Market Commentary September 2023: The Price is Right

September Update: The Price is Right

America lost a television icon in August with the passing of Bob Barker, long-time host of The Price is Right. As one of our colleagues insightfully noted, he died at age 99, coming as close as possible to 100 without going over. We will come on down and use a few of the show’s games for this month’s recap.

September Update – Key Takeaways

- Fed policy finally started to squeeze investors in August.

- The deck remains stacked against investors as we consider the factors we track.

- The rest of the year may be a cliff hanger, especially for higher valuation stocks.

August Recap – Squeeze Play

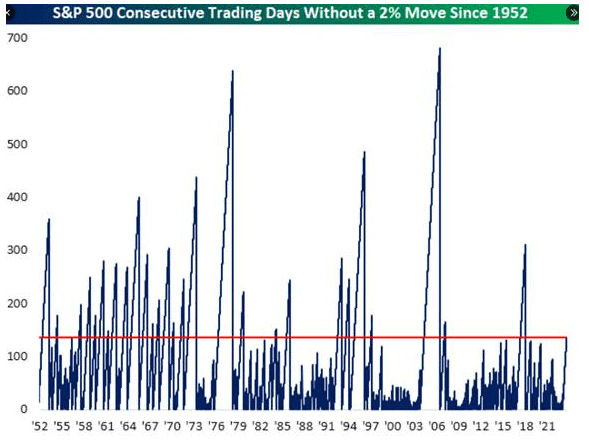

The market began to feel the squeeze from the Fed’s steady diet of rate increases in August. Just as we saw in 2022, both stocks and bonds declined during August, albeit without a major daily decline for the index, where we are at a post-COVID high as it relates to days without a large (2%) daily move:

We have also seen the volatility index (the VIX) plumb its post-COVID depths while investor sentiment remains bullish. In other words, complacency is high, and why would it not be?

Despite modest drawdowns in August, we have seen strong returns over the past year for the S&P 500 and the NASDAQ, which are the favorites for many retail (and passive) investors. For a detailed analysis on what risks these investors face in terms of index construction, click here for a recent piece we wrote on the topic.

| Index | 1-Month | 3-Month | YTD | 1-Year |

| S&P 500 INDEX | -1.59 | 8.28 | 18.72 | 15.92 |

| Invesco S&P 500 Equal Weight E | -3.20 | 7.85 | 7.13 | 8.44 |

| NASDAQ Composite Index | -2.05 | 8.72 | 34.89 | 19.87 |

| Russell 2000 Index | -5.01 | 8.99 | 8.93 | 4.61 |

| MSCI EAFE Index | -3.82 | 3.87 | 11.40 | 18.67 |

| MSCI Emerging Markets Index | -6.14 | 3.61 | 4.80 | 1.63 |

| Bloomberg US Treasury Total Re | -0.52 | -1.61 | 0.70 | -2.07 |

| Bloomberg US Agg Total Return | -0.64 | -1.06 | 1.37 | -1.19 |

| Invesco DB Commodity Index Tra | -0.36 | 11.52 | -0.24 | -3.82 |

Source: Bloomberg (as of most recent month end)

The Fed raised rates by 0.25% at its July meeting. While there was no August meeting, Chair Powell did speak in Jackson Hole. While the market viewed the speech as largely a non-event, we were struck by his statement that, “It is the Fed’s job to bring inflation down to our 2% goal, and we will do so.” We will talk more about inflation in the Outlook section but suffice it to say a meaningful commitment to 2% may have implications for the duration of higher rates, i.e., rates remain higher for longer, versus the potential for additional rate increases.

September Outlook – Stack the Deck

The seven key factors we track showed no change month over month and we continue to believe the deck is stacked against outsized returns for the index:

| More Negative | Neutral | More Positive | |||

| Inflation | ≈ | ||||

| GDP Growth | ≈ | ||||

| Fed Policy | ≈ | ||||

| Interest Rates | ≈ | ||||

| Credit Spreads | ≈ | ||||

| Stock Multiples | ≈ | ||||

| Earnings Growth | ≈ | ||||

| Deteriorating | ← | ||||

| Stable | ≈ | ||||

| Improving | → | ||||

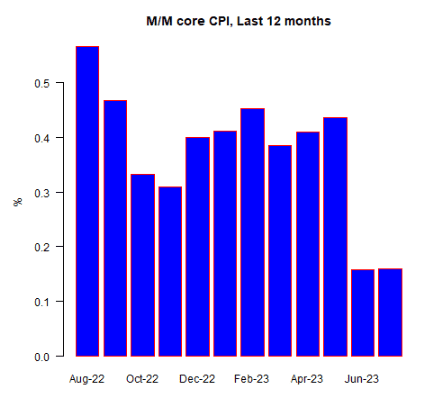

- Inflation – Negative but stable. July core CPI came in at 0.16%, which would annualize to around 2%, which is the Fed’s target. Second month in a row at that figure:

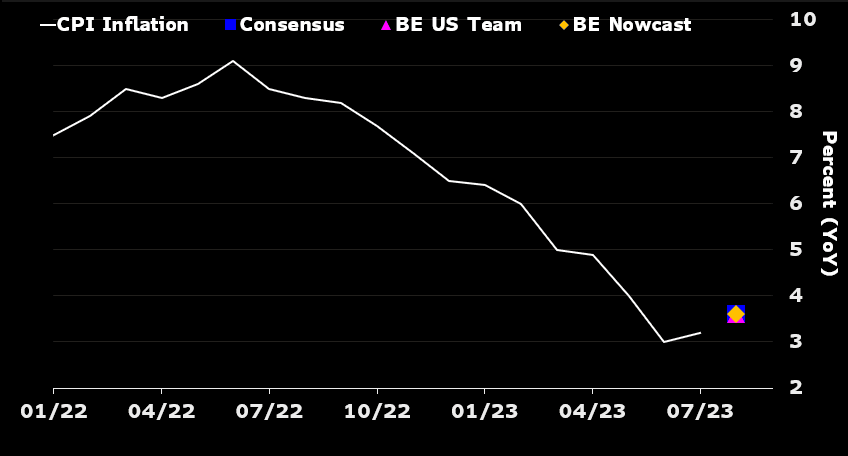

However, as we have mentioned, year-over-year comps become more difficult from here as the tailwind from lower energy prices disappears, especially when combined with renewed strength for oil prices. AAA showed retail prices at the pump increasing almost 7% in August. Bloomberg forecasts call for CPI to rebound to 3.6% when August data is reported this week:

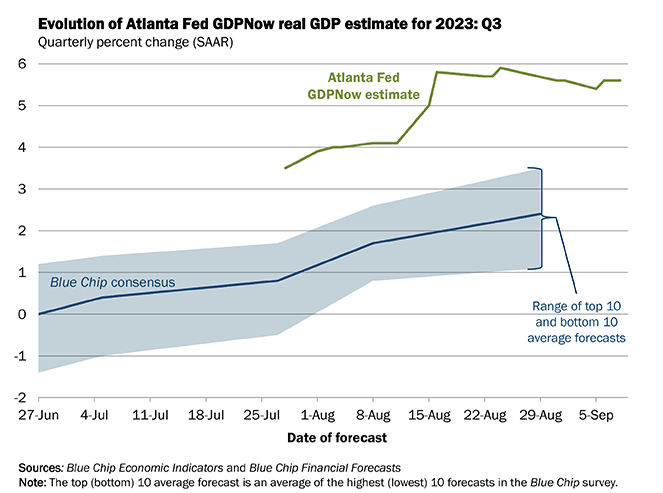

- GDP Growth – Negative but stable. Employment data and Fed GDP estimates for Q3 would argue for this to move to neutral but given that a) employment is a lagging indicator, and b) the Fed’s estimates are notoriously unreliable, we leave GDP Growth unchanged:

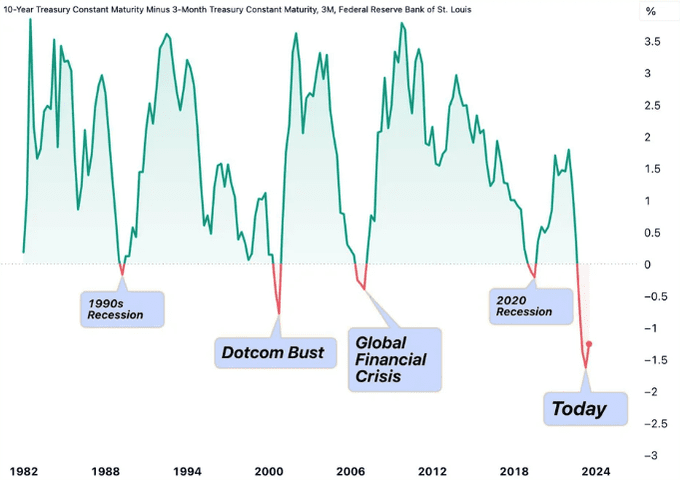

While the inversion of the 10-2 curve remains sizable, the 10 year-3-month curve is the attention grabber at present, given it is at a 40-year low and has an unblemished record of predicting recessions during that time:

While it is hard to underestimate the massive amount of government stimulus that has been injected into the system, the marginal effect of higher rates and renewed student loan payments may be problematic; throw in a possible government shut down for good measure, too. Per the linked Bloomberg article, “Researchers at the Federal Reserve Bank of San Francisco say the excess savings that have helped consumers get through the price spike will run out in the current quarter.”

