October Market Update: From the Chair

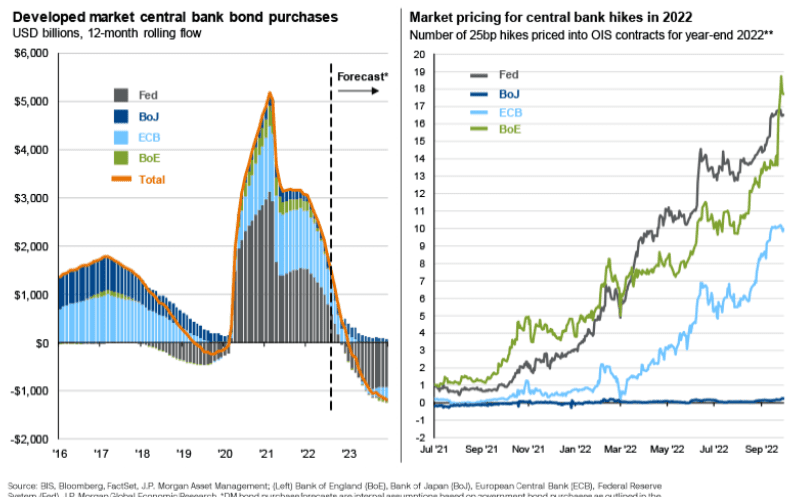

It’s the beginning of trading in the month of October and the markets have seen a steady decline. This is one of the more difficult market environments we’ve seen. Jonathan Ruffer, one of the greatest investors of whom you have never heard, recently wrote, “(i)n the forty-five years I have been an investor, I cannot recall a more dangerous period than today.” In a career of worsts this feels all too familiar. The realities are the market had forward priced earnings that were unsustainable. We believe earnings are unsustainable because we cannot stimulate our way out of everything. Inflation is primarily a biproduct of pandemic-driven Central Bank stimulus; this stimulus is being removed with alacrity on two fronts: shrinking balance sheets and higher rates.

Currently, the United States Federal Reserve is trying to tamp down inflation, which is squeezing the consumer like the bellows on an accordion. The reality is that inflation will solve itself one way or the other. As many market wags say, “the cure for high prices is high prices.” The problem with this thinking is that it creates an Icarean dilemma. If the economy burns too hot, it can crash to earth due to embedded inflation expectations. Unfortunately, the Fed is seemingly manufacturing the exact same result, which we are seeing today as the stock market prices in higher interest rates and a recession. In other words, they are shooting Icarus before he can get high enough to melt his wings. Unfortunately, the result is the same, which is a hard landing.

42

Many of our clients have been asking what the endgame might look like. I would refer you to Douglas Adams “Hitchhikers Guide to the Galaxy’ for your answer. The comedy points out that the number 42 is “The Meaning of Life.” Of course, this is a fantastical, nonsensical parody, but for me it has other meaning.

Ironically, 42 is a very important number for me. Years ago, when my then one-year old son was sick, it occurred to me that he would be “in the clear” by the time I was 42 years old. Oddly enough, I decided to create FORMIDABLE, in my 42nd year. I had never relished aging, but I couldn’t wait to be 42. I thought that the doubling of the age 21 would be a bad thing, but it turns out that that wasn’t true for my life. And reaching 42 was something I hoped with all my being…understandably. 42 freed my family of a large amount of worry, and even though it wasn’t perfect, it was a milestone. Since then, I have always thought of that number as pivotal.

