The Big Short Squeeze: Is the Juice Worth the Squeeze?

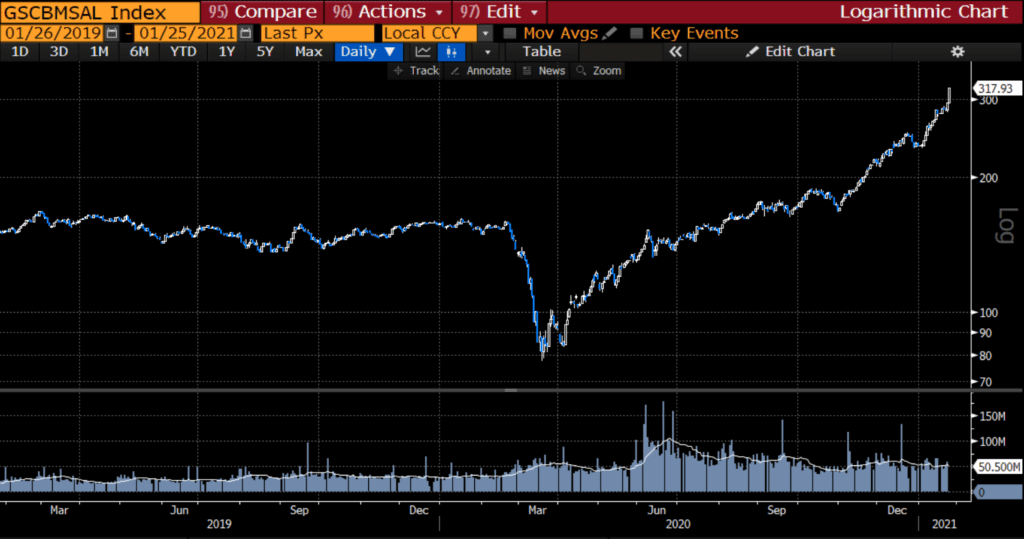

One of the books on our recent reading list was a fantastic biography on Winston Churchill. A quote of his we use often is, “You will never reach your destination if you stop and throw stones at every dog that barks.” Recently, dogs, so to speak, have been barking. By dogs, we mean seemingly down-on-their-luck companies that have been the target of short sellers. And by barking, we mean terrifying those who are short the stocks. The most highly shorted companies are absolutely flying of late; the following graph shows a basket of the most highly shorted names is up almost threefold from the March lows, and over 20% so far this year:

For those who may not be overly familiar with the concept, short sellers are those who are betting on the price of a stock to decline. We’ll use an example of an imaginary company to make it easy.

Let’s pretend we think Sendrax, which devised a technique for televising opera back in the 1990s, is overvalued at $20 per share, given everyone knows opera is in secular decline. We decide to short Sendrax, meaning we sell the shares at $20 without owning them. In order to sell the shares, we have to borrow them from someone who owns then. This number is tracked by stock exchanges and data providers. Normally, it is viewed in terms of percentage of float, i.e., total shares of the company, or days to cover, i.e., how many days of trading volume for a stock it would take for shorts to cover their positions.

If, as expected, Sendrax declines to $10, we may decide to buy the shares for $10, having already sold them at $20, making a tidy $10 profit. Great job. But what if we are wrong?

Let’s say a lot of people think Sendrax is doomed and are lined up on the short side with us. What if Sendrax surprises us with a good quarter, or involvement from an activist, or excitement on a Reddit message board. This may trigger what we know as a short squeeze, which is in the press lately due to the amazing story of GameStop Corp (NYSE: GME). As the price of Sendrax moves above $20, our short position starts to lose money. Unlike long positions, as the short moves against us, it becomes a larger part of our portfolio, so to manage the risk, we have to cover, i.e., buy, shares of Sendrax. Ironically, this can throw gasoline on the fire, causing the price to increase more, prompting us to buy more shares to cover; rinse, repeat. This is precisely what is happening now, with the most highly shorted names gaining momentum as short sellers are forced cover.