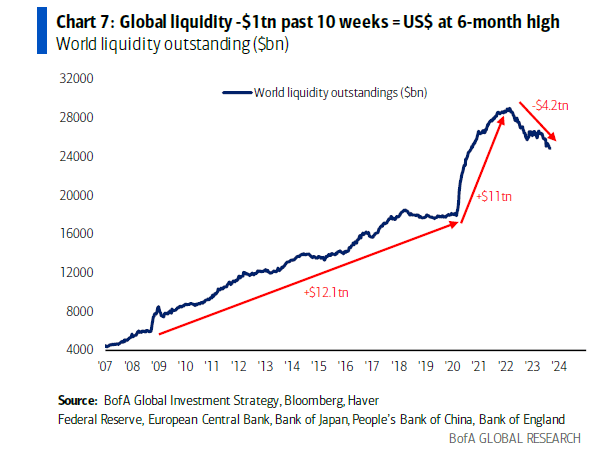

- Fed Policy – Negative but stable. Quantitative tightening continues both here and abroad:

However, on the rate front, Fed trial balloonist Nick Timiraos recently published this piece in the Wall Street Journal, with the subtitle “Central bank is likely to pause rate increases in September, then take a harder look at whether more are needed.”

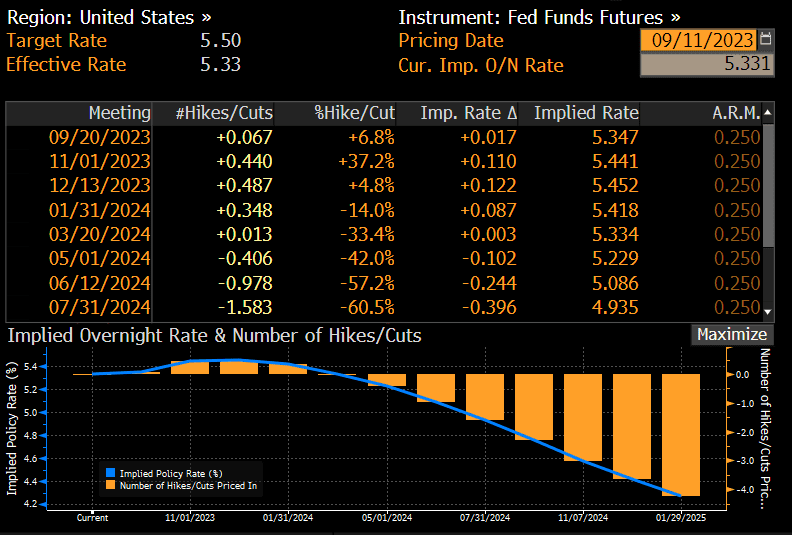

The market has lowered odds of further hikes but also pushed out the likely timing of cuts, which we hope to be true. As mentioned in prior newsletters, Fed shifts to rate cuts are often indications of market stress:

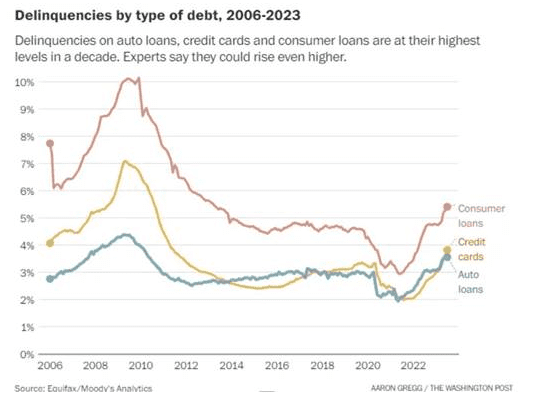

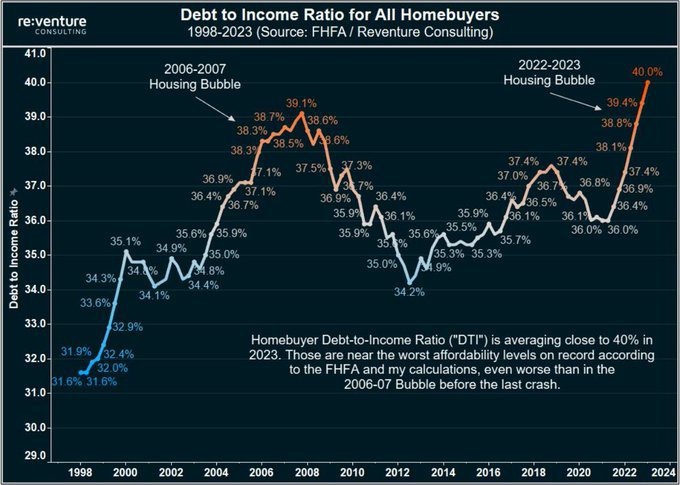

- Interest rates – Negative but stable. The 10-year Treasury yield has held above 4% since the end of July and is near 4.3%. Mortgage rates are over 7.5% and continue to trade at an elevated spread to the 10-year (approximately 3% spread; highest since 1988). There is no easy way to say it, but interest rates are restrictive at this point and are starting to have a deleterious effect on borrowers:

Both parts of the numerator of the affordability equation (prices and interest rates) are accelerating faster than the denominator (incomes). While there are differences in terms of underwriting standards, etc. between now and the housing bubble, affordability (or lack thereof) is in an almost identical spot:

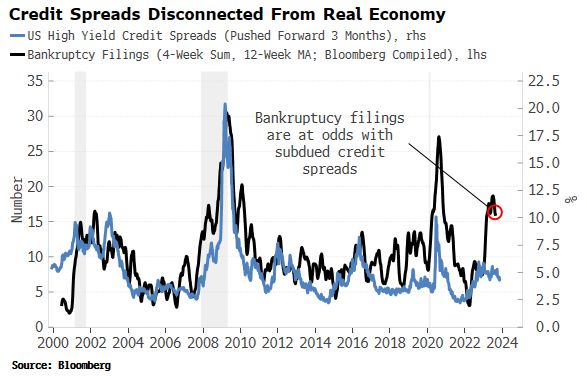

- Credit spreads – Negative but stable. A reminder we use this as a contrarian indicator. Spreads are indicating no stress despite bankruptcies soaring:

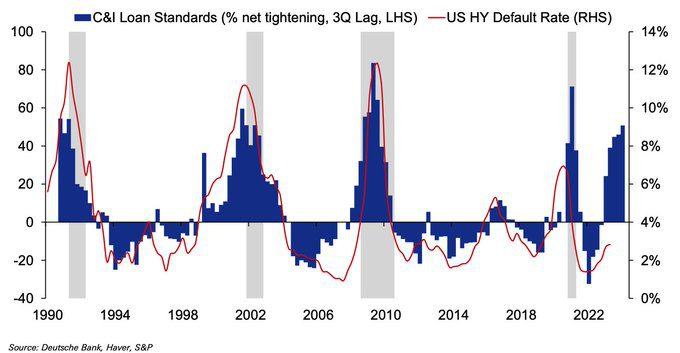

Defaults (the red line) tend to lag the blue line (tightening lending standards). Credit has become harder to access, and it seems likely defaults will rise from here:

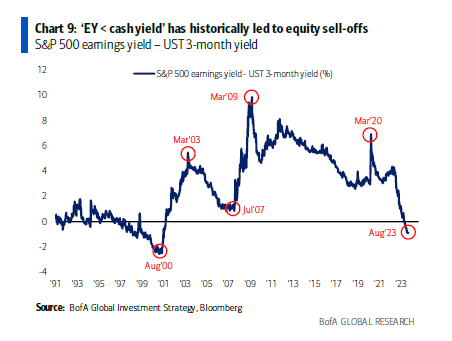

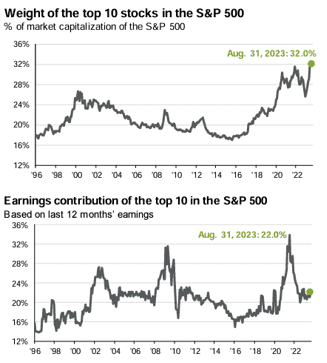

- Stock multiples – Negative but stable. We will state this again: stocks are not cheap at the index level. The top 10 stocks are even more overvalued, and the S&P 500 Index is as concentrated as it has even been. Relative to short-term interest rates, the S&P 500 is as expensive as it has been since the tech bubble:

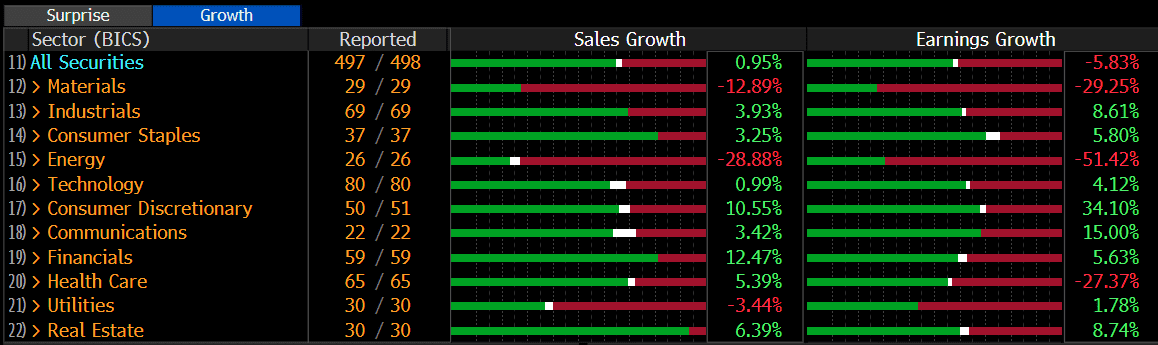

- Earnings growth – Negative but stable. Earnings have been poor in absolute terms (-6%) but better than expectations (+8% on earnings surprises):

Conclusion – Cliff Hangers

By far my favorite TPIR game is Cliff Hangers. The suspense, the yodeling, it’s incredible:

The Fed is playing its own version, seeing how close they can get the economy to the edge of a recession to control inflation without us plummeting over the brink because they have gone too far. Admittedly, the odds of getting this right are better than that of getting a Showcase Showdown correct to the dollar. This has happened exactly once (a story so good they made a documentary about it; if you don’t have the time to watch, just give this a read instead.)

However, it is possible they have already gone too far. If not, we are approaching a precipice in banking. While many have already put the Silicon Valley Bank fiasco in the ancient history bin, we think there is more to come. Will unearthed some fascinating data on so-called BTOs (bespoke tranche opportunities) investing in CRE (commercial real estate), which are eerily similar to the infamous CDOs that helped cause the GFC (enough acronyms for now). CRE is facing significant challenges due to the aftermath of COVID as well as Fed policy. Banks own about 40% of the CRE market, while BTOs and similarly opaque vehicles own around 25%.

In terms of the perfect bid, the mistake TPIR made was this: “The Price is Right was recycling the same prizes for the same prices for way too long. There wasn’t enough variation.”

