October Update: Waiting for Godot

Part I – Summary

October Update: Waiting for Godot

In a case of almost perfect irony, I have waited a long time to use this theme. However, with Google’s AI Overview informing me ”the play’s tone is absurdist and nihilistic,” it seemed appropriate at this point in the market and election cycle.

Key Takeaways:

- Gogo

- Q3 was another “gogo” one for equities, with the first of what investors hope are many Fed rate cuts fueling a rally.

- A brief (and mild) correction in August was quickly forgotten as the S&P 500 ended the quarter near an all-time high.

- For the first time in recent memory, assets outside the so-called Magnificent Seven led the rally.

- Pozzo

- Economic data points have introduced some conflict into the bullish narrative, though Fed policy has pushed our indicators toward neutral.

- The upcoming election has provided a source of uncertainty, as have geopolitics.

- Unexpected stimulus from China provided a further boost.

- Godot

- After waiting for what seems like an eternity, market broadening finally showed up in Q3.

- We are hopeful that history will repeat itself as it relates to momentum continuing into Q4.

- However, we are reticent to believe that the consensus soft landing narrative (aggressive rate cuts combined with double digit earnings growth and higher margins and economic growth) is the most likely outcome.

For those who prefer not to read further, before you close the email, please know these three things.

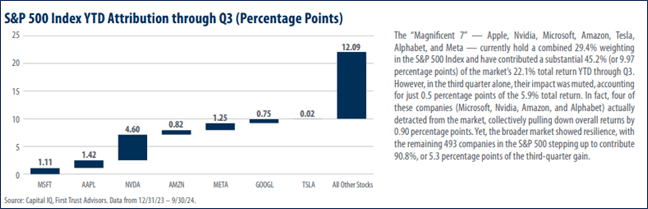

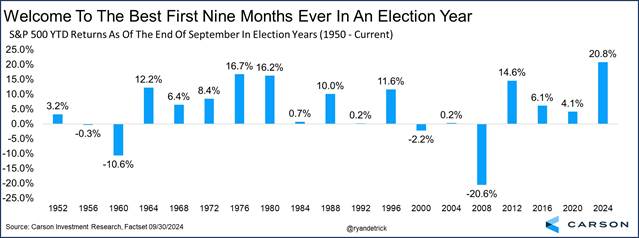

- This is the best first nine months for the S&P 500 in any presidential election year, though the Magnificent Seven have accounted for around 45% of the market’s YTD return.