The downside of shorting is this unlimited risk potential. If we own a stock, the most we can lose is what we invest, i.e., it can go to zero, but no lower. Sendrax can go to infinity, theoretically. It is for these reasons we are judicious in the management of our hedge fund with regard to shorting stocks; we use advanced techniques to mitigate the risk of this “naked” shorting.

In looking through the short squeeze carnage, many already reflect the surrender of the short sellers. However, in at least on case, we have identified a company where the juice looks like it worth the squeeze, but for activist involvement.

Time to Toss a Rock at This Barking Dog?

Part of our job as portfolio managers and analysts is to evaluate companies in terms of business models and capital allocation policies. By nature, we are critical people, and see lots of barking dogs in terms of those that are managed sub-optimally. Sometimes, we may find a flaw or two, whereas other times, there may be more reasons to be critical. We don’t throw rocks very often though.

However, in the case of PetMed Express, Inc. (NASDAQ: PETS), we feel compelled to toss a rock. We find a company with attractive economics, secular tailwinds for growth, and a long, relatively stable roster of clients, products, and cash flows, yet a history of underperformance and undervaluation versus its small cap and retail peers. Moreover, we see a lack of innovation and a general comfort with a status quo that has seen the company lose share and suffer stagnation.

The following is our assessment of the company and what we think management might consider as ways to close these valuation and performance gaps. Formidable has recently initiated a position in the company.

We see the following as areas where the company has an opportunity to improve, and subsequently generate returns for shareholders:

- Static Management and Board

- Inefficient Balance Sheet and Capital Return

- Antiquated Business Model

Static Management and Board

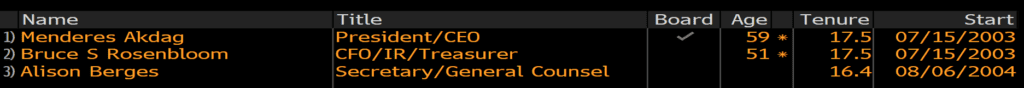

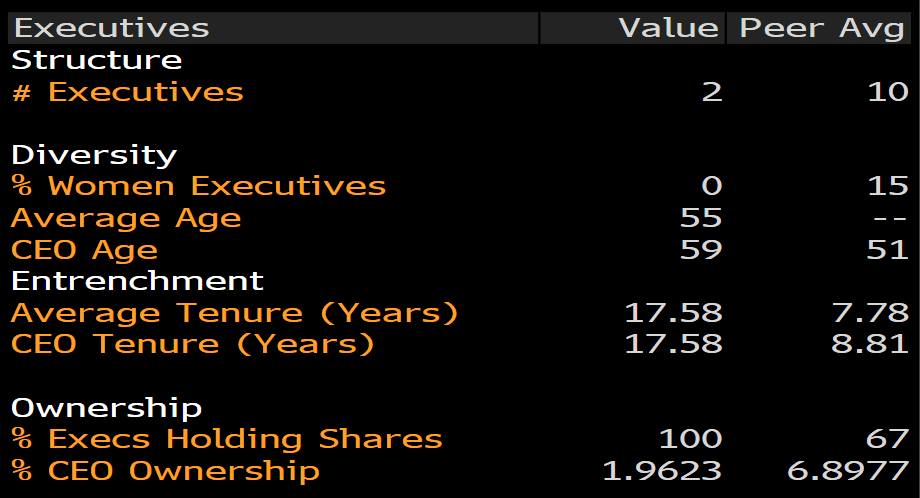

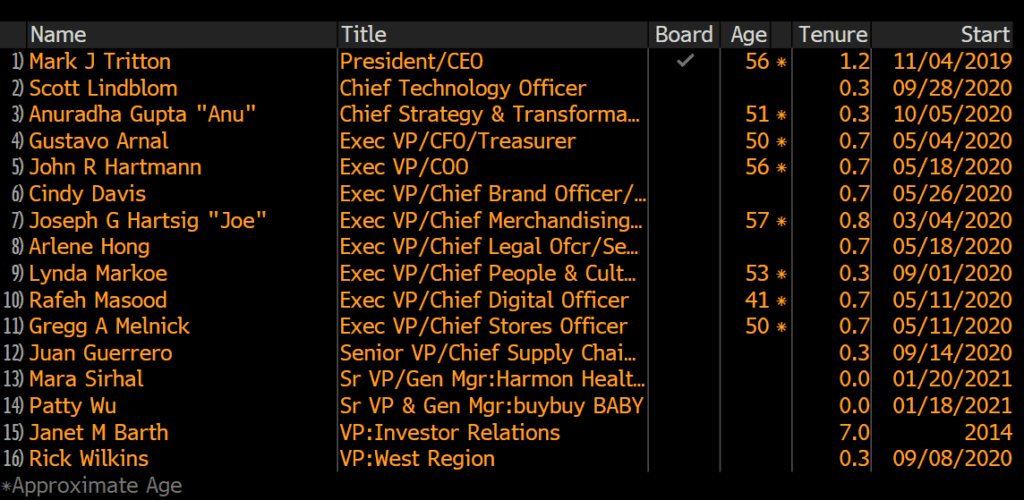

Continuity is great. However, new voices can help companies unlock new growth opportunities and change with the times. C-suite management has been at the helm since 2003:

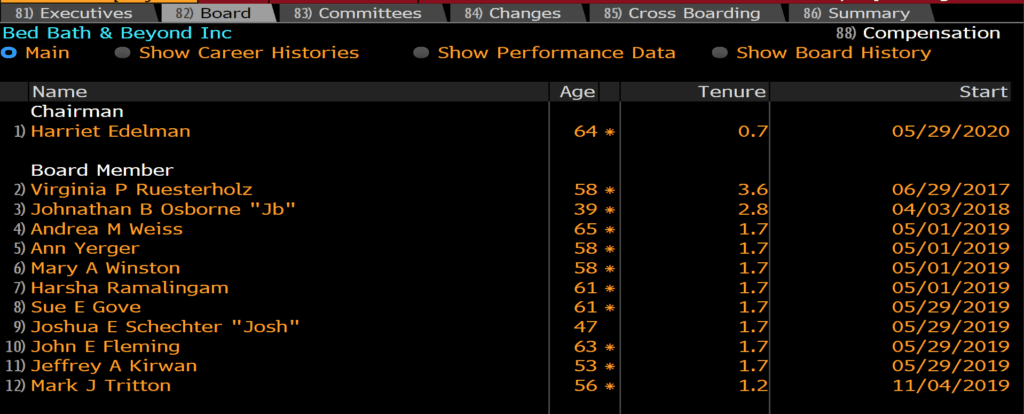

Perhaps the board is different? With one exception, again, the answer is no:

To put it bluntly, management seems understaffed, lacking diversity, entrenched, and seemingly underinvested. We think these traits lend themselves to the apparent lack of innovation that has recently plagued the company.

Inefficient Balance Sheet and Capital Return

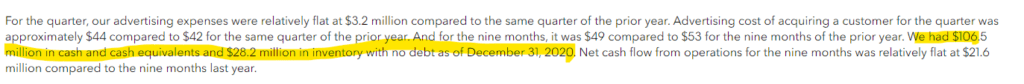

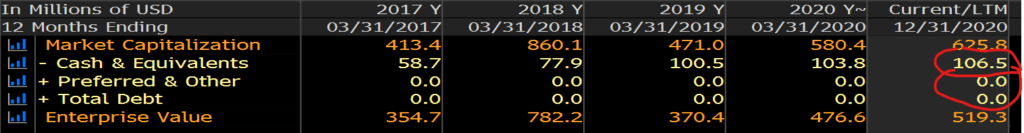

In an era where rates are rock bottom, as are corporate bond spreads, having a debt-free balance sheet should not be a point of pride for an established company that consistently generates free cash flow from its operations. However, that is just what PETS has. Cash is over $100M; there is no debt. From the Q3 2021 earnings call (1/19/21):

To its credit, the company is highly cash generative, making the continual cash stockpile inexplicable.

