Workhorse Group, INC–The Small Cincinnati Company

“Delivering” in the Electric Vehicle Race

It is rare to find a company at the intersection of two major trends; it’s even more unusual that it is in your hometown. However, that is the case with the aptly named Workhorse Group, Inc. (ticker: WKHS) headquartered in Loveland, OH. Formidable Asset Management (“FAM”) recently established a position; following are the key pieces of our investment thesis:

- Established technology and infrastructure

- Marquee customers

- Undervalued investments

Overview

Workhorse manufactures electric vehicles (both land-based and aerial), predominantly for use in deliveries (think Amazon, UPS, or the U.S. Postal Service). Despite its presence in this attractive niche, valuable intellectual property, and potentially transformative strategic partnerships, the company trades at a significant discount to our estimate of its intrinsic value.

Established technology and infrastructure

The company builds more than electric vehicles; it has developed an integrated platform to offer clients a holistic delivery solution that includes cost efficient ground vehicles, telematics to optimize deliveries, and unmanned aerial systems (UASs) for last mile delivery. In the company’s opinion, it is a first mover with a two-to-three year head start over its competitors, which is critically important. Once established, it is very difficult to displace an incumbent within the context of a vehicle fleet, especially one that is integrated.

The company has seven (7) granted and four (4) pending patents. As we’ll see later, some of Workhorse’s core electric vehicle intellectual property is currently being licensed. Its Metron telematics are potentially valuable on a licensing basis as well.

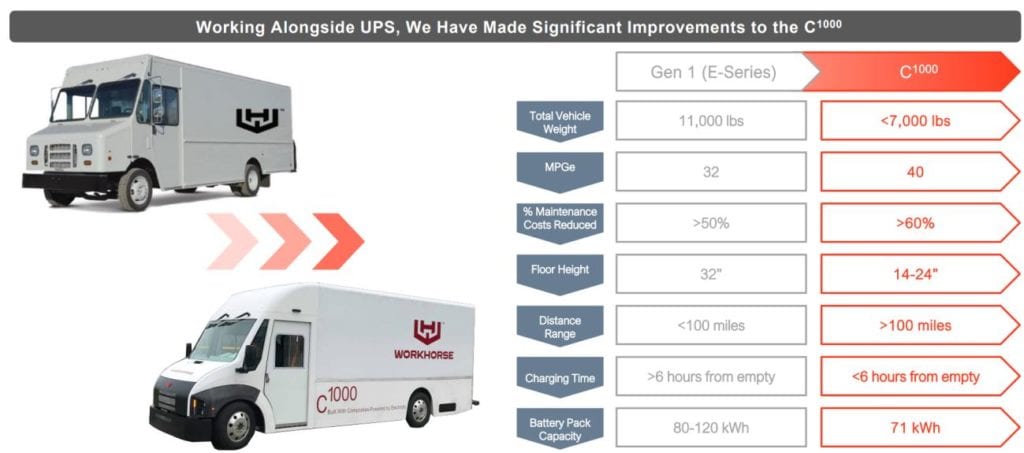

The company is expected to deliver between 300 and 400 vehicles this year for its C-Series, which is the next generation of its core delivery vehicle. These vehicles are built at its Union City, Indiana assembly plant. The company collaborated with UPS on a redesign of the C-Series; UPS is invested in the success of the endeavor and has been a partner since 2012.

One facet of the companies many investors are underestimating is the value of having a sizable installed base, which requires service and maintenance. Think of the auto dealership model, where revenues go beyond the initial sale and become a perpetuity through the useful life of the vehicle; Workhorse has the potential for consistent revenue from this part of its business.