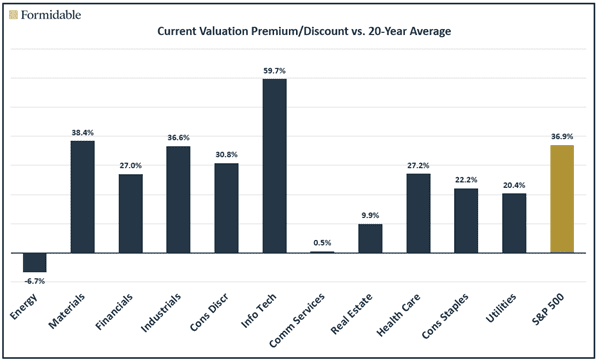

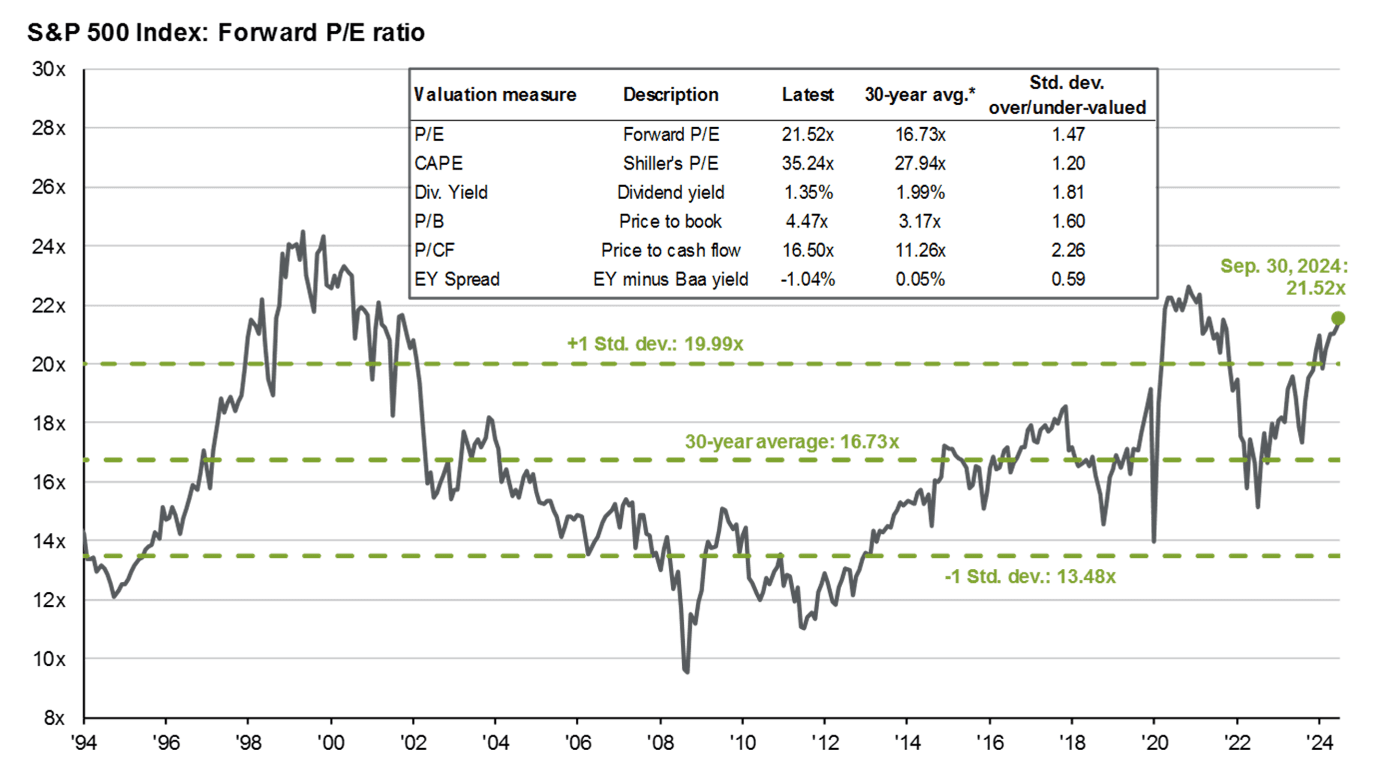

- Valuations are above average for 10 of the eleven sectors in the S&P 500, with the index around 37% more expensive than its long-term average (graph below).

- While a strong start has historically set the stage for good gains in Q4, we think the market’s optimistic assumptions about both interest rates and earnings boosting stocks defy logic (and history).

Source: J.P. Morgan

Part II: Q3 Recap – Gogo

Having been admonished that this quarter’s theme is too esoteric, we will begin with a brief summary of the source material. The most succinct summary, which seems AI generated, is as follows: “The play follows two men, Vladimir and Estragon. The men wait beside a tree for a mysterious man, Godot. However, we eventually learn that Godot constantly sends word that he will arrive tomorrow but that never happens.”

SparkNotes is a little more insightful, stating, “According to both theatre critics and literary scholars, Beckett’s Waiting for Godot is essentially a play in which nothing happens not once, but twice. This often-used phrase describes the way in which the characters find themselves stuck in an endless cycle of waiting throughout the play, unable to make any forward progress toward their goal by the end of either act.”

So, as opposed to Seinfeld, which was a show about nothing, this is a play about nothing…twice.

One of the protagonists, Estragon, is also known by his nickname, Gogo. And gogo is what stocks have done for almost two years now. Just over the past year, every major category among stocks is up double-digits, though by far the biggest winners have been the biggest companies here in the U.S. Year-to-date, the Magnificent Seven are up 35%, accounting for almost ½ of the return for the S&P 500.

| Fund/Index | 3-Month | YTD | 1-Year |

| S&P 500 INDEX | 5.89 | 22.08 | 36.33 |

| Invesco S&P 500 Equal Weight E | 9.48 | 14.91 | 28.48 |

| Russell 2000 Index | 9.27 | 11.16 | 26.74 |

| NASDAQ Composite Index | 2.76 | 21.84 | 38.70 |

| MSCI EAFE Index | 7.35 | 13.55 | 25.45 |

| MSCI Emerging Markets Index | 8.82 | 17.13 | 26.41 |

| Bloomberg US Treasury Total Re | 4.74 | 3.84 | 9.72 |

| Bloomberg US Agg Total Return | 5.20 | 4.45 | 11.57 |

| Invesco DB Commodity Index Tra | -4.13 | 1.04 | -6.42 |

Source: Bloomberg (as of most recent month end)

However, during the third quarter, we did see broader participation in the rally, with the equal-weight S&P 500 beating the top-heavy market cap S&P 500; small caps and non-U.S. stocks also outperformed. In other words, diversification worked for the first time in a long time. Also, though most have already forgotten, we did experience a brief, technical correction in early August. The S&P 500 declined over 10% at one point, due to the combination of weak U.S. economic data and a surprise rate hike by Japan’s central bank. However, markets recovered in near record time to close Q3 near all-time highs.