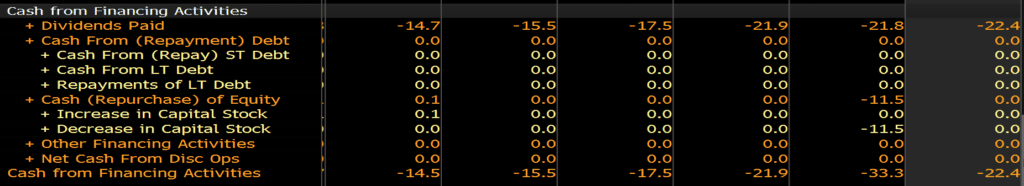

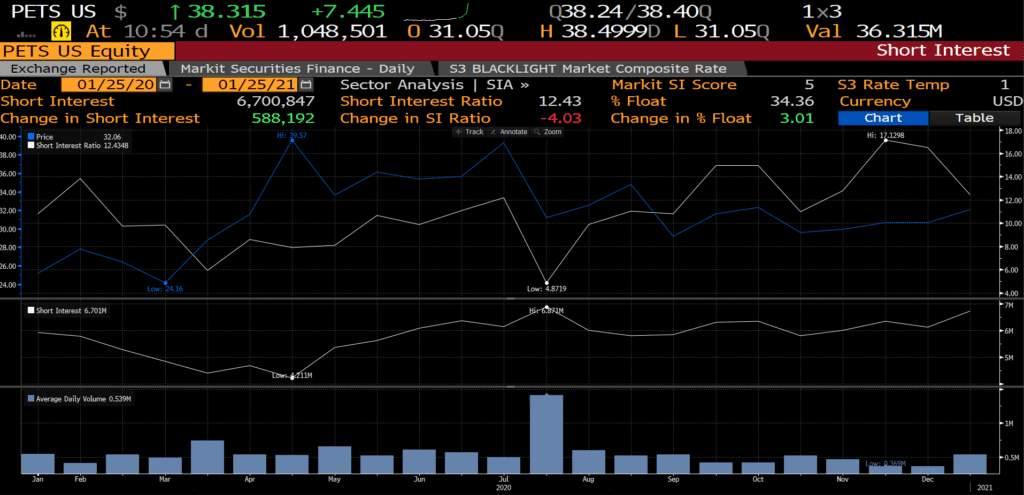

Part of the cash is returned to investors via dividends. While we like dividends, a more balanced approach, given the relative undervaluation of the company (not to mention its excruciatingly high short interest) may give the stock price a much-needed jolt.

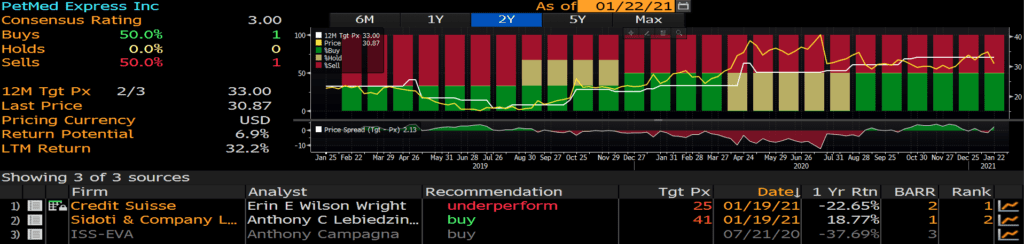

This lack of capital markets activity limits sell-side coverage on the stock, which, though unfair, also limits its ability to attract institutional investors, many of whom are unwilling to do the deep, fundamental research we conduct. There were three (3) analysts on the company’s most recent earnings call:

Accordingly, the majority of the largest holders are passive index and sector funds.

Antiquated Business Model

Entrenched management is seemingly dogmatic in its approach (no pun intended). For example, the company’s logo (just updated) still includes its 1-800 number.

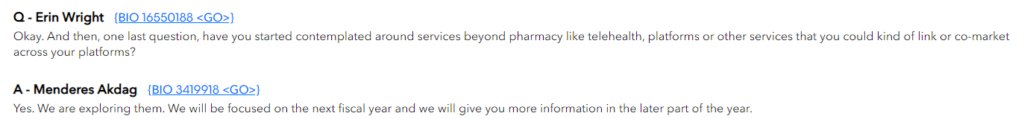

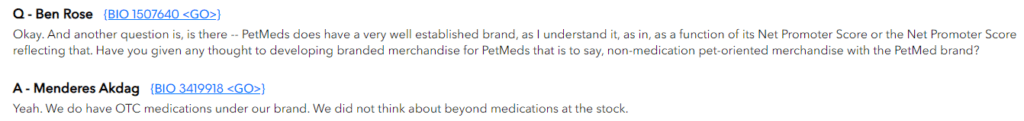

Ancillary (hopefully high margin) cross sells and monetization tools would seem to be a high priority for a company in PETS position. We will let you know is the response:

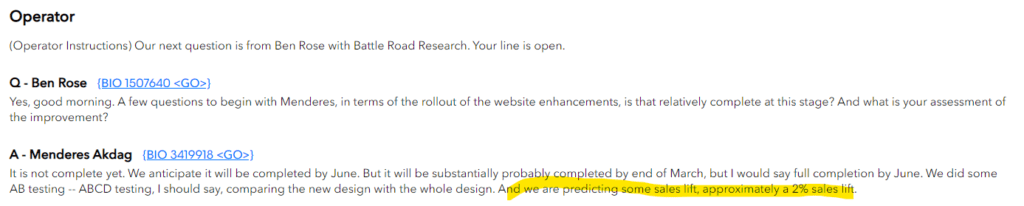

Call us crazy, but a 2% sales lift from a website refresh does not seem material or aimed at making the structural changes the company desperately needs. Perhaps capital is better allocated to the aforementioned new verticals, new endeavors, or to other branded products beyond medication? In a world where successful retailers are looking at myriad of ways to capture data, insource margin, and create stickier customer relationships, it does not seem like management is adapting the way their more innovative competitors are. For example, competitor Chewy (NASDAQ: CHWY) spends significantly more to acquire customers (around $150 versus approximately $40 for PETS).1

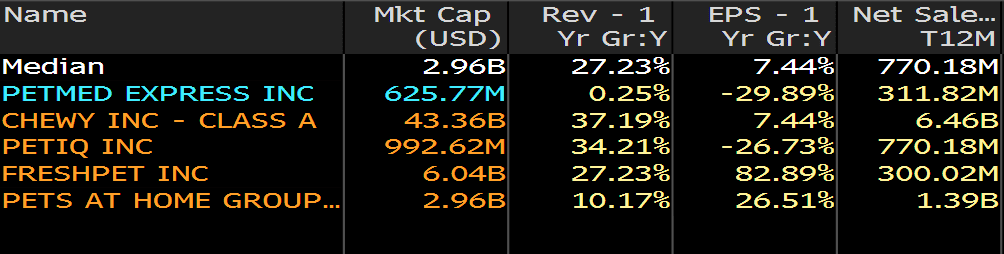

Though the last year was challenging, retailers focused on ecommerce (or, in this case, phone commerce), i.e., PETS, should have had a significant tailwind. CHWY grew its revenues over 37% during the pandemic. However, revenue for PETS was only flat versus significant increases for peers, while earnings showed the sharpest decline within the peer group. All this while having the smallest base, which should make it easier to grow, given a smaller base. The median for its pet-oriented peer group is 27%; PETS is flat from a revenue perspective.