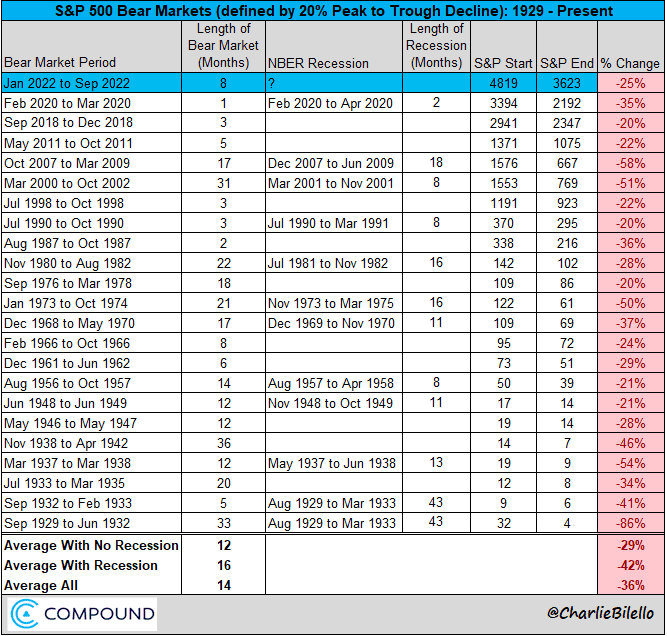

Yet again, I’m waiting for 42. This time I’m not so happy about it. But my hope is that the current markets endgame will subside at 42. The reality is that at a loss of approximately 42% of the S&P Index (from peak to trough) this bear market decline, on a historical basis, could end. This would put the low on the S&P at 2795 from a high of 4818. At the current level of 3585, this is a far from welcome scenario.

Professionals & Amateurs

I’m hopeful that this downturn won’t be that painful, but Adam Eagleston, our CIO, has cogently pointed out that previous downturns historically speaking have reached this type of nadir. This average is skewed by outliers, so we are cautiously optimistic we get more of a regular recession (and less severe drawdown) as opposed to something more severe.

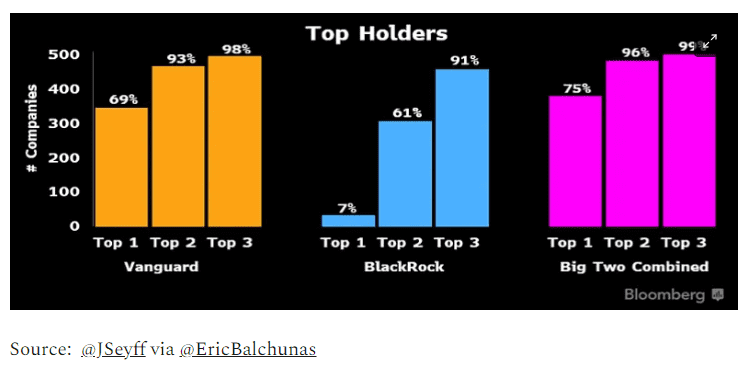

This downturn is the product of forced selling and poor investor behavior, including myopic buying of index funds.

At this point, we STILL have too many speculators in the market, and they need to be carried out—feet first. The market will take care of this, but in the meantime, clients will feel less rich and worried about their futures. This is a typical response to transient behavior in the stock market. As legendary trader Jesse Livermore stated, “the human side of every person is the greatest enemy of the average investor or speculator.”

This human side is abundantly clear in the actions of retail speculators, meme traders, and Robinhooders. And as always, professional investment management will prevail. We’ve seen all 31 flavors of this detached from reality belief behavior (think Day Traders of the late 90s, Occupy Wall Street…Wall Street was even bombed in 1920, etc.). And yet, here we are, the industry continues to evolve and thrive despite the threats of this amateur hour of speculators.

The Politics of Covid and Immigration: How We Got Here

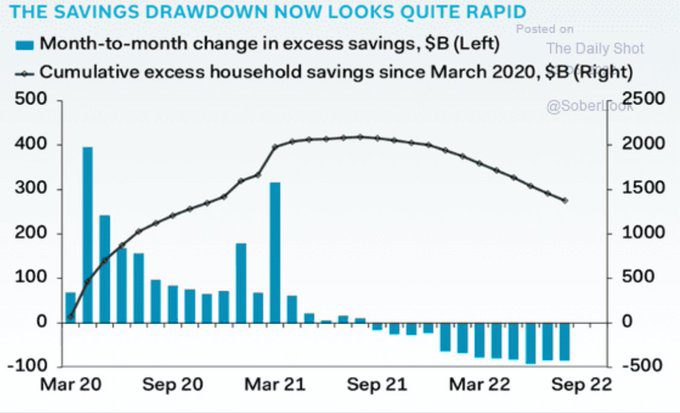

There is some confusion about how the current administration responded to recent challenges. In part, inflation was driven by fiscal stimulus that was advocated by the former administration. In the former’s defense, there wasn’t a good decision to be made here because we simply didn’t understand Covid or the short and/or long-term ramifications and the risks associated with it, health wise, socially, or psychologically. Largely, we still don’t. Simply put, when the novel coronavirus took root in our society, conventional wisdom forecast that 10% of the Earth’s population would succumb to it. This is historically consistent. So, it was wise, at the time, for the Central Banks and governments to overstimulate in order to arrest a global demand shock (not to mention supply chain disaster). And this was a worldwide phenomenon, so it has been amplified. Domestically, we are starting to see this excess stimulus cash start to evaporate:

The previous administration, rightfully, at the time, encouraged stimulus and even complained about the Fed not doing enough during this period. This was seemingly appropriate because the undefined issues facing society were profound and, frankly, are ongoing in the form of mental health issues worldwide. Additionally, and possibly more importantly, another policy decision, made before Covid began has had additional long-term consequences.