To put this 2024 in historical context, it is the best year-to-date performance through September in any election year since Americans liked Ike.

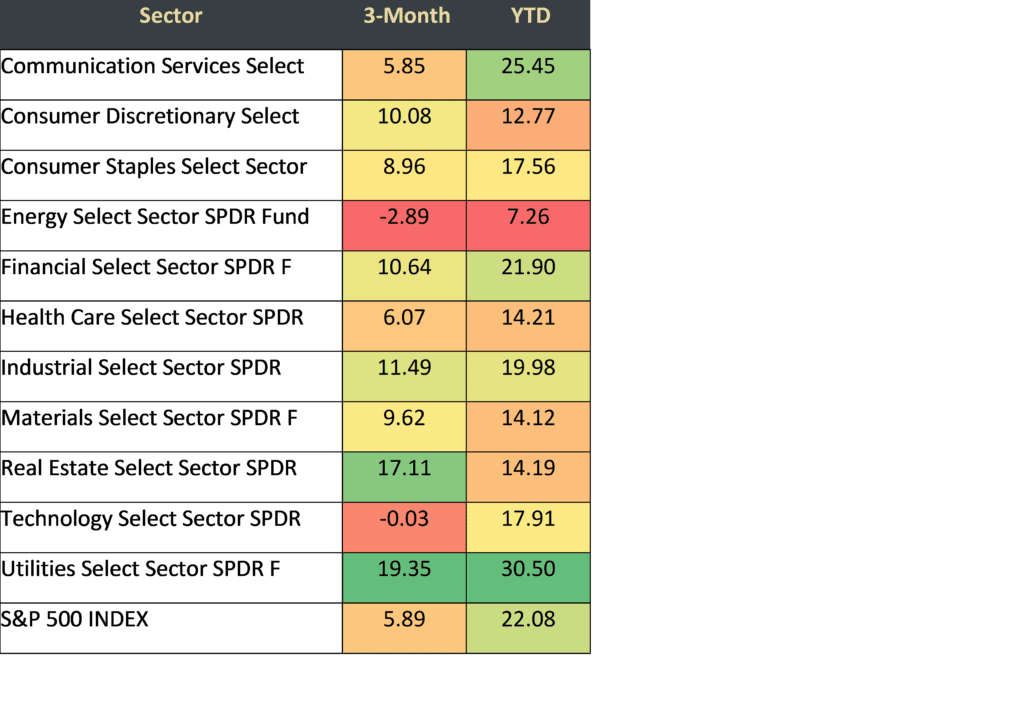

At the sector level, Technology was a laggard in Q3 while the best performers were interest-rate sensitive areas like Utilities and Real Estate. Energy stocks continued to struggle despite escalating conflict in the Middle East and valuations that are low versus history. At present, the Energy sector is the only sector trading at a discount to its longer-term average; every other sector is expensive (more on that later).

Q4 Outlook – Pozzo

To the degree there is any catalyst in the play, it is Pozzo. For investors, there have been (and will continue to be) myriad catalysts. During the past quarter, we saw the following:

- Change in presidential nominee for the Democrats.

- First Fed rate cut this cycle.

- Ukraine seizing Russian territory.

- Israel expanding offensive activities into Lebanon and eliminating the leadership of Hezbollah.

- Sizable stimulus injections by the Chinese central bank.

- The Japanese central bank with a surprise rate increase.

- Massive damage from Hurricane Helene.

So far this quarter (and projected over the remaining three months of 2024), we have the following:

- Iran retaliating against Israel, and Israel threatening a response.

- A labor strike at multiple U.S. ports (since resolved).

- Tightly contested races for president and control of both the house and senate.

- Two Federal Reserve meetings where further rate cuts are expected.

- Further massive damage from the oncoming Hurricane Milton.