Marquee Customers

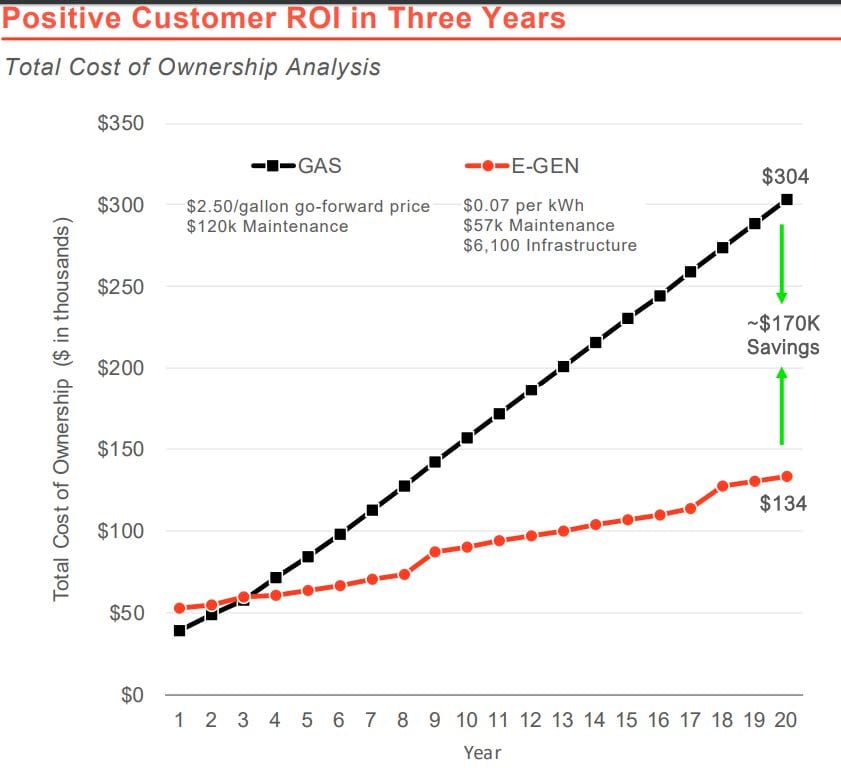

A key stamp of approval for the company is its client roster. Given the critical importance of last-mile delivery, companies like UPS, DHL, FedEx, and Ryder would not trust just anyone. With over 350,000 delivery vehicles purchased annually, the total addressable market (TAM) for Workhorse is exponentially larger than its current production levels. From the buyer’s perspective, the payback period associated with the slightly higher initial cost of a Workhorse vehicle is short.

The next generation of products for the company is straight out of a science fiction novel from the 1950s, with unmanned drones, which it calls the HorseFly, that work with its land-based vehicles. This UAS is FAA compliant and the value proposition for clients is immense, with the cost per mile for the HoreseFly around $0.04 per mile versus around $1.00 for traditional vehicles. Each UAS can carry up to 30 lbs at a speed of up to 50 mph.

The company is currently vying for a $6 billion contract with the USPS, which would provide revenue visibility for five-plus years. While this would require $200 million in capital (in the event the company won the entire contract), it would be transformative. Bids are due in July, with a decision expected in mid-October.

Undervalued Investments

The kicker for the company is its investment in Lordstown Motors Corp. (LMC). It is carried at a value of around $12M on the company’s balance sheet, a pittance compared to WKHS’s market cap of over $250M.

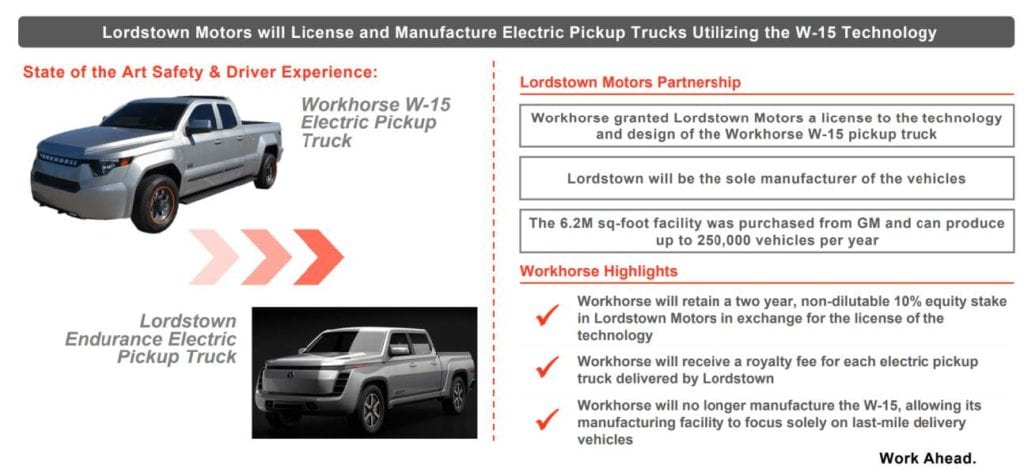

At one point, Workhorse was developing (and taking orders for) its own electric pickup truck. Management made a strategic decision to focus on its core delivery solution and instead licensed its intellectual property to LMC so the latter could begin development and production of an electric pickup truck, the Endurance. In exchange, the company received a 10% ownership stake in LMC as well as the opportunity for variable revenue consisting of commissions and royalties based on LMC’s productions, which are slated to begin this year, with delivery in 2021. Per LMC CEO Steve Burns, in a Detroit Free press article, “I think we’ll have well, well north of the 20,000 well spoken for. The demand side is super strong, I am starting to worry we won’t be able to make them fast enough.”