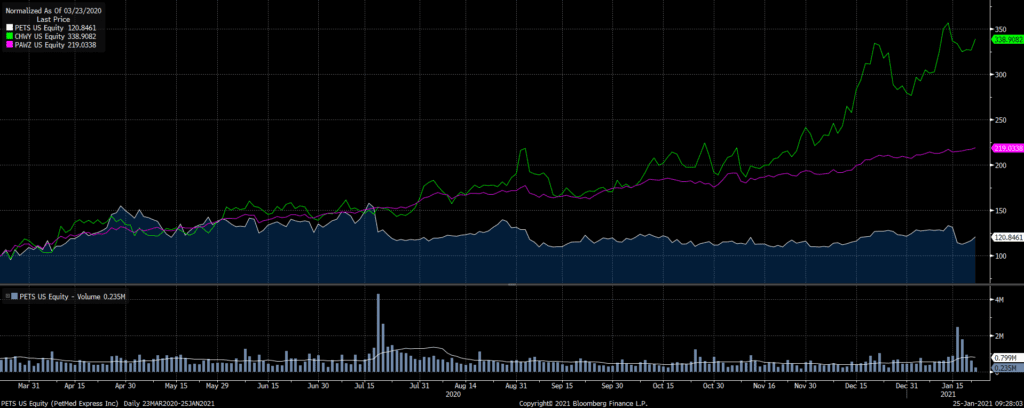

This criticism may come across as harsh, but PETS is seemingly missing a great opportunity in a channel with tremendous secular and cyclical growth (think of the recent spike in pet ownership). How has the market responded to PETS lack of innovation and growth? Unfavorably, to put it mildly. Since the market bottomed in March, PETS has lagged peers (PAWZ is the ProShares Pet Care Equity ETF) and CHWY by huge margins:

As just one example, Chewy launched an online pharmacy in July 2018 that generated over $500 million in 2020 sales). PETS, well, they have a 1.800 number and a new logo…

Valuation

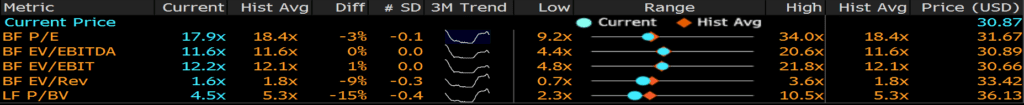

While valuations for equities, as a whole, are at all-time highs, given massive fiscal stimulus (aimed at consumers, i.e., pet owners) and monetary stimulus, PETS is valued only in-line with its longer-term metrics, i.e., its multiple has compressed in relative terms:

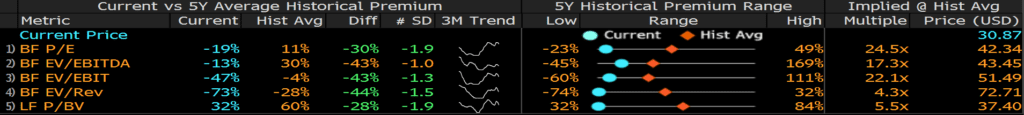

Versus peers, it is excruciatingly cheap:

Historically, the company has traded at a premium to peers based on the more relevant metrics (forward P/E, EV/EBITDA, and EV/Revenue). The reason? As much as we have beaten up on the company, it does generate very high returns on assets and invested capital, given it is a capital-light business with modest capex. However, the market has become disenchanted, given the lack of recent growth.

A reversion to prior averages would put the stock price in the low 40s. A CHWY-like multiple on revenue would be a more than double on the name (PETS is at 2x versus CHWY at 5x).

What could unlock the value?

Formidable is not an activist. It is not in our DNA. However, we generally understand how most institutional investors think, and believe PETS taking some of the following steps may increase investor appetite for the company:

- Balance sheet restructuring – Rates and spreads are at historic lows. Take on a little debt to provide for flexibility to…

- Buy back shares – Given relative valuation, management should be repurchasing shares. Additionally, proceeds of debt could be used to…

- Innovate – Migrate beyond the 1.800 era and begin to better monetize the established customer base. If customer acquisition costs increase in the interim, that’s fine, as the market has been rewarding growth (and punishing the lack thereof).

The playbook we would recommend is that employed by Bed, Bath, and Beyond, Inc. (NASDAQ: BBBY; disclosure: we are long BBBY). Hire top-flight management, pivot the company more toward ecommerce, divest flagging assets, eliminate the dividend, and use cash to buy back shares.

Here is what BBBY’s new management team looks like:

And here is the board:

Here is what BBBY has done coming out of the COVID-crisis market bottom versus PETS:

By the way, the backdrop for BBBY has been one where the stock is highly shorted, providing a coiled spring for the efficacy of buybacks. While BBBY’s short as a percent of float is much higher than PETS (64% versus 34% for PETS), its days to cover (which we believe is a better metric of the power of a squeeze) is 12 days versus 14 days to cover for BBBY, i.e., a sizable buyback program could trigger a similarly effective squeeze.