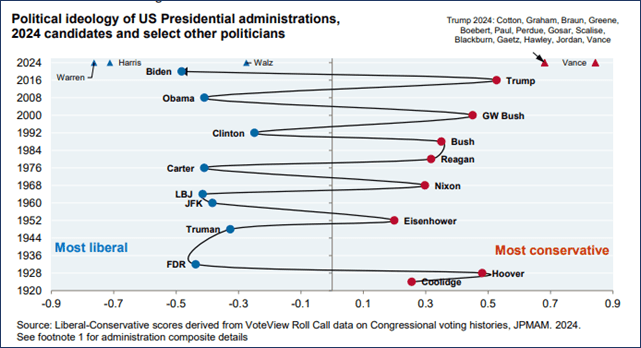

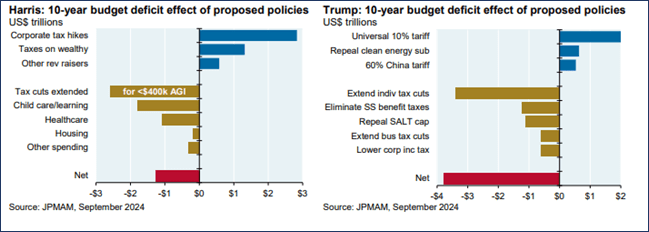

This is an investment newsletter, not a political one, but it is worth noting that the divergent outcomes from November are the widest on record, at least politically speaking. One thing is for sure, and that is either candidate will push for policies that will increase the budget deficit (over $1 trillion is the estimate for Harris policies while Trump’s policies are projected to cost almost $4 trillion).

Setting aside politics, the major factors we track are a little less negative than they have been recently, thanks in no small part to the Fed’s more aggressive rate cutting posture. For details, click here.

| More Negative | Neutral | More Positive | |||

| Inflation | → | ||||

| GDP Growth | ≈ | ||||

| Fed Policy | → | ||||

| Interest Rates | → | ||||

| Credit Spreads | ≈ | ||||

| Stock Multiples | ≈ | ||||

| Earnings Growth | ≈ | ||||

| Deteriorating | ← | ||||

| Stable | ≈ | ||||

| Improving | → | ||||

Conclusion – Godot

Just like Gogo and Didi, we, too have been waiting. In our case, for two things. One is for stocks outside the Magnificent Seven to outperform. We got that in Q3. The other has been for multiples to start to normalize, due to either earnings growth or lower prices, i.e., a correction. Did we get that in Q3? Technically, yes, the S&P 500, at its intraday nadir, was lower by 10%. However, defying the odds, the S&P 500 rebounded in record time without retesting the lows, something that is historically anomalous (had occurred in only two out of 15 prior drawdowns like this).

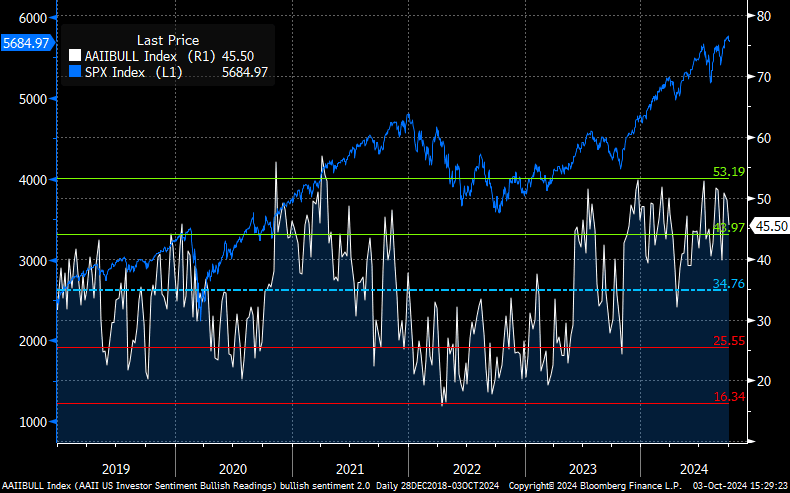

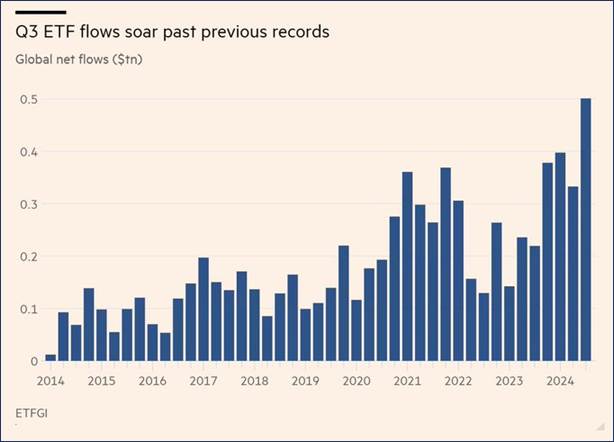

Despite the geopolitical and domestic tumult, fear of missing out remains the dominant emotion. Investor sentiment has not dropped below average this year, and flows into exchange-traded funds (ETFs) are breaking records.

