which is roughly ½ of ACTG’s market cap.

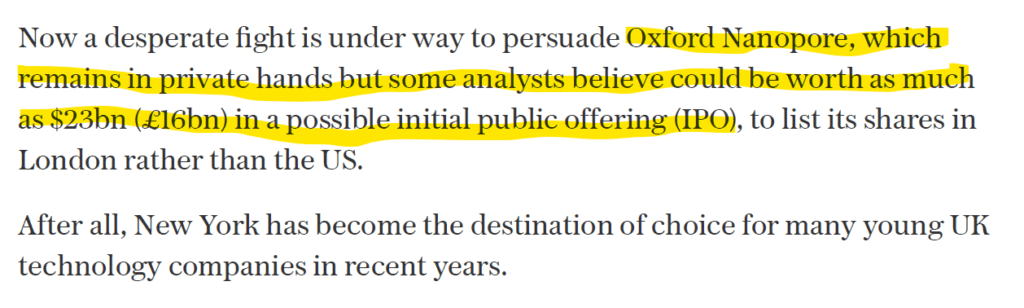

AMO Pharma

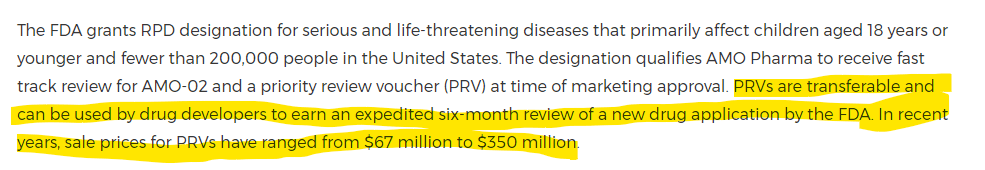

While not as glamorous, AMO Pharma has potential as well[10]:

Using the midpoint of this valuation range would give ACTG’s stake a value of approximately $30 million.

NovaBiotics

Acacia Research owns a small, but meaningful percentage (four percent) of the company. As of 12/31/2020, the company valued these assets at a paltry $8.4 million. Putting it bluntly, this is shockingly disconnected from what we believe NovaBiotics’ technology is worth.

In summary, NovaBiotics designs and retrofits anti-infectants and has designed several compounds with profound indications for anti-microbial interventional therapies. The company was founded in 2004 by Dr. Deborah O’Neil.

We begin with Nylexa, (NM002), an amino based therapy that, based on clinical research, is very effective in treating advanced disease symptoms in COVID-19, especially as it mutates.[11] We believe this compound both enhances the body’s immune system and simultaneously generates a therapeutic anti-inflammatory effect. This derivative therapy is the merger of technologies, both old and new, repurposed to assist in supercharging the immune system to defend itself from many pathogens.

Nylexa, while found to be effective against COVID-19, is also a potentially transformative weapon against many microbial adversaries. Stand-alone Nylexa could be the transcendent time bridge that allows the world’s biotechnology assets to develop next level therapies. The trials have been so encouraging that the UK Government is absorbing and funding the company’s phase III clinical trial (more of a formality, at this point). This is revelatory because of the need for ongoing interventional therapy for advanced COVID-19 therapy as COVID-19 begins its endemic place in the spectrum of healthcare challenges within humanity.[12]

Little is known about valuation for the company. The last publicly available information regarding a capital raise was associated with Woodford in 2015. The company has recently announced a few commercialization opportunities and is introducing COVID-related therapies as well.[13]

The undervaluation of Nylexa alone could significantly understate the fair value of ACTG. An analog for Novabiotics brings us to Pfizer’s Zithromax (azithromycin) which generated $276 million in revenues in 2020, and $336 million in 2019 (the truncated flu season, with COVID-19 running rampant worldwide in 2020 attributed to the decline, in our opinion). Assuming NovaBiotics achieves a similar level of revenue and profitability and grows at a modest 5% rate, our analysis (assuming industry standard margins and a 20% discount rate) yields a valuation of nearly $1 billion. We believe Nylexa has a much larger total addressable market, so we consider this the lower boundary of valuation.

