April 4, 2025 Update: From the Chair – Tariff-Eyeing*

*By the time you read this, markets may have changed yet again as headlines are driving stocks right now. The following is provided for informational purposes in as politically neutral context as possible.

We are just here to provide perspective on the initial effects of the Administration’s tariff policies on stocks and evaluate where we may go from here.

First, some good news. Corporate earnings were solid last quarter; sales growth was over 5% and earnings grew 14%; both were better than analysts’ estimates. Also, economic data on jobs continued to show broad based hiring in March.

However, while earnings and economic data have remained resilient, sentiment has soured. As we mentioned in our last market update, valuations were high entering the quarter, so some of these solid numbers were already reflected in the stock market. Coupling that with shock at the magnitude (and potential impact) of the Trump tariff plan, and we get a stock market that has taken a big step back.

Perspective

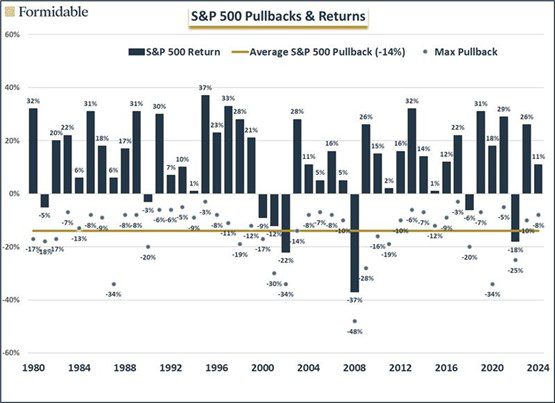

It is important to note, as we often do, that corrections are a part of investing in stocks. Historically, going back to 1980, stocks have averaged a 14% pullback each year, though the median is less than that.

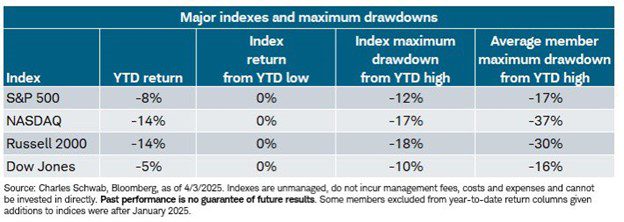

For the S&P 500, we were down 12% from the February 19 all-time high as of the close on April 3, meeting the technical definition of a “correction,” and a little more damage has been done today. Both the NASDAQ and small cap Russell 2000 are in bear market territory as we write this.

Why does this feel worse? One reason is complacency. We have had very small (and very few) pullbacks since 2023, and this decline has been violent and fast. Second, the average stock is down more than the index, losing more than 30% this year in both the NASDAQ and Russell 2000.

Third, the Magnificent Seven, which led the market in both 2023 and 2024, and are the biggest/most widely owned stocks in the world, are all down in 2025. As of the market close on April 3rd, the declines were as follows:

- Meta – Down 9%

- Microsoft – down 11%

- Amazon – down 19%

- Alphabet – down 20%

- Nvidia – down 24%

- Apple – down 19%

- Tesla – down 34%

What happens next?

Earnings season starts again soon, and a continuation of positive surprises could provide a lift. However, with most investors fixated on trade policy versus earnings at this point, the impact could be mitigated. The Fed does not meet again until May. Chair Powell stated today that although the economic effects of tariffs (higher prices and slower growth in his opinion) may be larger than anticipated, the Fed is in no hurry to adjust, i.e., lower, rates.

That leaves us with headlines out of D.C. to determine the overall direction the market takes.

All we can confidently look to is history. Statistically, a 10% correction turns into a bear market around 25% of the time, and that normally occurs when the economy dips into a recession. The rest of the time, the market recovers in about eight months, on average. Since 1980, i.e., 46 years, this has been the 24th year that has seen a 10% correction. In the previous 23, stocks finished higher 13 times.

Bear markets, i.e., 20% declines, usually occur only once per market cycle, and we have already had two this decade (Covid crash and 2022), so three in such rapid succession would be unusual. If tariffs have the effect Chair Powell fears and some of the small business uncertainty translates into reduced spending and hiring at the same time government jobs are being eliminated, the setup for a recession, and a more sustained decline, may seem in place.

However, if this is more Art of the Deal negotiating versus a Smoot-Hawley 2025, then perhaps this current correction, while unpleasant, could be shorter. Regardless, we are in the early innings of the new Administration. We noted prior to the election—no matter who won, there would be work to do with inflation and slowing growth. We have noted that the repricing of risk was likely inevitable. We all will have to wait and see as the Administration reacts. In the meantime, the Fed is also now on a wait and see approach regarding interest rates.

READY TO TALK?