Our goal is not to be either permanently bullish or bearish, but to look for opportunities where reward looks most attractive relative to risk, and for places where consensus just seems wrong. Right now, consensus is on a “soft landing” for the economy, and inflation. This is well stated in a Bloomberg article: “As it stands, we’re expecting rising profits, rising margins, an economic soft landing, and falling interest rates. One will have to give.”

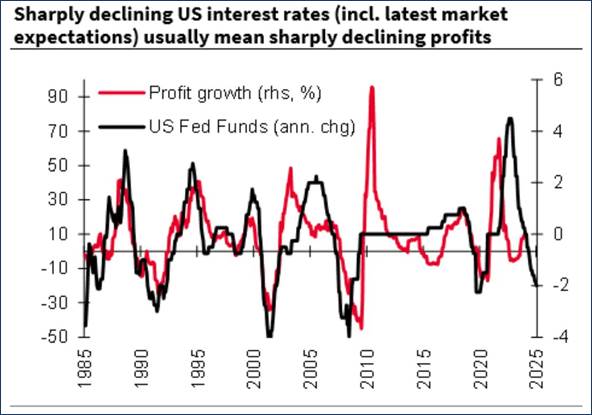

Moreover, as we see in the following graph, “This seems like a completely contradictory message, expecting sharp US rate cuts yet also continued strong earnings growth, as these cuts would historically be consistent with a 20% or more decline in reported profits and so a 30%+ drop in forward earnings.”

Our risk here is being like the unnamed boy in the cast of Godot. He shows up, tells Gogo and Didi that Godot will be there tomorrow, yet the title character never appears. Perhaps, to quote Irving Fisher from the late 1920s, stock prices have reached “what looks like a permanently high plateau”, and we will ride to new highs on the strength of passive fund flows and retail investors, with the Fed engineering a soft landing, rates falling, margins and earnings growing. Historically, after the type of run we have seen over the past 12 months, Q4 has been positive four out of six times, with the outlier being the 1987 crash.

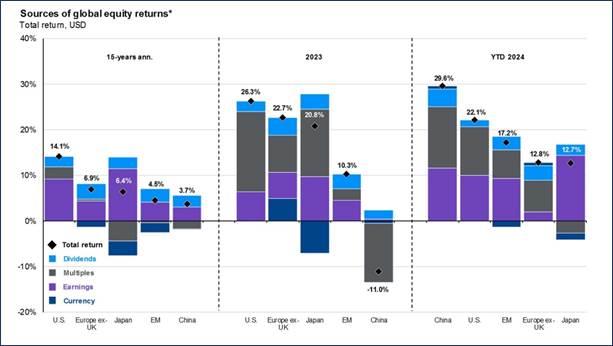

As realists (versus absurdists (perma-bulls) or nihilists (perma-bears)), we look at history and think what will generate returns in the future. Over the long term, it is earnings growth, then dividends, then multiples. Can U.S. stocks continue to return over 10% more than their recent (15 year) average, fueled predominantly by multiple expansion?

- 15-year average – around 15% contribution to returns

- 2023 – around 66% contribution to return

- 2024 – around 45% contribution to return

Waiting for Godot ends with the following exchange:

Vladimir: Shall we go?

Estragon: Yes, let’s go.

However, the last line is the stage direction, “They do not move.” While the play’s protagonists (and index investors) may have that as a choice, as active managers, we will move, especially as the various catalyst cited earlier have the potential to swing markets in Q4. We will remain focused on balancing the long-term growth potential from some of the Magnificent Seven with their higher valuations (and generally avoiding the risk associated with their weights in the index). We will also maintain our focus on quality, remaining confident in our view that Q3 may have marked an important inflection point whereby active management and diversification once again prove beneficial to our clients.

Part III: In-depth analysis of Key Factors

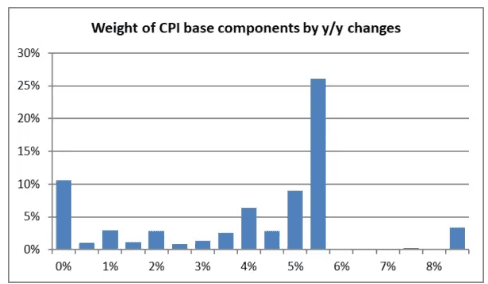

- Inflation – Negative but improving. Fed Chair Powell is confident the battle against inflation is won, stating on September 30, “Disinflation has been broad-based, and recent data indicates further progress towards a sustained return to 2 percent.” To us, and noted inflation expert Mike Ashton, that seems premature, and in terms of broad-based, inaccurate. While some components, especially goods, have been deflating, and the overall trend nudges this into the improving camp, services inflation remain persistently high.