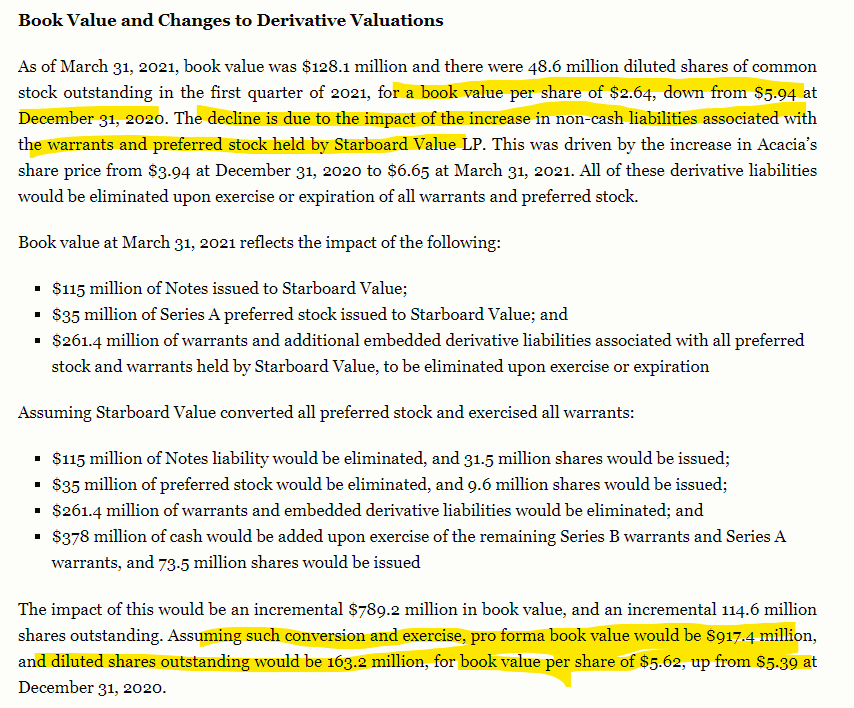

Book value

Historically, book value for ACTG has been understated, given the company is carrying several former Woodford investments at cost and/or using observed transactions that understate market value.

However, the accounting treatment of warrants/preferred stock has currently compelled an even larger gap than normal. Essentially, strong share price performance in Q1 compelled the company to recognize certain liabilities. Diluted book value, which is understated due to the private equity valuation discrepancies, was $5.62.

Formidable Valuation Estimate

We believe the market is mispricing the potential for ACTG to continue to monetize assets. At present, if we assume the fair value estimates we presented for Viamet and AMO are reasonable, ACTG’s current stock price of $6.24 is ascribing no appreciation beyond current book value to its most valuable investment, its 6% stake in Oxford Nanopore.

The following table shows our estimated ACTG share price at varying reasonable valuation levels for Oxford Nanopore and levels of discount the market ascribes to our estimate of ACTG’s fair value.

| Oxford Valuation/ACTG Fair Value Discount | 0% | 10% | 15% | 20% |

| Book Value | 6.10 | 5.49 | 4.66 | 3.73 |

| >Oxford 5/2021 Capital Raise | 8.13 | 7.32 | 6.22 | 4.98 |

| PACB (Peer; a/o 6/7/21) | 10.59 | 9.53 | 8.10 | 6.48 |

| FT Article (High of 7B GBP) | 16.06 | 14.45 | 12.28 | 9.83 |

Yellow reflects the approximate current price, green is our base case (Oxford Nanopore valued similarly to peer PACB and market discounts fair value of assets by 10%), and blue is our blue-sky target.

We would add another $0.50 to this valuation to reflect a 20% discount ascribed to the market for our estimated value of NovaBiotics, bringing our base case to approximately $10 per share. Based on the current share price (as of market close on 6/17/21), shares trade at a 35% discount to what we believe the fair value of ACTG’s assets are.

Importantly, what this sum-of-the-parts completely ignores is the value of ACTG’s actual core business of patent litigation. If we look back to valuation for ACTG before it began working with Starboard and focused on its private equity business, the stock traded at a nadir of around $2 per share, meaning the patent business is worth something. We would argue, given the renewed vigor associated with ACTG’s efforts on this front and its recent momentum, including the CSCO settlement, our $1.40 estimate is an incredibly conservative value.

This brings our total base case valuation for ACTG to approximately $12 per share.

But what about dilution?