During the early months of the previous administration’s term, there were many immigrants (millions) in the United States illegally. This was believed to be a headwind for U.S. citizens to get work; the narrative was that they were being “crowded out” by cheap labor in the form of illegal immigrants. President Trump ran on this issue and delivered to his constituency a more restrictive policy on illegal immigration. His administration’s approach was to round up those here illegally and have them deported to their country of origin. This was, at the time, a consistent way to message that, in order to be here, it was mandatory to be here legally.

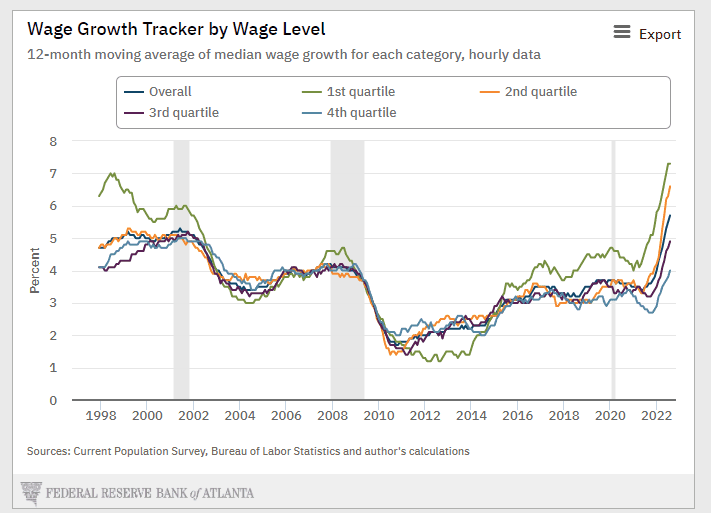

These policies and enforcement have, in part, created a shortage of inexpensive labor that is helping drive inflation to the stratosphere; per the following graph, this acceleration in wages for the lowest quartile began around 2016. The Fed is responding to this incredible pressure in wages by raising interest rates and tanking the stock market, which is an incredibly blunt tool to achieve the objective of reducing wage inflation in aggregate, and especially for the lowest income quartile (quartile 1).

While Covid is taking a backseat to new headlines, we must face the reality that a large portion of people are experiencing health issues either from Covid or other maladies that are debilitating to the point where they cannot work. What’s striking about this is the population of long-haul patients is very large at this point. Having personally experienced transient long-haul symptoms, I can tell you that they are daunting to say the least. Thankfully, my symptoms have abated but many people I know are experiencing incredible challenges functioning after having Covid. This is the challenge of now millions of people who are unable to work or function. This is a highly inflationary issue because these people can’t come off the bench because, simply put, they can’t walk onto the field.

Long-term inflation will need to be addressed using multiple approaches. Number one, the supply chains in this country must get better and thankfully, they are beginning to improve. That’s disinflationary. In fact, it may be severely disinflationary because the retailers are now being crowded with inventory that no one will purchase, which may cause some level of deflation. The supply chain volatility is undefined and frankly, by the time the deflationary oversupply of goods rears its ugly head, the Fed may be in full crisis mode.