- GDP Growth – Positive and stable. The Atlanta Fed’s volatile GDPNow estimate for Q3 has settled in the mid-2% range, which is clearly not recessionary, but also not scintillating. Employment data on job openings remains worrying.

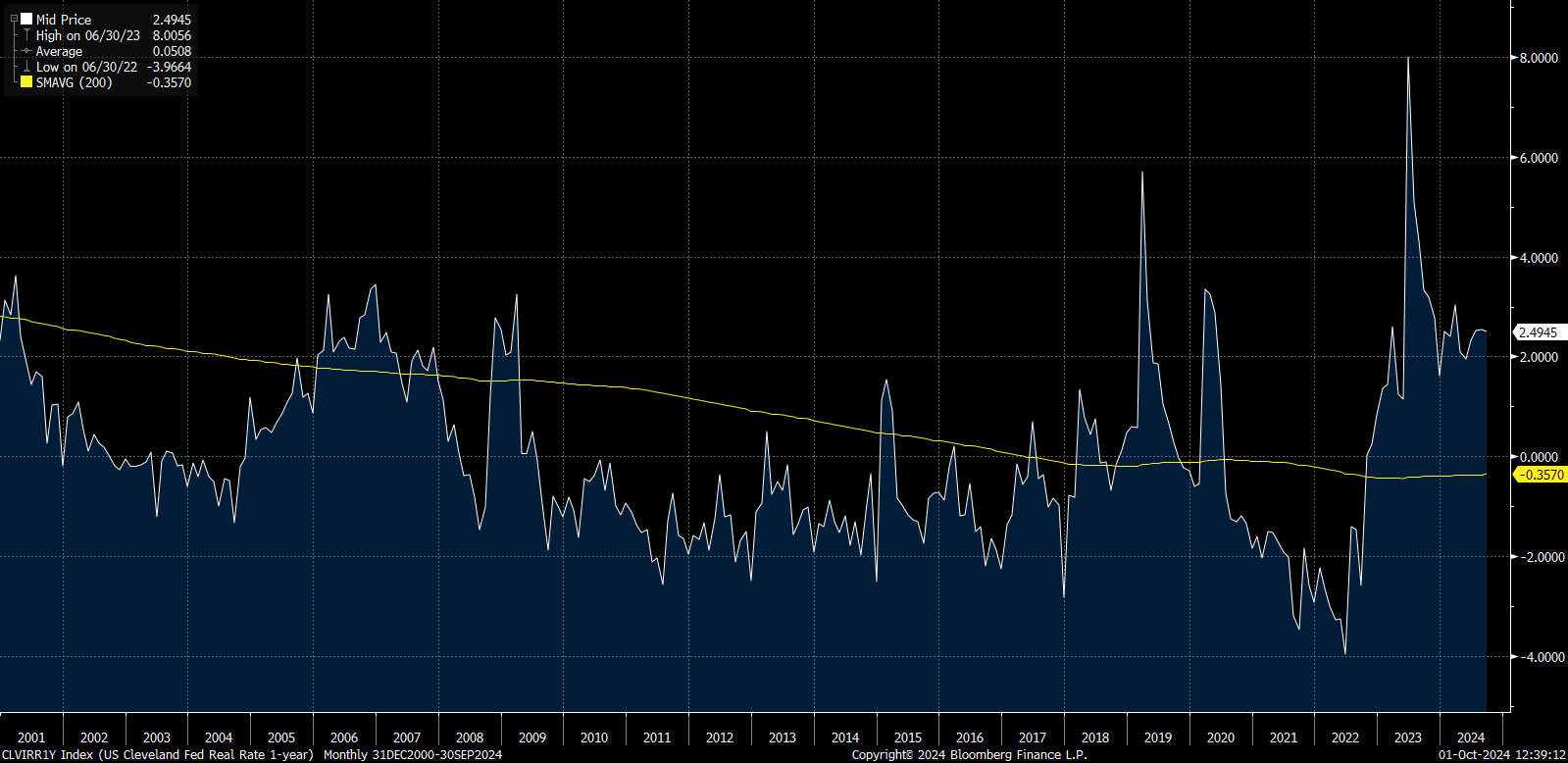

- Fed Policy – Neutral and improving. The Fed delivered a 50 basis point cut at its September meeting, which was a positive surprise as the odds were only about 50% for a cut of this size. Where we go from here is unclear (odds after a hot jobs report for September have reduced expectations from three cuts to two cuts for the rest of this year). The Fed has more work to do to get real, i.e., inflation adjusted, rates in line with their longer-term averages. In other words, Fed policy could be considered restrictive, though if it delivers on its expected rate cuts, especially in 2025, it would shift toward neutral.