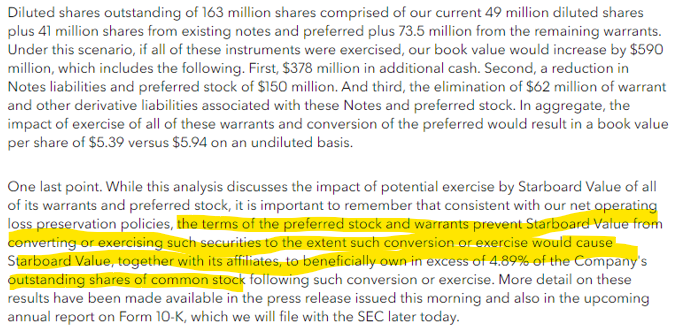

Of course, Starboard waits in the wings to potentially dilute current shareholders. We believe meaningful dilution would be likely only after these valuation targets are approached. Even then, material dilution, although possible, is unlikely as it would not be in the best interest of either party; from the Q4 earnings call:

Accordingly, if we dilute shares by 5%, we will see marginal declines in our price targets, though all would reflect significant capital appreciation from the stock’s current price.

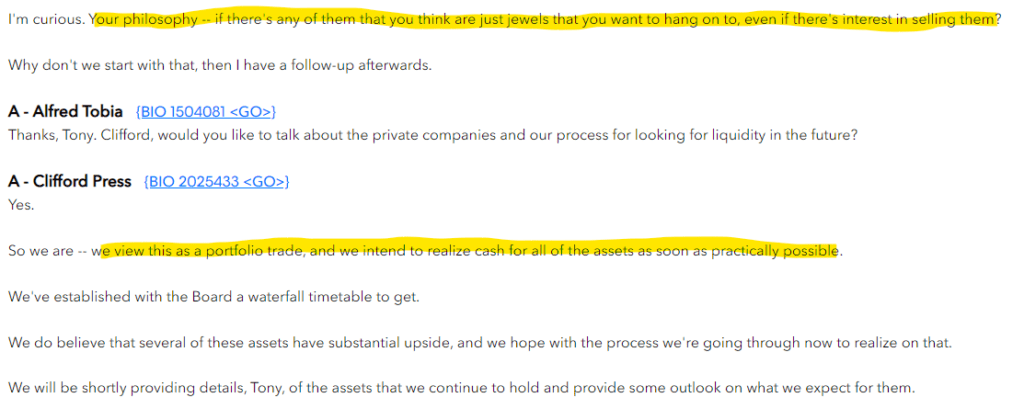

Imminent Monetization

The company recently announced a collaboration with Mark Woodford, whose portfolio the company acquired.[14] Woodford is set to return to the investment business; perhaps he repurchases his legacy assets at something close to fair market value. Acacia has become an activist with some of the portfolio holdings, as it did with its Immersion Corp holdings, unlocking value and improving the likelihood of monetization.[15] It is clear CEO Clifford Press (below conversation is interaction with an analyst on an earnings call) is looking to monetize assets quickly and it is financially beneficial for ACTG to move with alacrity.[16]

Acacia Challenges

A Misunderstood, Mischaracterized Research Company with Significant Upside

The company’s prior reputation as a patent troll may take some time to change, and its core patent business could continue to be challenged. Moreover, many “sum-of-the-parts” opportunities trade at a persistent discount in the absence of catalysts that force investors to take note, e.g., ACTG’s Woodford transaction or IAC’s spin-off of Match. Dilution from Starboard is possible, though it would likely be measured, given the repercussions of a large exercise. Finally, the company’s stock often trades in sympathy with the broad biotech universe, which has been weak of late, explaining much of ACTG’s recent share price weakness.

What could unlock the value?

Formidable believes any of the following events could help the market begin to close the gap between ACTG’s current price and our estimates of fair value. Each event has a reasonable probability of coming to fruition:

- Oxford IPO – A lot of value investors have died on the hill of sum-of-the-parts valuation. The difference here is that the former Woodford portfolio will be liquidated relatively quickly, especially as Oxford Nanopore moves forward with its planned IPO.

- Putting ample dry powder to work – Not every deal may be as lucrative as the Woodford one, but, given the stock’s reaction to that deal, another transaction has the ability to move the stock as well as its book value.

- Attention – The company is covered by one (1) sell side analyst. Greater visibility could move the needle, given the general laziness of most buy-side investors.

- Portfolio development – Valuations for all biotech assets are based on point-in-time estimates. Material developments (new drug approvals, commercial development, etc.) could serve to re-rate any of the life sciences holdings.

- Litigation wins – A flurry of suits filed, acquisitions of new patent portfolios, and the recent settlement are all indicators of business momentum for this part of the company.

Conclusion

Value investing has been left for dead until recently. However, for those willing to do the work, opportunities continue to exist. Against a backdrop of elevated market multiples, the ability to purchase a company with limited downside (book value) and sizable upside (forcing market to mark its Woodford investments at fair value by liquidating) makes ACTG an attractive investment.