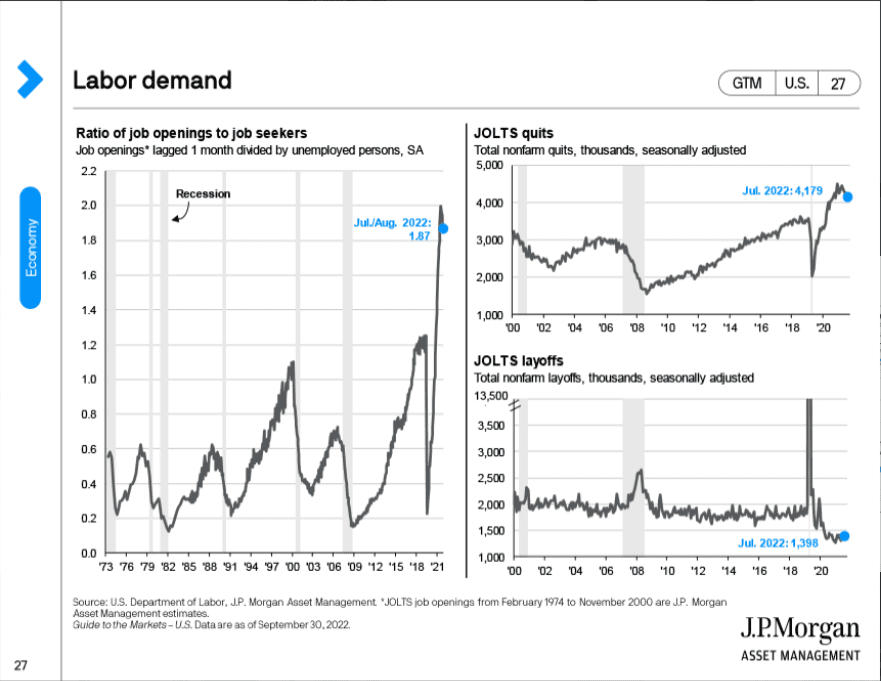

Secondarily, we are going to need a solution for the challenges facing the work force. The combination of restrictive immigration policy and departures from the work force due to the direct (long Covid/health issues) and indirect (early retirement/not wanting to return to office) are structural challenges to the Fed arresting inflation; the current imbalance of job openings to job seekers (left) remains near record levels of almost 2:1; job quitters are also near record levels while layoffs are near lows.

Our economy is riddled with trapdoors right now. Often times, small businesses go to full employment only to realize that they are going to go out of business because wage inflation is trapping them in a loss of profit spiral. We are seeing this unfortunate scenario play out in our communities as local restaurants and businesses go quietly into this dark night. The stock market is in jeopardy because of terrible policy timing by the Federal Reserve. They waited too long to raise interest rates (refer to our notes from the second half of 2021 that criticized the notion of the “transitory” inflation) and we are all going to pay for this for a while.