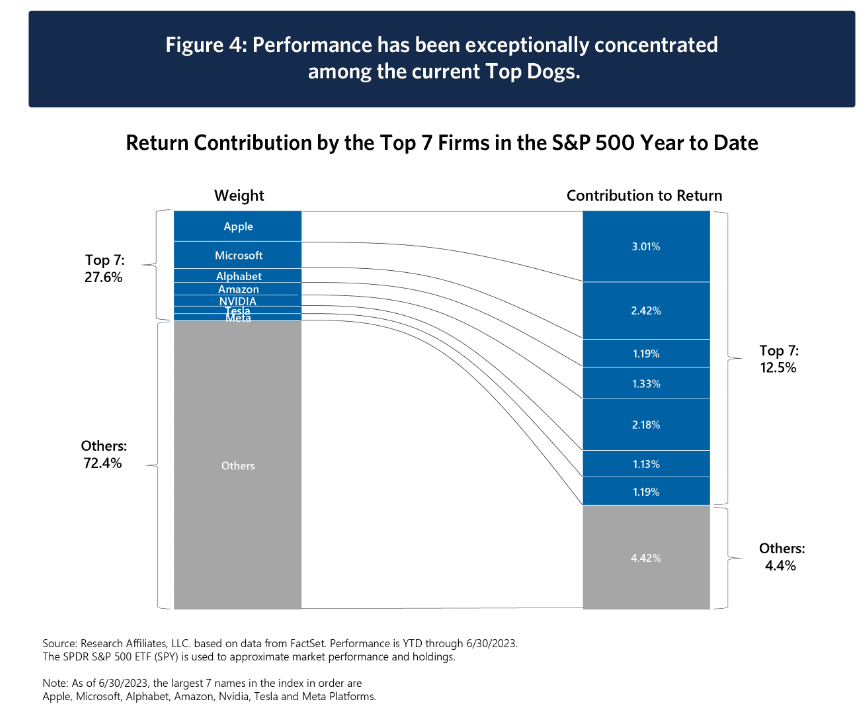

Investors have been guilty of the same thing to some degree, although they are paying an increasingly large price for the same prizes, i.e., megacap stocks, which are back to a record level of index composition (32%) but now only 22% of earnings:

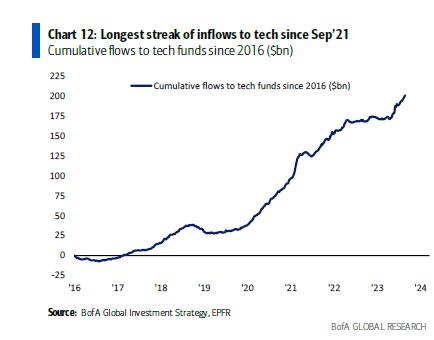

One thing that has contributed here is speculators piling into short-dated options, with zero-day to expiry (0DTE) hitting 50% of all options volume during August. The other is unabated flows into technology stocks:

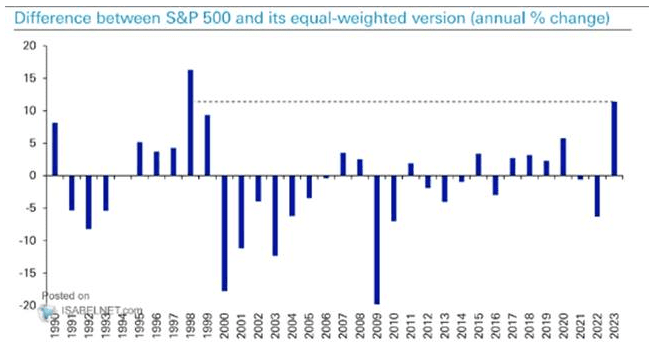

This has exacerbated the spread between the return of the index and the average stock to levels last seen during the tech bubble:

Here’s a different perspective:

We look to other practitioners for their perspectives as well. This piece by Research Affiliates we found insightful; the key takeaway is this: “When a bull market emerges from a powerful narrative propelling the stock prices of a narrow group of popular companies, those stocks may disappoint in the years to come. For example, following the peak of the tech bubble in March 2000, the average stock in the S&P 500 rose by 25% over the following two years while the cap-weighted index, dominated by popular tech stocks, declined by 21%.”

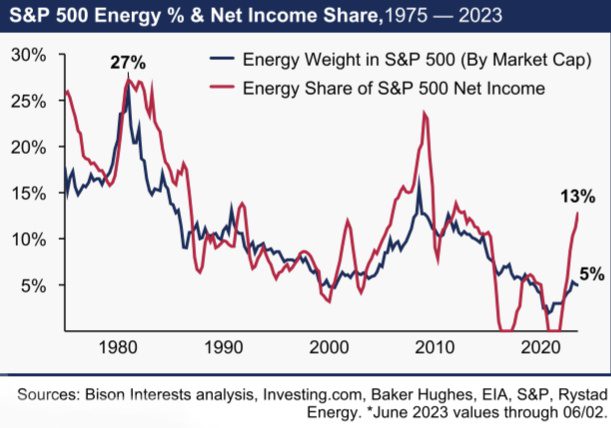

The opportunities we see are in certain market segments (smaller and mid cap stocks, value stocks, non-U.S. stocks), and unloved sectors, like energy. Here, the divergence between the weighting from a market cap perspective versus earnings works in our favor (not to mention the structural supply deficit and plummeting inventory at the Strategic Petroleum Reserve).

My favorite moment in any TPIR is a contestant bidding one dollar, which happens when they are highly confident their opponent(s) overbid. You are punished on the show for bidding too much, which is how we think about stocks. Unfortunately, we do not believe the price is currently right for most stocks, and especially not the index. The technology sector trades at a forward P/E of over 26x versus its historical average of 18x, a nearly 40% level of overvaluation. We believe the current setup is perilous for the index, and that the divergence in favor of the index over the average stock has the potential to revert just as it did when we exited the tech bubble.

READY TO TALK?