Footnotes:

[1] Accessed on June 18, 2021 via url: https://www.law.com/therecorder/2021/01/04/patent-litigation-got-on-the-comeback-trail-in-2020/.

[2] Accessed on June 18, 2021 via url: https://www.law360.com/newjersey/articles/1329395/patent-litigation-trends-to-watch-in-2021 ):

[3] Accessed on June 18, 2021 via url: https://iphawk.substack.com/p/acacia-research-group-actg-may-18.

[4] Accessed on June 18, 2021 via url: https://www.businesswire.com/news/home/20191118005480/en/Acacia-Research-Announces-Strategic-Partnership-Starboard.

[5] Accessed on June 18, 2021 via url: https://www.marketwatch.com/story/spac-starboard-value-acquisition-stock-soars-after-34-billion-merger-deal-to-take-cyxtera-public-2021-02-22).

[6] As of June 6, 2021.

[7] Accessed on June 18, 2021 via url: https://nanoporetech.com/about-us/news/oxford-nanopore-announces-ps844m-new-capital.

[8] Accessed on June 18, 2021 via url: https://nanoporetech.com/ont/announcement.

[9] Accessed on June 18, 2021 via url: http://malinplc.com/wp-content/uploads/2021/03/2020_Annual_Report_Results_Presentation.pdf.

[10] Accessed on June 18, 2021 via url: https://www.prnewswire.com/news-releases/fda-grants-rare-pediatric-disease-designation-to-amo-pharma-for-amo-02-for-treatment-of-congenital-myotonic-dystrophy-301168175.html.

[11] Accessed on June 18, 2021 via url: https://www.nytimes.com/2021/06/07/health/covid-alpha-uk-variant.html.

[12] Accessed on June 18, 2021 via url: https://www.globenewswire.com/news-release/2019/11/04/1940514/0/en/Amoxicillin-Market-To-Reach-USD-4-962-6-Million-By-2026-Reports-And-Data.html.

[13]Accessed on June 18, 2021 via url: http://www.pmlive.com/pmhub/market_access/onyx_health_ltd/press_releases/licensing_deal_for_np213_nail_fungus_treatment_is_another_key_milestone_for_novabiotics.

[14] Accessed on June 18, 2021 via url: https://www.thetimes.co.uk/article/neil-woodfords-no-monkey-says-new-partner-clifford-press-ww8nvk88t

[15] Accessed via url: https://www.streetinsider.com/Corporate+News/Acacia+Research+%28ACTG%29+Endorses+the+New+Directors+of+Immersion+Corp+%28IMMR%29/16764353.html .

[16] Accessed on June 18, 2021 via url: https://citywire.co.uk/funds-insider/news/us-buyer-flips-woodford-stocks-after-cut-price-deal/a1369015?section=funds-insider.

DISCLOSURES

General Firm

Formidable Asset Management, LLC (Formidable) is an investment adviser registered under the Investment Advisers Act of 1940. Registration as an investment adviser does not imply any level of skill or training. The information presented in the material is general in nature and is not designed to address your investment objectives, financial situation or particular needs. Prior to making any investment decision, you should assess, or seek advice from a professional regarding whether any particular transaction is relevant or appropriate to your individual circumstances. Although taken from reliable sources, Formidable cannot guarantee the accuracy of the information received from third parties.

The opinions expressed herein are those of Formidable and may not actually come to pass. This information is current as of the date of this material and is subject to change at any time, based on market and other conditions. Any index performance cited or used throughout is intended to illustrate historical market trends and performance. Indexes are managed and do not incur investment management fees. An investor is unable to invest in an index. The performance shown may not reflect a Formidable portfolio.

Past performance is no guarantee of future results.

Reader should assume that future performance of any specific investment or investment strategy (including the investments and/or investment strategies discussed in these materials) made reference to directly or indirectly in these materials will be profitable or equal the corresponding indicated performance level(s). Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will either be suitable or profitable. Historical performance results for investment indices and/or categories generally do not reflect the deduction of transaction and/or custodial charges, the deduction of an investment management fee, nor the impact of taxes, the incurrence of which would have the effect of decreasing historical performance results.