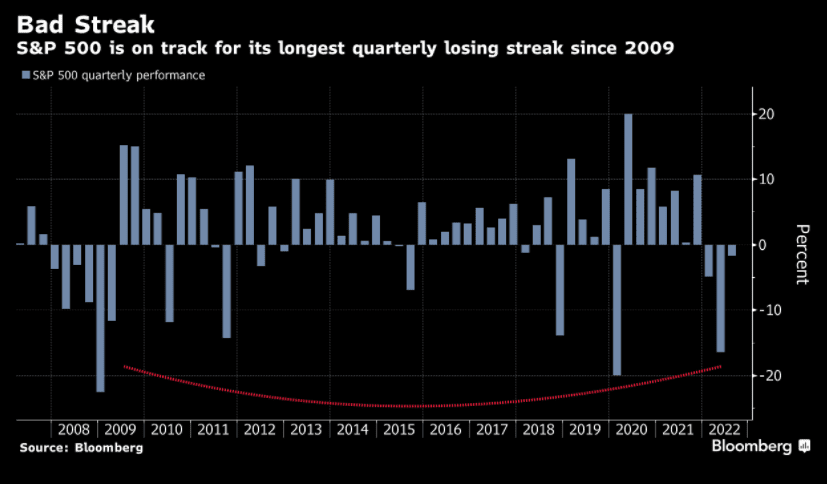

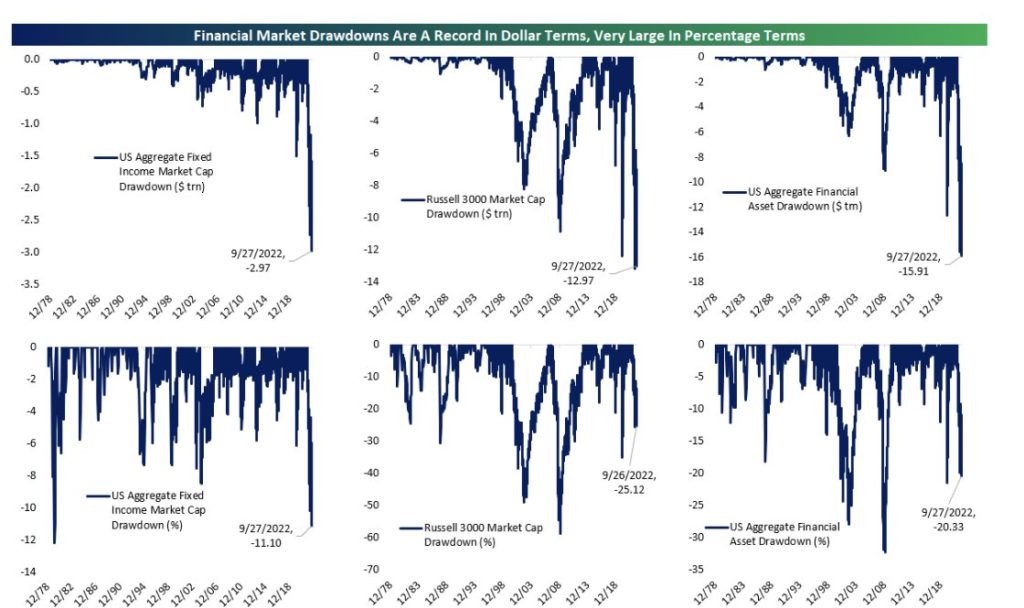

The current administration has culpability in this and the interest rate cycle. Because of the timing, this rate cycle is now viewed as politically skewed for the midterms. This amplifies the inherent challenges of policy shifting. And we now face more pain as a result of the Fed’s ineffective engagement. Because of the timing, the Fed is chasing an out-of-control inflation scenario. Plainly, the Fed waited too long to raise rates meaningfully, and now they are going fast and breaking things. Look no further than the S&P’s current losing streak, its worst since 2009, and the magnitude of the drawdowns for both equities (the Russell 3000 has lost almost $13 trillion, or 25%) and bonds (U.S. fixed income has lost almost $3 trillion, or 11%). The total damage is almost $16 trillion, or 20% of market value.

What’s Next

At Formidable, we do expect earnings and estimates to come down….forward guidance could be very dismal. However, bad news in this case could be good news because policymakers may see this as evidence that their policies have been effective and inflation has begun to ebb. We fear this realization may come too late, the damage already done. This period of time will be remembered as the end of Covid, which is not technically true. The pandemic’s consequences will transcend the rest of the decade. I can say this as I think about all of the people I have lost to the terrible disease.

In this downturn, we believe opportunity will avail itself as result of others’ mistakes. The market often goes through these types of cycles. We expect discomfort followed by an emergence of reformulated opportunity. The main message here is that there is no easy fix. We believe the end will result in a beginning. The Fed’s interest rate experiment has failed or is about to fail, and they will have to pivot quickly. This was illustrated by the Bank of England, pushing on the pull door by supporting its currency after newly appointed UK policymakers cut taxes so aggressively it caused a crash in their currency.