For those who think this is not a big deal, we would point to the recent IPO of Nikola Corp. (ticker: NKLA), which (as of 6/10/2020) traded at a market cap of $23 billion on a pre-revenue basis, i.e., it, too, is taking orders for an electric pickup truck, which won’t be delivered until 2022, after the anticipated release of the LMC pickup. Electric vehicle manufacture Tesla Motors (ticker: TSLA) has a market cap of over $190 billion on revenues of only $25 billion for 2019.

In other words, this is a hot area for institutional investors, and even if LMC came to the market a valuation of $3 billion, Workhorse’s stake in LMC would roughly equal the company’s current market cap, i.e., you would be getting the delivery solution business for free.

Conclusion

Ultimately, we believe the market has a tremendous appetite for electric vehicles, especially given investors’ increasing consideration of ESG (environmental, social, and governance) factors, not to mention the proliferation of investment products that focus on ESG companies. Both WKHS and LMC would certainly fit this bill. Even if LMC was seen as only half as valuable as NKLA in the eyes of the market, the company’s stake in LMC alone would be worth over $1 billion.

DISCLOSURES

General Firm

Formidable Asset Management, LLC (Formidable) is an investment adviser registered under the Investment Advisers Act of 1940. Registration as an investment adviser does not imply any level of skill or training. The information presented in the material is general in nature and is not designed to address your investment objectives, financial situation or particular needs. Prior to making any investment decision, you should assess, or seek advice from a professional regarding whether any particular transaction is relevant or appropriate to your individual circumstances. Although taken from reliable sources, Formidable cannot guarantee the accuracy of the information received from third parties.

The opinions expressed herein are those of Formidable and may not actually come to pass. This information is current as of the date of this material and is subject to change at any time, based on market and other conditions. Any index performance cited or used throughout is intended to illustrate historical market trends and performance. Indexes are managed and do not incur investment management fees. An investor is unable to invest in an index. The performance shown may not reflect a Formidable portfolio.

Past performance is no guarantee of future results.

Reader should assume that future performance of any specific investment or investment strategy (including the investments and/or investment strategies discussed in these materials) made reference to directly or indirectly in these materials will be profitable or equal the corresponding indicated performance level(s). Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will either be suitable or profitable. Historical performance results for investment indices and/or categories generally do not reflect the deduction of transaction and/or custodial charges, the deduction of an investment management fee, nor the impact of taxes, the incurrence of which would have the effect of decreasing historical performance results.

Specific Securities

The mention of specific securities and sectors illustrates the application of our investment approach only and is not to be considered a recommendation by Formidable. The specific securities identified and described above do not represent all of the securities purchased and sold for the portfolio, and it should not be assumed that investment in these securities were or will be profitable. There is no assurance that the securities purchased remain in the portfolio or that securities sold have not been repurchased. Charts, diagrams and graphs, by themselves, cannot be used to make investment decisions. You may contact Formidable Asset Management, LLC for a full list of recommendations made during the preceding period one year

Not an Offer

These materials do not constitute an offer to sell, a solicitation of an offer to buy, or a recommendation of any security or any other product or service by Formidable or any other third party regardless of whether such security, product or service is referenced here. Furthermore, nothing in these materials is intended to provide tax, legal, or investment advice and nothing in these materials should be construed as a recommendation to buy, sell, or hold any investment or security or to engage in any investment strategy or transaction. Formidable does not represent that the securities, products, or services discussed here are suitable for any particular investor. You are solely responsible for determining whether any investment, investment strategy, security or related transaction is appropriate for you based on your personal investment objectives, financial circumstances and risk tolerance. You should consult your business advisor, attorney, or tax and accounting advisor regarding your specific business, legal or tax situation.

The opinions expressed here are those of Will Brown and Adam Eagleston are not intended as investment advice. They are also subject to change with changing market conditions. Clients of Formidable may have positions in securities discussed in this article. This writing is for informational purposes only—Formidable and the authors expressly disclaim all liability in respect to actions taken based on any or all of the information from this writing.

READY TO TALK?