Specific Securities

The mention of specific securities and sectors illustrates the application of our investment approach only and is not to be considered a recommendation by Formidable. The specific securities identified and described above do not represent all of the securities purchased and sold for the portfolio, and it should not be assumed that investment in these securities were or will be profitable. There is no assurance that the securities purchased remain in the portfolio or that securities sold have not been repurchased. Charts, diagrams and graphs, by themselves, cannot be used to make investment decisions. You may contact Formidable Asset Management, LLC for a full list of recommendations made during the preceding period one year

Not an Offer

These materials do not constitute an offer to sell, a solicitation of an offer to buy, or a recommendation of any security or any other product or service by Formidable or any other third party regardless of whether such security, product or service is referenced here. Furthermore, nothing in these materials is intended to provide tax, legal, or investment advice and nothing in these materials should be construed as a recommendation to buy, sell, or hold any investment or security or to engage in any investment strategy or transaction. Formidable does not represent that the securities, products, or services discussed here are suitable for any particular investor. You are solely responsible for determining whether any investment, investment strategy, security or related transaction is appropriate for you based on your personal investment objectives, financial circumstances and risk tolerance. You should consult your business advisor, attorney, or tax and accounting advisor regarding your specific business, legal or tax situation.

The opinions expressed here are those of Will Brown and Adam Eagleston are not intended as investment advice. They are also subject to change with changing market conditions. Clients of Formidable may have positions in securities discussed in this article. This writing is for informational purposes only—Formidable and the authors expressly disclaim all liability in respect to actions taken based on any or all of the information from this writing.

Appendix

Starboard Value

Starboard is widely considered one of the premier activist investors in the world. Below is from a recent Forbes article:

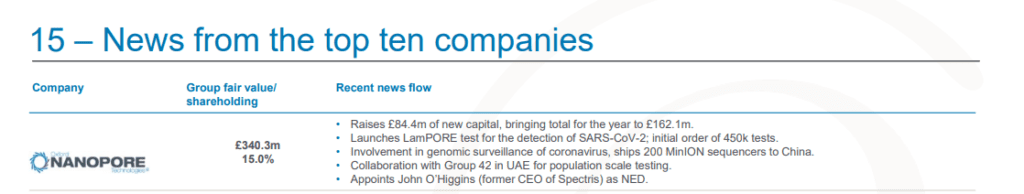

Oxford Nanopore

Following is from an October 2019 article on the company.[1]

The company has proved the efficacy of its sequencing was awarded a sizable contract by the U.K. government for Covid tests.[2] This was posted in a release from a U.K. listed private equity company, IP Group: “Following the capital raise, IP Group has a 15.0% undiluted beneficial stake in Oxford Nanopore, valued at £257.7 million. The directors will review the carrying value of Oxford Nanopore, as usual, as part of the Group’s Annual Results for 2020 in light of this funding round and all other relevant information.”

IP Group’s most recent report[3] reflecting results as of December 31, 2020 showed this. This values Oxford Nanopore at approximately $3.1 billion, making ACTG’s stake approximately $186M.

Valuation Scuttlebutt

Rumors abound on the company; here are a few:

- According to a Citywire article, “Jefferies analyst Ken Rumph has suggested Oxford Nanopore, currently valued at £1.6bn, could be worth $6bn (£4.5bn) in a mid-2021 flotation or sale.”

- On March 30, 2020, the UK’s Financial Times published this piece[4], estimating a value for the company of between 4-7 billion GBPs, and, more importantly, indicating this listing is likely in 2021

- Recent enthusiasm for IPOs prompted the U.K. newspaper The Telegraph to publish a piece on the transatlantic battle for the company’s listing, with the following noteworthy nugget:

Using a range of estimates for Oxford’s valuation, we see significant upside:

| Source | Estimated Value (USD) | Implied ACTG Ownership Value ($) | Implied ACTG Stake (per share) |

| ACTG Financial Statements | 1,851,666,667 | 111,100,000 | 2.29 |

| IP GROUP | 3,215,154,400 | 192,909,264 | 3.97 |

| Oxford 5/2021 Capital Raise | 3,500,000,000 | 210,000,000 | 4.32 |

| PACB (Peer; as of 6/7/21) | 5,491,000,000 | 329,460,000 | 6.78 |

| FT Article (High) | 9,920,400,000 | 595,224,000 | 12.25 |

| Telegraph Article | 32,595,600,000 | 1,955,736,000 | 40.24 |

So, to summarize, ACTG’s ownership in Oxford Nanopore, based on various sources of conjecture, could be worth anywhere between $111M (ACTG’s carrying value) or $1.9 billion (which is so far beyond other estimates that we excluded from our scenario analysis). We use valuation for Pacific Biosciences (NASDAQ: PACB) as a proxy in our base case. PACB’s market cap is approximately $5.5B, though was materially higher earlier this year.