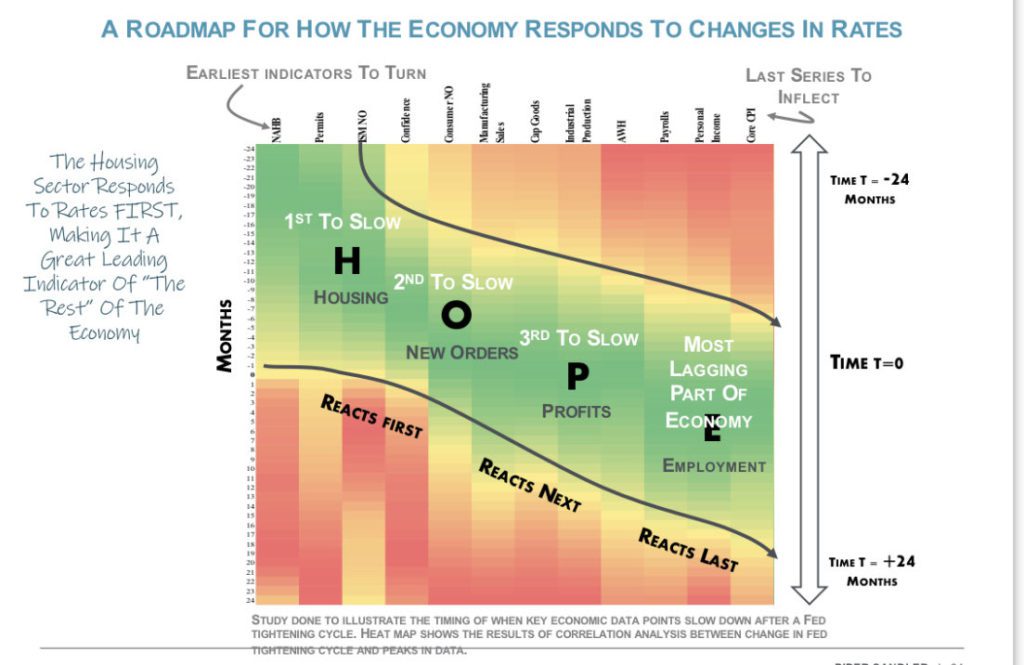

The U.S. Federal Reserve is dealing with its own mistakes. Should we expect a pivot by the Federal Reserve in the coming quarters? The question will be, “just how wrong are they”? Historically, they tend to be very wrong; a focus on data dependence compels them to drive in the rearview. This graphic illustrates how rate increases flow through the economy. With the Fed myopically focused on wages and employment, they are looking for an impact on the most lagging indicator. We are already seeing housing and, just today, new orders, weaken. Profits, as mentioned, are likely to be next.

Then, importantly, what are they to do once labor, inevitably, weakens? Clearly, we shall see. , With OPEC bandying about oil production cuts of consequence, the Fed’s job may be made even more difficult. The primary catalyst for a relief rally in risk assets would be a pivot by the Fed. Perhaps the only thing they have seemingly gotten right about the word transient is that it will describe their aggressive interest rate policy here soon. Or perhaps their careers will be transient. The next month and quarter will be very interesting as it could lead to clues as to what’s next. The role of the investor is to dig in, not flinch, and find a way to survive. That’s how winning is done in the stock market, which, as a reminder, is not monolithic. Although the market, as a whole, is not cheap and appears vulnerable to negative earnings revisions, we continue to scour for companies that are inexpensive even when assuming trough multiples and earnings declines.

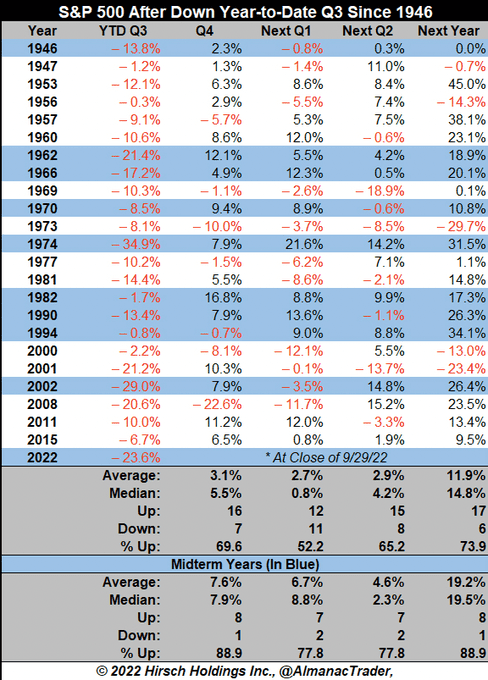

Seldom have we seen such a divergence between the technical setup for stocks (oversold with favorable seasonality) versus the fundamental setup (average evaluations with high probability of earnings cuts). While we are hopeful the former will prevail (the following table shows a favorable setup, especially in midterm years), Ruffer’s admonition that “humanity has a tendency to believe that a settled pattern of order will continue indefinitely” is top of mind. For around 40 years, we have been accustomed to generally declining interest rates and an accommodative central bank. The ultimate direction of markets, especially in the near term, will be highly dependent on whether this historically accommodative inertia remains in place or we see a Fed truly committed to fighting inflation.

A personal note: The tragedies of our friends and loved ones living in Florida is not lost on the people of Formidable. Hurricane Ian has been a terrible, catastrophic, life altering event for millions. If you, or someone you know, needs financial guidance, help or information, we will gladly serve them. We understand that there are those that need help that simply can’t afford our services, but we feel it is our duty to assist others, nonetheless. Please introduce them to us if you feel this is appropriate. This task will take heavy lifting by all of us. We are right here.

READY TO TALK?