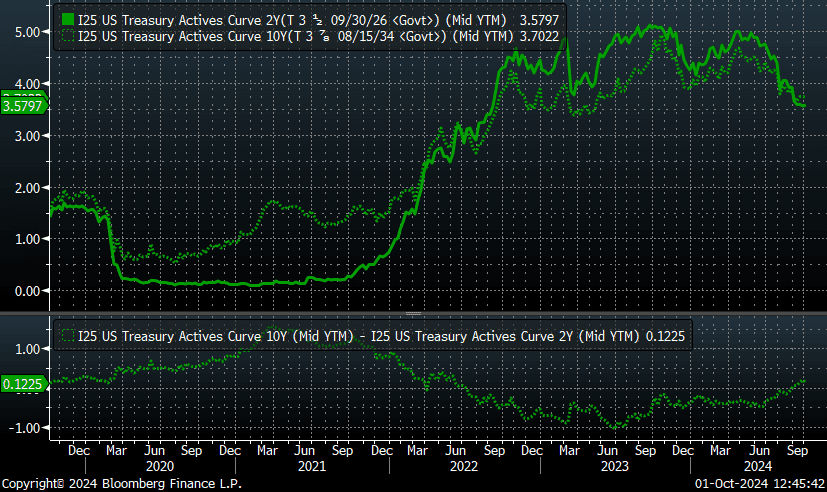

- Interest rates – Neutral and improving. The 10-year Treasury yield fell sharply in Q3, hitting a nadir of around 3.6% before ending the quarter around 3.7%, almost a full percent below its year-to-date high.

After a near record length of inversion, the 10-2 curve recently uninverted, but has since re-inverted. This type of whipsaw action in the bond market is without precedent. However, we would note that the only soft landing engineered by Fed rate cuts was in the mid-1990s and had neither an inverted yield curve nor unemployment starting at such a low level.

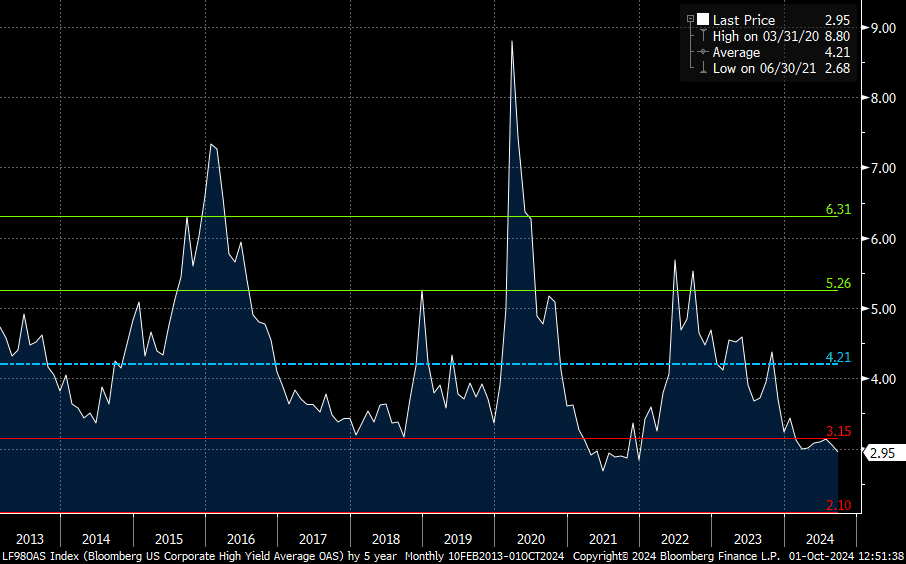

- Credit spreads – Negative and stable. A reminder we use this as a contrarian indicator. In other words, if we see spreads widening into the area above the green line, we may start to view risk/reward more favorably. High-yield spreads and investment grade spreads are incredibly narrow.

- Stock multiples – Negative but stable. Multiples expanded during Q3, driven by expectations for further Fed rate cuts. On a forward P/E basis, we are approaching post-Covid highs.

Source: J.P. Morgan

While much has been written about extreme valuations in certain sectors, e.g., technology, the fact is almost every sector is trading well above its historical average.