AMO Pharma

Viamet

Source: Malin, PLC presentation

Source: ACTG Earnings Call

NovaBiotics

Public Equity Portfolio

Pretty simple here. The company owns the following; as noted, IMCR moved from private to public equities with its IPO in Q1 2021:

| Public Equities (per BBG) | Shares | Value as of 6/8/21 (USD) |

| ARIX LN EQUITY | 25,833,311 | 64,069,195 |

| SENS LN EQUITY | 15,176,204 | 32,261,574 |

| INHC LN EQUITY | 4,200,000 | 4,732,031 |

| IMCR US EQUITY | 1,533,991 | 60,746,044 |

| Total | $161,808,843 |

Arix Bioscience plc (LON: ARIX)

Arix Bioscience plc is a London-based global venture capital company that invests in and builds breakthrough biotech companies around cutting-edge advances in the life sciences. The Company invests in seed stage companies as well as preclinical and clinical stage assets (private or public). Its portfolio consists of 13 biotechnology companies across five therapeutic areas: anti-infectives, genetic diseases, immunology, oncology, and rare diseases. Arix Bioscience’s pipeline consists of 16 therapeutics undergoing phase one (10), phase two (5), and phase three (1) clinical trials. The company has achieved two successful exits since 2020 and seeks to grow through clinical milestones, potential M&A, strategic partnerships, and other financing events across its portfolio. Arix Biosciences employs both hands-on methodology and extensive global networks in venture capital, biotech, pharma, and academia to support company growth.

Sensyne Health plc (LSE: SENS)

Sensyne Health plc is a UK-based healthcare technology company that works in collaboration with National Health Service (NHS) Trusts. Sensyne utilizes Clinical Artificial Intelligence (AI) to analyze and commercialize real-world evidence from large databases of anonymous patient data. Pharmaceutical companies use Sensyne’s analytics throughout the research, development, and commercialization process of novel therapies, while healthcare providers gather insights to improve patient care. In addition, Sensyne has developed its own portfolio of Clinical AI technologies to generate patient data. The company has led discovery programs in therapeutic areas like respiratory, cardiovascular, neurological, and immunological diseases as well as cancer.

Induction Healthcare Group plc (LON: SENS)

Induction Healthcare Group plc is a rapidly growing healthcare technology company that went public in May 2019. It owns offices in the United Kingdom (HQ) and Australia. The company develops electronic platforms to support health information management across hospitals, patients, and healthcare providers. Current technology solutions include health professional communication tools (Induction Switch), patient portals to manage one’s care (Induction Zesty), advice and guidance platform for National Health Service (NHS) Trusts (Induction Guidance), online booking service for NHS staff, patients, and students (Induction Booking), and a cloud-based, Outpatient Parenteral Antimicrobial Therapy Management System (OPAT PMS). Each of these solutions can be integrated into hospital systems as one comprehensive, complementary suite.

Immunocore Holdings plc (NASDAQ: IMCR)

Immunocore Holdings plc is a leading T cell receptor (TCR) biotechnology company located in the United Kingdom. It strives to produce first-in-class biological therapies to address unmet patient needs in oncology as well as infectious, autoimmune, and inflammatory diseases. Immunocore aims to overcome the limitations of both human immune systems and current therapies by developing high affinity TCR molecules (ImmTAXTM). These engineered molecules can activate a patient’s T cells (white blood cells) and allow them to recognize and kill infected or cancerous cells. The company’s pipeline consists of proprietary and partnered products that include therapies for Hepatitis B Virus (HBV), Human Immunodeficiency Virus (HIV), and a variety of cancers (uveal melanoma, ovarian, breast, gastric, etc.). Immunocore Holdings completed an IPO in February 2021.

[1] https://www.tradingandinvestmentnews.co.uk/uk-biotech-star-oxford-nanopore-to-reject-ipo-for-1-6-billion-private-round/

[2] https://www.clinicalomics.com/topics/molecular-dx-topic/oxford-nanopore-to-supply-u-k-with-450k-lampore-covid-19-tests/

[3] (https://www.ipgroupplc.com/~/media/Files/I/IP-Group-V2/documents/investor-relations/IPG_FY20_presentation.pdf)

[4] https://www.ft.com/content/6ce78367-9e32-4cc0-a9c2-1fc1535f2788.

READY TO TALK?