Conclusion

The high short PETS provides considerable lift opportunity, if only the match would light. One need look no further than the recent mania in GameStop, Corp. (NYSE: GME) for what can happen when activism and price appreciation start to take hold of a highly shorted stock. By happenstance, the activist who in some ways lit the match for GME, Ryan Cohen, is the co-founder and former CEO of the aforementioned PETS competitor CHWY. It would seem reasonable, if so inclined, he may be ideally suited to provide a similar push for PETS. Additionally, very little in board initiative would not only be welcome but disruptive to the coddled ecosystem the board apparently, currently enjoys, at the shareholders’ expense.

We believe the upside in the stock is easily re-priced if the company committed more cash to a shareholder repurchase program; it could even borrow money, at very low rates, to enhance its price and shareholder return proposition. This company seems ripe for an activist, and it does not seem like it would take much to move the needle right off the page. Innovation is a longer-term endeavor, but has the potential to retrofit a successful, but somnambulant, good company into an industry leader.

DISCLOSURES

General Firm

Formidable Asset Management, LLC (Formidable) is an investment adviser registered under the Investment Advisers Act of 1940. Registration as an investment adviser does not imply any level of skill or training. The information presented in the material is general in nature and is not designed to address your investment objectives, financial situation or particular needs. Prior to making any investment decision, you should assess, or seek advice from a professional regarding whether any particular transaction is relevant or appropriate to your individual circumstances. Although taken from reliable sources, Formidable cannot guarantee the accuracy of the information received from third parties.

The opinions expressed herein are those of Formidable and may not actually come to pass. This information is current as of the date of this material and is subject to change at any time, based on market and other conditions. Any index performance cited or used throughout is intended to illustrate historical market trends and performance. Indexes are managed and do not incur investment management fees. An investor is unable to invest in an index. The performance shown may not reflect a Formidable portfolio.

Past performance is no guarantee of future results.

Reader should assume that future performance of any specific investment or investment strategy (including the investments and/or investment strategies discussed in these materials) made reference to directly or indirectly in these materials will be profitable or equal the corresponding indicated performance level(s). Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will either be suitable or profitable. Historical performance results for investment indices and/or categories generally do not reflect the deduction of transaction and/or custodial charges, the deduction of an investment management fee, nor the impact of taxes, the incurrence of which would have the effect of decreasing historical performance results.

Specific Securities

The mention of specific securities and sectors illustrates the application of our investment approach only and is not to be considered a recommendation by Formidable. The specific securities identified and described above do not represent all of the securities purchased and sold for the portfolio, and it should not be assumed that investment in these securities were or will be profitable. There is no assurance that the securities purchased remain in the portfolio or that securities sold have not been repurchased. Charts, diagrams and graphs, by themselves, cannot be used to make investment decisions. You may contact Formidable Asset Management, LLC for a full list of recommendations made during the preceding period one year

Not an Offer

These materials do not constitute an offer to sell, a solicitation of an offer to buy, or a recommendation of any security or any other product or service by Formidable or any other third party regardless of whether such security, product or service is referenced here. Furthermore, nothing in these materials is intended to provide tax, legal, or investment advice and nothing in these materials should be construed as a recommendation to buy, sell, or hold any investment or security or to engage in any investment strategy or transaction. Formidable does not represent that the securities, products, or services discussed here are suitable for any particular investor. You are solely responsible for determining whether any investment, investment strategy, security or related transaction is appropriate for you based on your personal investment objectives, financial circumstances and risk tolerance. You should consult your business advisor, attorney, or tax and accounting advisor regarding your specific business, legal or tax situation.

The opinions expressed here are those of Will Brown and Adam Eagleston are not intended as investment advice. They are also subject to change with changing market conditions. Clients of Formidable may have positions in securities discussed in this article. This writing is for informational purposes only—Formidable and the authors expressly disclaim all liability in respect to actions taken based on any or all of the information from this writing.

[1] Kalaygian, Mark: A Closer Look At Chewy’ Latest Earnings Report; Information accessed on January 25, 2021 via URL: https://www.petbusiness.com/blogs/a-closer-look-at-chewys-latest-earnings-report/article_8e6a693d-d8e7-5cce-9cd5-6bd7eedd62ee.html#:~:text=Expensive%20Customer%20Acquisition&text=In%20fact%2C%20Chewy%20went%20from,about%20%24148%20per%20new%20customer

READY TO TALK?