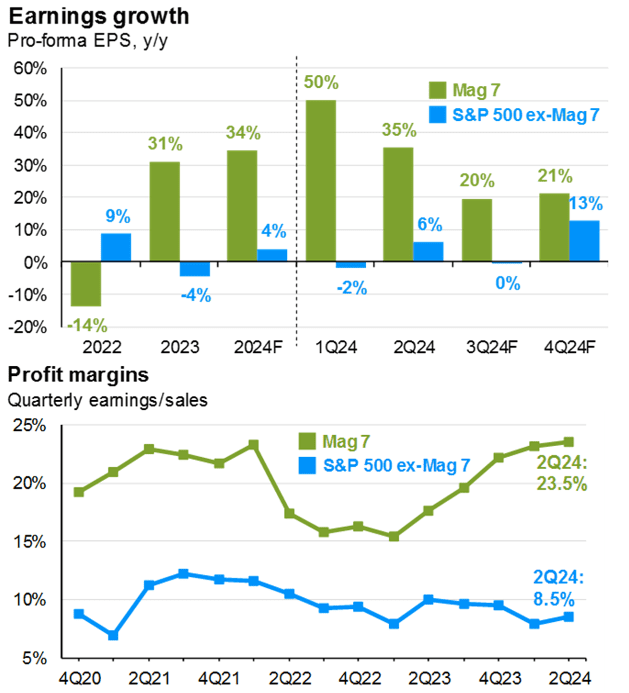

- Earnings growth – Negative but stable. Excluding the Magnificent Seven, earnings growth has been paltry. Expectations, in terms of both earnings and margin, are incredibly high for the Magnificent Seven, though have been lowered for the other 493.

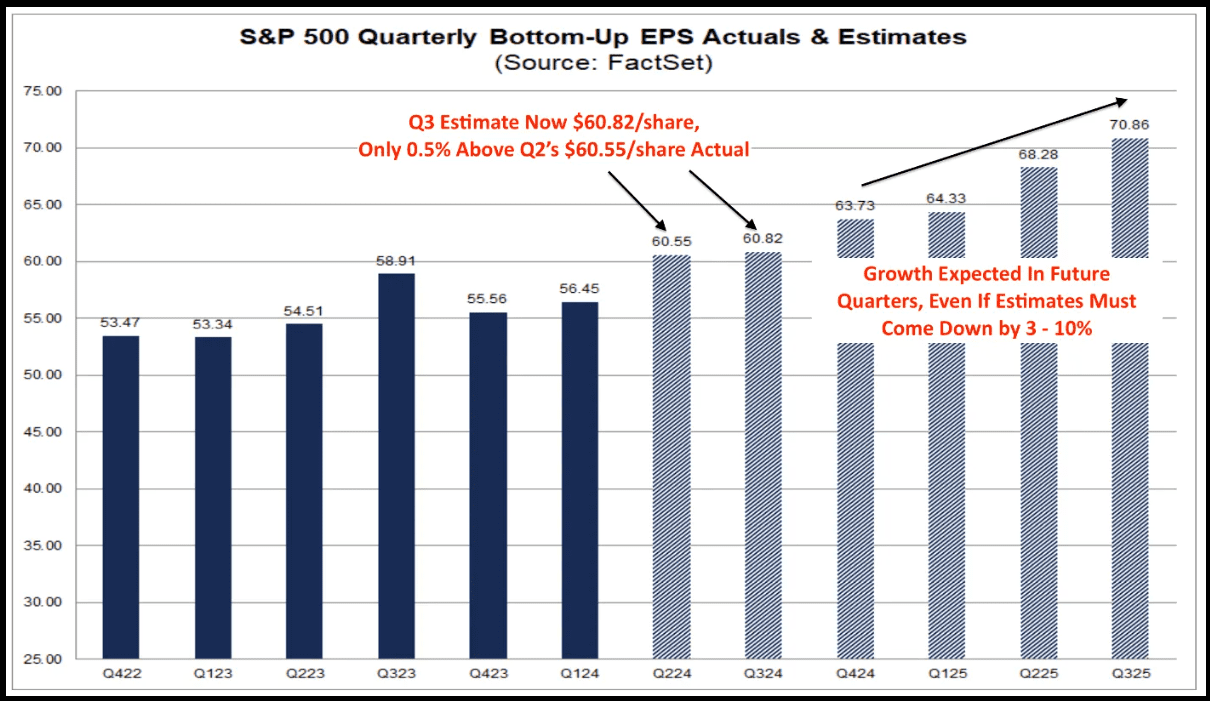

Are we set up for positive surprises as companies report this quarter? Yes. However, are expectations too high for 2025? Quite possibly:

READY TO TALK?